5 reasons why Bitcoin is not a means of payment?

So-called crypto experts deny Bitcoin’s suitability as a means of payment.

These 5 reasons are usually cited:

- Processing time

- Transaction costs

- Scalability

- Volatility

- Acceptance

We want to address these points of criticism and clarify whether the criticism is justified and what solutions may already exist.

Bitcoin via the Lightning Network

If we analyze the possible uses of Bitcoin as a means of payment, we must first note that there are two ways to make Bitcoin payments:

- Bitcoin payments via the blockchain (on-chain)

- Bitcoin payments via the Lightning network (off-chain)

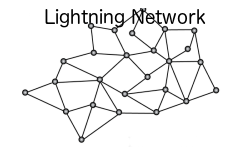

The Lightning Network is another layer (second layer) that is based on the Bitcoin blockchain.

The Lightning Network is a network of Lightning payment channels via which Bitcoin payments are routed.

The Lightning Network is based on the Bitcoin blockchain and is therefore referred to as a second-layer solution.

The connection between the Bitcoin blockchain and the Lightning Network is established via payment channels. When a payment channel is opened or closed, this is recorded on the Bitcoin blockchain. The Lightning Network consists of these payment channels through which Bitcoin payments are transferred. Payments that are sent between the Lightning nodes via payment channels are not visible on the Bitcoin blockchain and are therefore referred to as off-chain payments.

Payments that are made via the Bitcoin blockchain are referred to as on-chain payments. Bitcoin transactions on the Lightning Network are not communicated to the entire Bitcoin network, but initially only to the participants involved in the transaction. The entire network is informed later when the off-chain transactions are published in balance on the blockchain when a payment channel is closed. This has the advantage that only one netted transaction needs to be recorded at the end. As a result, off-chain transactions can be carried out much faster, cheaper and more anonymously than on-chain transactions.

Processing time

It takes at least 10 minutes, sometimes much longer, for a Bitcoin payment to be confirmed on the Bitcoin blockchain. No customer will want to wait that long if they want to pay for a coffee. Unfortunately, it is true that a Bitcoin payment via the blockchain can take longer until the payment is finally credited to the payee’s wallet. The final crediting may take some time, but the payee can immediately see in the mempool that the payment has been successfully sent. The mempool is like a waiting room in which all Bitcoin transactions that are soon to be saved on the Bitcoin blockchain are stored. Depending on the product and value, the payment recipient can decide how and when to deliver the goods to the buyer. A restaurant owner can deliver a coffee immediately as soon as the payment is visible in the mempool. A jeweler, on the other hand, should play it safe when selling an expensive piece of jewelry and wait until the payment has been confirmed on the blockchain. An online retailer can assemble the ordered goods as soon as the payment is visible in the mempool. However, they should not send the parcel to the post office until the Bitcoin payment has been confirmed on the blockchain. You have to agree with the critics here. A Bitcoin payment via the Bitcoin blockchain takes a little longer. However, a Bitcoin payment can also be made via the Lightning Network instead of the Bitcoin blockchain. A Bitcoin payment via the Lightning network is lightning fast. A Bitcoin payment via the Lightning Network is not stored in the Bitcoin blockchain. The Lightning Network is an additional layer on the Bitcoin blockchain. Put simply, a connection is established between the Bitcoin blockchain and the Lightning Network. The establishment of this connection is logged on the Bitcoin blockchain. All payments that then take place on the Lightning Network are no longer recorded on the blockchain. We have presented the Lightning Network in more detail in separate videos. At this point, it should only be noted that Bitcoin payments via the Lightning Network are fast and inexpensive payments. The payments are only known to the trading partners and are therefore relatively anonymous. Lightning payments are a transfer of value and are like cash in digital form.

Transaction costs

The transaction costs for a Bitcoin payment depend on how quickly the payment is to be executed and how many transactions are still outstanding to secure a coveted spot in one of the next blocks. In 2017, the demand for Bitcoin increased rapidly and a place in the next block was therefore highly coveted. Some users were willing to pay up to 50 US dollars for a spot in the next block. But that was a long time ago. On average, a Bitcoin payment costs 30 cents and if you have time until the Bitcoin payment is credited to the recipient, you can save a lot on transaction fees over the weekend. See also: https://coincharge.io/bitcoin-transaktionsgebuehr/ Here, too, you can save even more with a Bitcoin payment via the Lightning network. A Lightning payment is possible for just a few milli-cents.

Scalability

Only 7 transactions per second can be carried out on the Bitcoin blockchain. Despite all the optimizations, a maximum of one million transactions per day may be possible. Today, PayPal processes up to 5 million transactions per day, the Visa network around 150 million. Bitcoin can never become a global payment system because it can only process so few transactions. It is true that the Bitcoin blockchain is limited in the number of possible transactions. In 2017, there was a discussion about whether the number of possible transactions could be increased by increasing the block size. There have been Bitcoin forks that have opted for a larger block size, such as Bitcoin Cash or Bitcoin SV. However, the large space in the blocks is not needed as these forks are not used by anyone. Bitcoin continues to use the smaller blocks and relies on additional layers that are technically based on the Bitcoin blockchain, such as the Lightning Network. This is because the Lightning Network is able to carry out an infinite number of Bitcoin transactions, i.e. to scale infinitely. Now there are critics who point out that a transaction on the Bitcoin blockchain is required to enter and exit this Lightning Network. With a limit of one million transactions per day, access to the Lightning Network is in turn limited. The Lightning Network would be a huge success story if the opening and closing of channels were to reach its limits. But there are already solutions to this future problem, such as Chumian eCash, Fedimint, batch opening or channel factoring. Scaling via the Bitcoin blockchain actually reaches its limits at around 1 million transactions per day. However, Bitcoin scales excellently via additional layers that are based on the Bitcoin main layer. Should scaling problems arise on the second layer in the future, solutions on the third layer are already in the starting blocks.

Volatility

Another point of criticism is the volatility of Bitcoin, which has shown through strong price fluctuations in the past that Bitcoin is not suitable for everyday use. In November 2021, the Bitcoin price was USD 67,000 and one year later, in November 2022, it was USD 17,000. Within one year, the Bitcoin price has fallen by more than 70%. However, if you look at the short-term price fluctuations on a daily or even weekly basis, volatility has now shrunk to just a few percent. The extreme price fluctuations of the past have decreased significantly with the increasing use of Bitcoin. A trader who accepts bitcoins today no longer runs the risk of having lost everything at the end of the day. A merchant must then also ask himself whether he wants to keep the bitcoins he has received. Be it as a private individual or as an asset in their company. If you want to keep Bitcoin in the long term, you consciously accept the price development of Bitcoin. Merchants who accept Bitcoin payments but do not trust the volatility and still have to pay their suppliers in euros and fiat currencies can use the services of a Bitcoin payment service provider. When a merchant receives Bitcoins from its customers, the Bitcoin payment provider takes over these Bitcoins at the time of payment. The merchant receives the equivalent value credited to their bank account and pays a small fee. In this way, a merchant can accept Bitcoin payments and has no volatility risk.

Acceptance

Nobody pays with Bitcoin and there are hardly any merchants who accept Bitcoin payments. It’s true that we don’t yet have any large retail chains or well-known online retailers such as Amazon in German-speaking countries where you can pay with Bitcoin. But if you take the trouble to look around a little, you will be surprised at how many stores and online stores already accept Bitcoin payments. Coinpages.io lists over 2,000 stores and online stores in German-speaking countries that accept Bitcoin payments, with more being added every day. The stores that accept Bitcoin and draw attention to it in their surroundings report that it is being used. For example, the XXXX at the Princess Hotel. To be honest, the number of stores that accept Bitcoin is still manageable. Most of the stores that accept Bitcoin are Bitcoiners who want to contribute to the spread of Bitcoin in this way. More stores need to be convinced to accept Bitcoin payments, but Bitcoiners also need to be convinced to use Bitcoin.

Not only Hodln, but also Spendln.

I can only call on everyone who runs a retail store, an online store or a website to offer Bitcoin payments and to clearly indicate this. Be it with stickers on the front door or at the checkout and in a prominent place on the website. If you run a website, refer to Coinpages so that your visitors know where they can pay with Bitcoin. Because if you want to contribute to the spread of Bitcoin, you also have to pay more with Bitcoin. Many Bitcoiners now say that it is better to keep and save your Bitcoins than to spend them. Just as you save your euros in your savings account and keep a few bills in your wallet, you can do the same with Bitcoin. Set up a savings plan and save Bitcoin regularly. Add a few Satoshi to a Spendl wallet that you always use to make payments. You know your way around and can top up the Satoshi you have spent at any time with just a few clicks. Instead of paying with €20 at your favorite kebab shop, you exchange the €20 at your exchange or broker and then pay with Satoshi. Your saved bitcoins have not decreased and you have contributed to someone else having more bitcoins. It’s like you’re buying Bitcoin for someone else. The more Bitcoiners pay with Bitcoin, the more businesses will accept Bitcoin. The more Bitcoin is used, the greater the demand and this affects the price. If you then want to spend your saved bitcoins in a few years’ time, you won’t have to exchange them for euros, but there will be enough stores where you can pay with bitcoin.

Conclusion

If supposed crypto experts claim that Bitcoin is not a means of payment, then they are either stuck in 2017 and ignoring the existence of the Lightning Network. Bitcoin payments via the blockchain are indeed only suitable as a means of payment to a limited extent. But Bitcoin via the Lightning Network is a perfect means of payment and is the cash for digital payments due to its speed, low transaction costs and anonymity. The volatility is no longer as serious as it was a few years ago and the volatility risk can be eliminated if necessary by using Bitcoin payment providers. Everyone can play their part in acceptance. With Coincharge, we are making our contribution by providing information on how to accept Bitcoin payments in stores or online stores. With Coinpages, we give Bitcoin stores the opportunity to present themselves and Bitcoiners can find out where they can pay with Bitcoin. In this way, we can all help to ensure that Bitcoin develops into a successful means of payment.