Bitcoin tax and accounting when accepting Bitcoin payments in a brick-and-mortar store.

How are Bitcoin payments in a stationary business such as a café, restaurant, snack bar or food truck, a boutique or retail store or as a craftsman or service provider recorded in the accounts?

How do I proceed for tax and accounting purposes if I accept Bitcoin payments in my business?

This article is aimed at anyone who accepts Bitcoin payments in their brick-and-mortar business and is wondering how to record these payments in their accounts and tax them properly.

YouTube Video: Bitcoin tax and accounting when accepting Bitcoin payments in a brick-and-mortar store.

We have published a video on the Coincharge YouTube channel with the topic“Bitcoin tax and accounting when accepting Bitcoin payments in a stationary store“.

Bitcoin payment in the store

How could such a Bitcoin payment work in a stationary business? Let’s imagine we have a café, a restaurant, a snack bar or food truck, a boutique or a store, or we would like to be paid in Bitcoin as a craftsman or service provider. In other words, all transactions where you normally pay with cash, i.e. when the payer and payee are face to face.

The customer stands at the checkout with their purchases in our store. We enter the purchases into the checkout system and create an invoice in our local currency including VAT. Then we ask the customer: “How would you like to pay? Cash, by card or with Bitcoin?

If the customer pays in cash, we note in the checkout system that this invoice was paid in cash and place the cash in the cash drawer of the checkout. If the customer wants to pay by card, we enter the amount into the card terminal, push the terminal to the customer, who then pays with their card or smartphone. This either happens automatically or you indicate in the checkout system that the invoice was paid by card. The accounting department then knows that the amount will be credited to the bank account via the credit card statement.

If the customer wants to pay with Bitcoin, we enter the invoice amount in euros into our Bitcoin payment device. We will discuss the different devices later. After the payer has scanned the QR code and paid with Bitcoin, we have to note on our POS system that this invoice was paid with Bitcoin.

Most POS systems offer the option of freely naming a corresponding field. If this is not possible, we use a field that we do not otherwise require, e.g. payment by check or American Express.

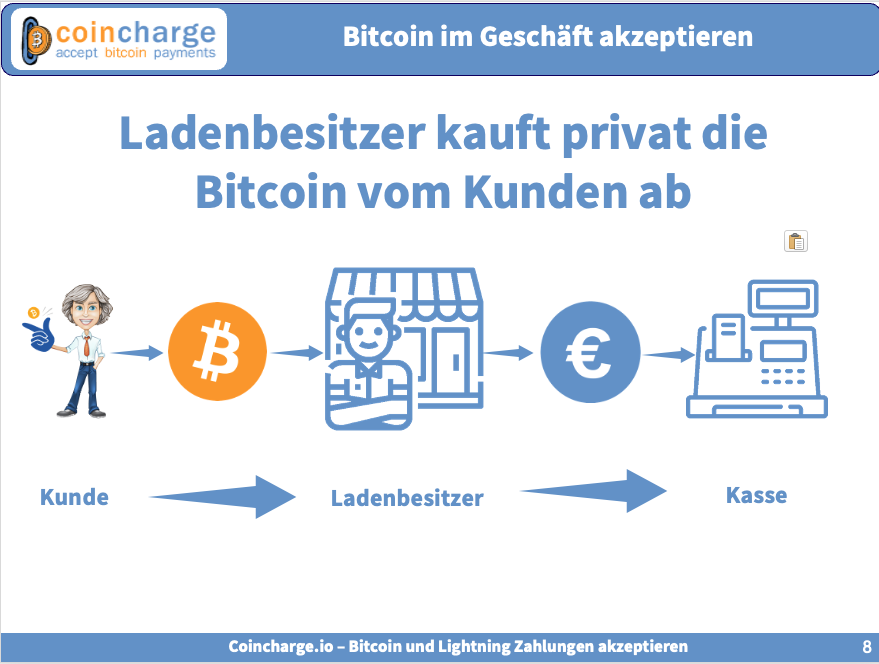

Store owner privately buys Bitcoin from customers

A popular solution for merchants who want to keep the Bitcoin themselves is to buy the Bitcoin from the payer privately. You should clarify with your tax advisor beforehand whether this is also possible for you. I am only reporting here what merchants who do this have told me.

How exactly does it work?

Let’s assume the invoice amount is 20 euros. If the payer wants to pay with Bitcoin, the merchant takes his private Bitcoin wallet and enters the invoice amount of 20 euros.

He then shows the payer the QR code and the Bitcoin worth the equivalent of 20 euros is credited to the merchant’s private Bitcoin wallet.

He now takes 20 euros from his private wallet, puts it in the cash register of his store and books the payment as a cash payment.

For the store’s accounting department, this payment is like a cash payment and has the advantage that no further bookings are necessary.

This procedure is only possible if the store owner wants to keep the Bitcoin private and is present in the store to receive the Bitcoin.

Your accountant or tax advisor will be happy to explain to you whether you should put the equivalent value of the Bitcoin in cash in the cash register, transfer it from your private bank account to your business account or book it as a private withdrawal.

This is an ideal entry-level solution for accepting Bitcoin payments. Simply install any Bitcoin Lightning Wallet on your smartphone, attach a sticker in the store stating that you now accept Bitcoin and off you go.

If more and more customers then pay you with Bitcoin and the amount of Bitcoin is higher than what you would like to save privately in Bitcoin, then you can take the next step, which we will now explain.

Keep Bitcoin in business

If more and more customers are paying with Bitcoin or if you are not operating the business alone and employees are also accepting Bitcoin payments, more professional solutions are required.

You can either use a normal Bitcoin Lightning Wallet such as the Blink Wallet or the Wallet of Satoshi for your business. However, you should make sure that you use a separate Bitcoin Lightning Wallet for business and private use in order to clearly separate Bitcoin payments.

You can also use a discarded smartphone that is available at the checkout for you and your employees and on which you have installed the Satoshi Wallet or the Blink Wallet for your business.

However, you can also use devices that have been developed for accepting Bitcoin payments in stores.

These can be app solutions that you install on your smartphone and also on the smartphones of your employees or a discarded smartphone that is available at the checkout.

Here we recommend the solution from Lipa and the point-of-sale solution from Wallet of Satoshi.

Or a web-based solution that works with any web browser, such as Coinsnap’s Web Point of Sale solution.

Or a hardware solution like the one from Opago or this Bitcoinize terminal.

We have already written articles about these solutions here on here or published detailed videos on the YouTube channel.

Overview of all Bitcoin payments

Similar to a bank account statement that lists each individual transaction, the accounting department or tax advisor requires such a list of the Bitcoin payments received.

Apps, Web-Point-of-Sale solutions and hardware terminals that specialize in accepting Bitcoin payments in business offer corresponding evaluations.

This transaction log documents the invoice amount in euros, the Bitcoin conversion rate and the Bitcoin received for each Bitcoin payment.

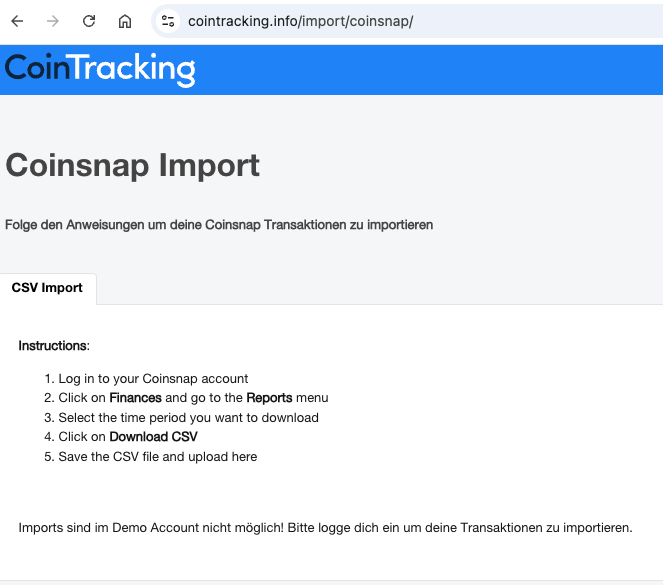

These solutions provide a detailed transaction log, which can also be downloaded as a CSV file.

The transactions can then be imported into other applications, e.g. tax tools such as Cointracking.

You import your CSV file into Cointracking and receive a tax report for your tax return.

You can try out CoinTracking and use up to 200 transactions free of charge. If you have more transactions, you can upgrade to a paid version and receive a 10% discount with the discount code Coinsnap.

Documentation of the Bitcoin portfolio

We have now seen how to receive Bitcoin payments on your Bitcoin Lightning Wallet and how to document each individual Bitcoin payment with its access value for accounting and tax purposes.

For accounting purposes, however, it is also important to know how much Bitcoin the company currently owns. In other words, how much Bitcoin is available on a certain key date.

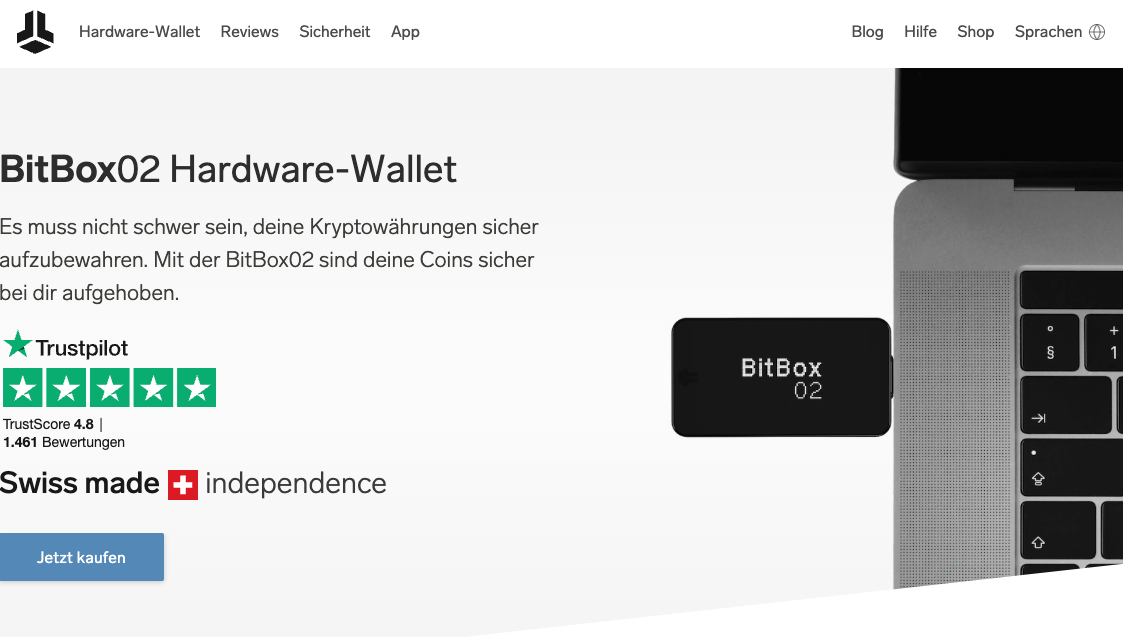

The Bitcoin we earn should not be stored long-term on the Bitcoin Lightning Wallet. Just as we take our cash to the bank at the end of the day and deposit it into our account, we should regularly transfer the Bitcoin from our Bitcoin Lightning Wallet to a Bitcoin hardware wallet.

A Bitcoin hardware wallet is used for the long-term storage of Bitcoin, while a Bitcoin Lightning Wallet is used for receiving and paying Bitcoin payments and not for storage.

Depending on whether you file your tax return monthly, quarterly or annually, you should transfer all your Bitcoin from the Bitcoin Lightning Wallet to the Bitcoin Hardware Wallet by this time at the latest.

You can create multiple wallets on your Bitcoin hardware wallet. With BitBox, for example, you can create as many wallets as you like and subdivide each wallet into further accounts. If you do not yet have a BitBox, you will receive a 5% discount when you buy your BitBox via this link.

Regardless of which Bitcoin hardware wallet you use, you should use one wallet for your private Bitcoins and another wallet for your business Bitcoins. This allows you to make a clean separation between business and private bitcoins.

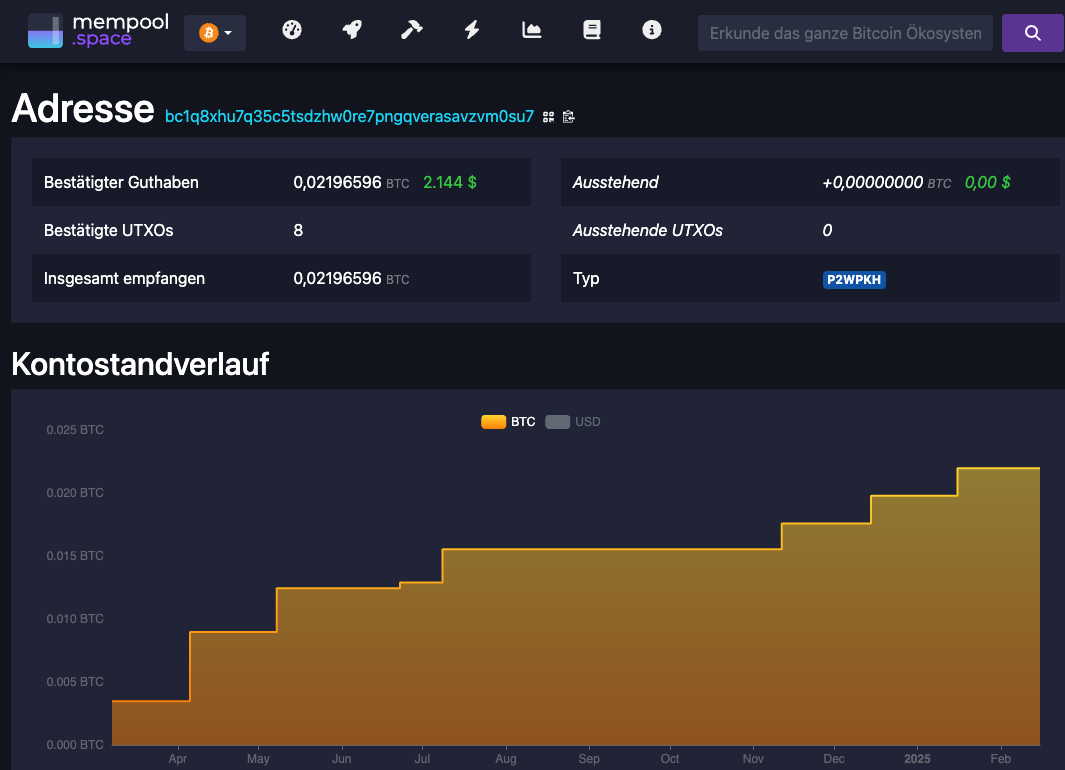

While you would otherwise use a new Bitcoin address for every Bitcoin transfer via the blockchain in order to protect your privacy, you should always use the same Bitcoin address in this case.

Take this static Bitcoin address and use it every time you make a transfer to the Bitcoin hardware wallet. Then give this Bitcoin address to your tax advisor. They can then check the Bitcoin blockchain themselves to see how many Bitcoin are in your Bitcoin Business Wallet.

This means your Bitcoin holdings are fully documented and verifiable for accounting, tax advisors and the tax office.

Keep or sell Bitcoin in the store

By documenting every Bitcoin transaction, it is possible to determine exactly how much Bitcoin has flowed into your company. How the Bitcoin is valued in the annual financial statements depends on individual factors and should be discussed with your tax advisor.

The question should also be clarified as to whether the Bitcoin will be held long-term and belong to fixed assets or whether you want to pay your suppliers with Bitcoin and therefore classify them as current assets.

If you sell your bitcoins at some point, your tax advisor will also be able to tell you how to deal with the profit or loss from the sale of the bitcoins, as this will have an impact on the success of your company.

There is also the question of whether you buy bitcoins privately from your company or sell them as a company directly to a Bitcoin broker or a Bitcoin exchange.

Anyone selling Bitcoin as a company to a Bitcoin exchange or broker should note that opening a business account with a broker or exchange is more complex for a company than for a private individual.

A KYC process must be carried out for the company and the acting persons and owners, and proof of the origin of the funds must also be provided.

It should be easier to prove the origin of funds using the procedure described in this article.

If you are afraid of the administrative effort involved in opening an account with a broker or exchange for your company, you can check with your tax advisor whether you could buy the bitcoins privately from your company and then sell them as a private individual with your Bitcoin broker.

Summary & conclusion

When Bitcoin accepts payments at your store, the entire process is similar to when someone pays at your store in a foreign currency such as dollars.

You issue a normal invoice in your currency, mark the invoice as paid and then have a foreign currency in your cash register or balance sheet.

Only when you consider whether you want to keep the Bitcoin in the long term and how you want to deal with any profits from the Bitcoin do tax considerations come into play and here you should definitely seek the advice of a tax advisor.

For this advice, it is not essential that your tax advisor is an expert in cryptocurrencies or Bitcoin.

Don’t be discouraged if your tax advisor initially waves you off because they may not be convinced by Bitcoin themselves and are reluctant to get involved.

If your tax advisor knows how foreign currencies are accounted for and recorded for tax purposes, then he also knows how to deal with Bitcoin.

Perhaps you can also turn your tax advisor into a bitcoiner. Why don’t you ask him if you can pay for his services with Bitcoin?

I hope this video has brought some clarity to the accounting aspects of a Bitcoin payment. It should show that it is possible to accept Bitcoin payments in your business without any problems.

So there’s no reason not to accept Bitcoin payments in your business because you’re not sure how to account for Bitcoin in your bookkeeping or tax.

My recommendation is to just get started.

Start with a separate Bitcoin Lightning Wallet for your business and a sticker at the checkout and on the door that you now accept Bitcoin payments.

Over time, as more and more customers pay you with Bitcoin, you can implement advanced solutions to meet your growing needs.

When can I pay with Bitcoin?

If you have any questions, please contact your tax advisor.

Tax is a very individual topic and can only be answered seriously by someone who knows your situation in detail and can assess it. As I am not a tax advisor, I am not allowed to give advice and have therefore explained in this article how you can obtain the information so that you can document the payment transaction with Bitcoin and your accountant and tax advisor can then act accordingly.