The development of Bitcoin as a payment from 2008 to today

The development of Bitcoin as a payment from 2008 to today. Has Bitcoin failed as a payment or can it still develop into a payment in the future?

Lately, you hear more and more often that Bitcoin has failed. Bitcoin is like a Ponzi scheme with no intrinsic value, nobody would pay with it and so Satoshi Nakamoto’s idea for a payment system has failed.

We want to take a closer look at whether Bitcoin has failed as a payment system and show how Bitcoin was used for payments in the early days, how Bitcoin is currently used for payments and venture an outlook on whether Bitcoin will prevail as a means of payment in the future.

In this article, we look at the beginnings of Bitcoin as a payment up to the present day.

YouTube Video: The development of Bitcoin as a payment from 2008 to today

We have published a video on the Coincharge YouTube channel with the topic“The development of Bitcoin as a means of payment from 2008 to today“

2008 – Bitcoin a cash-like payment system

On October 31, 2008, Satoshi Nakamoto published his Bitcoin white paper, in which he presented an electronic payment system similar to cash.

Bitcoin was presented as a concept for digital payments between people without the need for an intermediary.

2010 – first Bitcoin payment

On May 22, 2010, Bitcoin was used as a means of payment for the first time when two pizzas worth $41 were paid for with 10,000 Bitcoin.

The pizza transaction marked the first real use of Bitcoin as a means of payment and is celebrated annually as Bitcoin Pizza Day.

2011 – criminal internet money

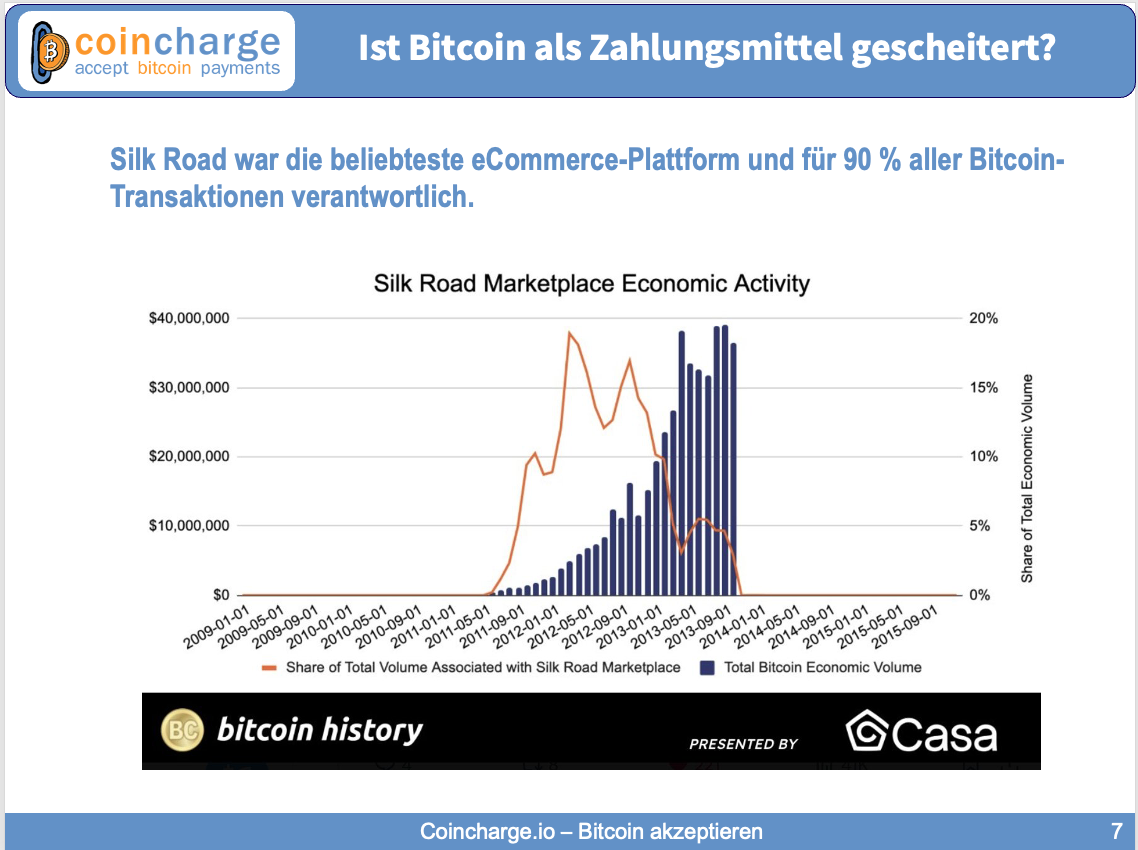

From 2011, Bitcoin enjoyed growing popularity as a means of payment on the darknet and gained a negative reputation as a criminal internet currency.

The most popular marketplace on the darknet was Silk Road, which could only be paid for with Bitcoin and was responsible for up to 90 percent of all Bitcoin transactions at times.

Since 2016 – No Bitcoin payments on the darknet

Silk Road was closed following the arrest of Ross Ulbricht in 2013. However, this did not mean the end of Bitcoin, as other marketplaces emerged on the darknet that accepted Bitcoin payments until 2016.

The realization grew that Bitcoin payments are not anonymous but pseudonymous and the privacy coin Monero took the place of Bitcoin on the darknet and since 2016 no more Bitcoin payments have been made on the darknet.

2014 to 2018: Bitcoin as a payment

However, this did not lead to the death of Bitcoin as a payment, but after Bitcoin left the dark corner, more and more businesses in the real world began to accept Bitcoin payments.

From 2014, for example, renowned companies such as Expedia and Microsoft began accepting Bitcoin payments.

Microsoft customers were able to top up their Microsoft account with Bitcoin and then pay for digital products in the Windows and xBox Store with Bitcoin. Payment with Bitcoin was only possible for digital and not for physical products and was reserved for American users only.

Stripe is one of the leading US payment providers and offered its online merchants the processing of Bitcoin payments in addition to credit cards and other payment methods from 2014 to 2018.

In the period from 2014 to 2018, there was great interest in paying with Bitcoin and accepting Bitcoin payments, particularly in America.

Bitcoin as a global payment

Hal Finney, who is considered one of the people behind the pseudonym Satosh Nakamoto, wrote in one of his first messages to Satoshi Nakamoto that he believed that a Bitcoin could be worth up to 10 million US dollars if it were to become a worldwide payment.

The more people use Bitcoin as a payment, the more Bitcoin will be in demand to pay with, and when demand increases, this inevitably leads to rising prices.

Bitcoin as an object of speculation

The expectation of rising prices in the future due to Bitcoin being limited to just 21 million units reached its first peak at the end of 2017. More and more people wanted to secure this limited commodity and demand for Bitcoin increased. However, not to pay with it, but rather for speculative reasons.

Bitcoin became an object of speculation and on December 17, 2017, the Bitcoin price reached a high of just under USD 20,000, only to fall again to USD 14,000 by the end of the year.

The increasing demand for Bitcoin led to a full blockchain and a Bitcoin transaction took a very long time and was very expensive. Apart from the volatility, it was unattractive for merchants and customers to pay with Bitcoin. Firstly, those who wanted to pay for their coffee with Bitcoin did not want to wait long for the payment to be confirmed and secondly, they did not want to pay more for the payment than for the coffee.

The success of Bitcoin as an object of speculation and the increasing demand for Bitcoin thus led to the failure of Bitcoin as a means of payment.

Alternative cryptocurrencies positioned themselves as alternative crypto payment methods with faster and cheaper transactions and larger blocks, which went down in Bitcoin’s history as the Blocksize Wars.

If you want to find out more, I recommend the book Blocksize Wars, which has just been published by Aprycot Media and can also be paid for with Bitcoin and Lightning.

Link below in the description. But back to the topic: Order The Block Site War from Aprycot Media or Amazon.

While the problems of Bitcoin payments via the blockchain became apparent in 2018, a solution to this problem was already being developed in 2015. Namely Bitcoin payments via the Lightning Network.

2018 – Bitcoin as a store of value

Based on the Bitcoin blockchain, a further layer has been developed that can be used specifically for the lightning-fast and cost-effective processing of Bitcoin payments.

Bitcoin on the blockchain is used for the long-term storage of Bitcoin, comparable to euros in a savings account. If I want to pay with some of my euros, I withdraw some from my account at an ATM and transfer it to my wallet as cash.

I also save and hold my on-chain Bitcoin, comparable to a savings account on a Bitcoin hardware wallet. If I want to pay with Bitcoin, I transfer part of my Bitcoin from my Bitcoin Hardware Wallet to a Bitcoin Lightning Wallet.

Since 2015 – Bitcoin Lightning as a payment

Bitcoin on the Lightning network, called Lightning, is used for Bitcoin payments and is comparable to the cash in our wallets.

Bitcoin on the blockchain has failed as a payment and has evolved from an object of speculation to a long-term store of value.

Bitcoin on the Lightning network has taken over the means of payment function and impresses with lightning-fast payments at minimal cost.

The Lightning Network was designed from 2015, tested for the first time in 2017, implemented on Bitcoin from 2018 and can be considered a means of payment suitable for everyday use from 2020.

Bitcoin is suitable for processing payments via the Lightning Network for several reasons. It enables payments in real time. The Bitcoin payment is credited to the payee immediately and there is no need to wait for the payment to be confirmed in the blockchain.

The cost of a payment is in the cent range and does not depend on how full the mempool is and how much other payers are willing to spend for an early place on the blockchain.

With a lightning payment, only the payer and the payee and some of the intermediary nodes know about the transaction. However, no external body can view the entire transaction or determine the identity of the partners involved.

There are no technical limits to the number of possible payments and 1 million transactions per second can already be processed today without any problems.

The amount to be sent can easily be transferred from the cent range up to €1,000. A Lightning payment is therefore predestined for micropayments. For amounts over €1,000, the transfer of Bitcoin via the blockchain is still recommended today. However, it is already foreseeable that Lightning will be able to transfer higher amounts in the near future.

Conclusion & summary

In the 17 years of its existence, Bitcoin has evolved from a means of payment to an object of speculation to a store of value.

We need to distinguish between Bitcoin as a store of value and as a means of payment.

Bitcoin on the blockchain, i.e. onchain, is an asset that is held for the long term, i.e. hodled, and that you should store on your own responsibility on a Bitcoin hardware wallet.

Bitcoin is also available as a means of payment in the form of Lightning and I hold Bitcoin on a Bitcoin Lightning Wallet as an app on my smartphone so that I can pay quickly and easily at any time.

Analogous to our euro in the savings account and the euro as cash in the wallet for payment.

When Bitcoin critics in 2025 deny Bitcoin’s suitability as a means of payment, they are referring to Bitcoin on the blockchain and ignoring the existence and technical possibilities of Lightning as a means of payment.

If we ask ourselves whether Bitcoin has failed as a means of payment, then we have to say yes for Bitcoin on the blockchain.

The Bitcoin blockchain is suitable for transferring the asset, i.e. the store of value. This is not the case for use as a means of payment and Bitcoin is the appropriate solution for this via the Lightning Network.