How does a credit card payment work and how does it differ from a Bitcoin payment?

In this article, we explain how a credit card payment works. We explain this from the perspective of a customer who pays by credit card and from the perspective of a merchant who accepts credit card payments. We compare credit card and Bitcoin payment processing and show the differences. This knowledge can help you if you are thinking about accepting Bitcoin payments or if you want to help merchants accept Bitcoin and Lightning payments.

We explain in detail:

- How payments by credit card work.

- How merchants can accept credit card payments.

- What fees merchants have to pay for accepting credit cards.

- Why merchants refuse payments with very small amounts.

- What advantages Bitcoin payments have over credit card payments.

We have published a German-language video on the Coincharge YouTube channel for the article:“How does a credit card payment work and how does it differ from a Bitcoin payment?“.

How does a credit card payment work?

Almost everyone has a card in their wallet, but have you ever thought about how a credit card payment works? What a credit card payment costs the merchant and why some merchants do not accept credit card payments or only accept payments above a certain minimum amount?

Let’s take a closer look at a credit card payment from a merchant’s perspective. This will help you as a credit card user to better understand why a merchant reacts the way they do. For example, if you want to convince merchants to accept Bitcoin and Lightning payments, this background knowledge may help you to better explain the benefits of a Lightning payment.

What is an issuer?

You are sure to find a credit card in your wallet. Have you ever looked to see who the issuer of this card is? Take the card in your hand and look at the back. There you will find the issuer of the card.

An issuer is a bank that has been authorized by Visa and Mastercard to issue cards. Now you will be surprised that the name of the bank from which you received the card does not appear there. This is because the banks only act as sales partners for Visa and Mastercard in order to distribute these cards to their own bank customers.

In order to be able to pay with a card, the consumer needs a card that is provided by an issuer. Some banks have founded their own subsidiaries that act as issuers or work together with issuer banks that specialize in issuing credit cards. However, every credit card is always linked to a bank account through which the credit card payments are processed. If you have a credit card, your bank has granted you a credit line of €1000, for example, and you can withdraw a total of €1000 within a month. Once a month, the credit card amount will be debited from your bank account. In contrast, there is the debit card, which works like a credit card. In this case, the card can only be used if there is a credit balance or a credit limit on the bank account. When a card payment is made, the bank account is debited immediately. The credit card is called Mastercard, the debit card is called Maestro and the Visa debit card is called V-Pay. The cardholder can only make payments with the card, but cannot receive, accept or approve payments.

What is an acquirer?

If you want to accept credit card payments, you need a credit card acceptance agreement with an acquirer. An acquirer is in turn a bank that is authorized by Visa and Mastercard to conclude corresponding credit card acceptance agreements. If you want to accept credit card payments in your business or online store, you usually contact a payment service provider. Such a payment service provider handles the technical payment processing.

In bricks-and-mortar retail, the payment provider provides the retailer with the corresponding hardware terminals. In online retail, the payment provider provides virtual terminals that are displayed to the end customer as a payment page. The functions of acquirer and payment provider can also be performed jointly by one company, as is the case with Wordline and Payone for bricks-and-mortar retail or Stripe and Adyen for online retail. The merchant’s bank acts as a reseller for the acquiring business and the credit card transactions are credited to the bank account.

Payment at the point of sale (store)

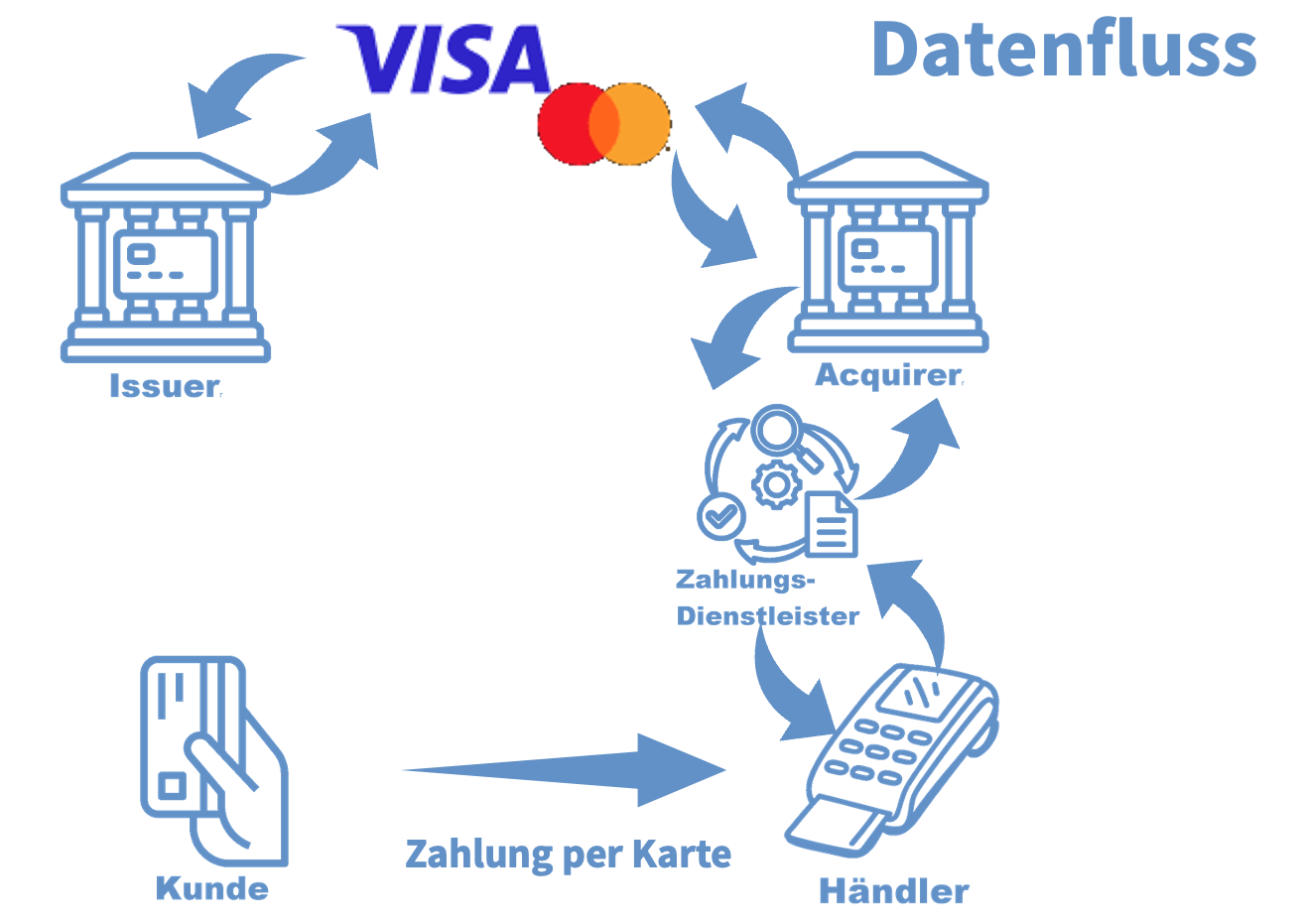

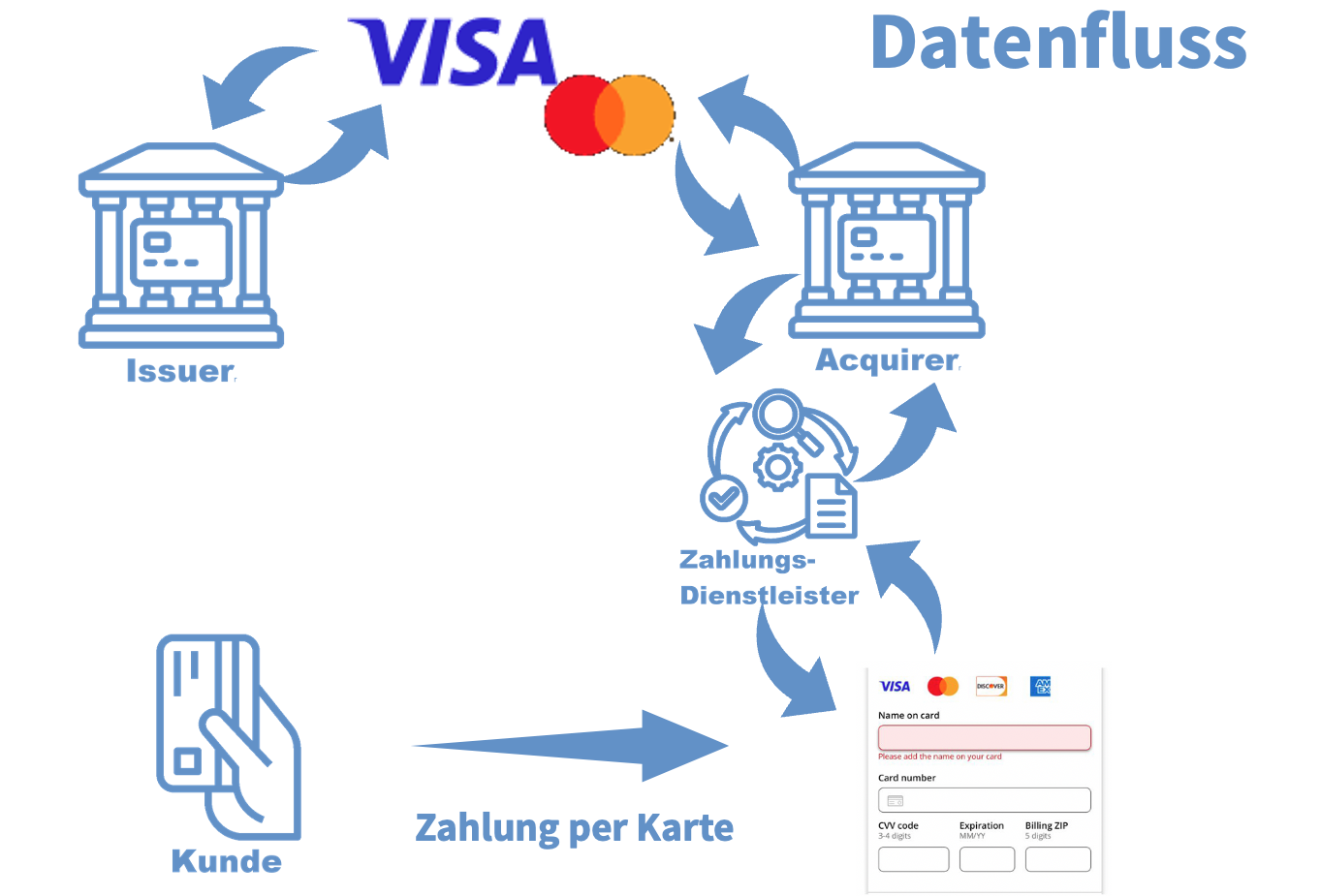

Let’s take a look at the process of a credit card payment and start with how the data flows between the partners involved. When a credit card payment is made in a stationary store, the credit card is inserted into or at a terminal. The physical card is on site and is therefore referred to as a card-present payment. This is also the case when the physical card is virtually in the smartphone because payment is made with Apply Pay or Google Pay. The payer authorizes the payment by entering a PIN, by signing or by approving the payment on the smartphone.

The terminal device transmits the payment request to the acquirer via the payment provider.

The acquirer forwards the data to the Visa or Mastercard network and thus to the issuer, the issuer of the credit card.

The issuer checks whether the cardholder has sufficient credit and releases the payment and sends the authorization to the acquirer via the Visa-Mastercard network

.

The acquirer then forwards it back to the terminal via the payment provider.

The cashier receives confirmation that the payment was successful and the goods are handed over.

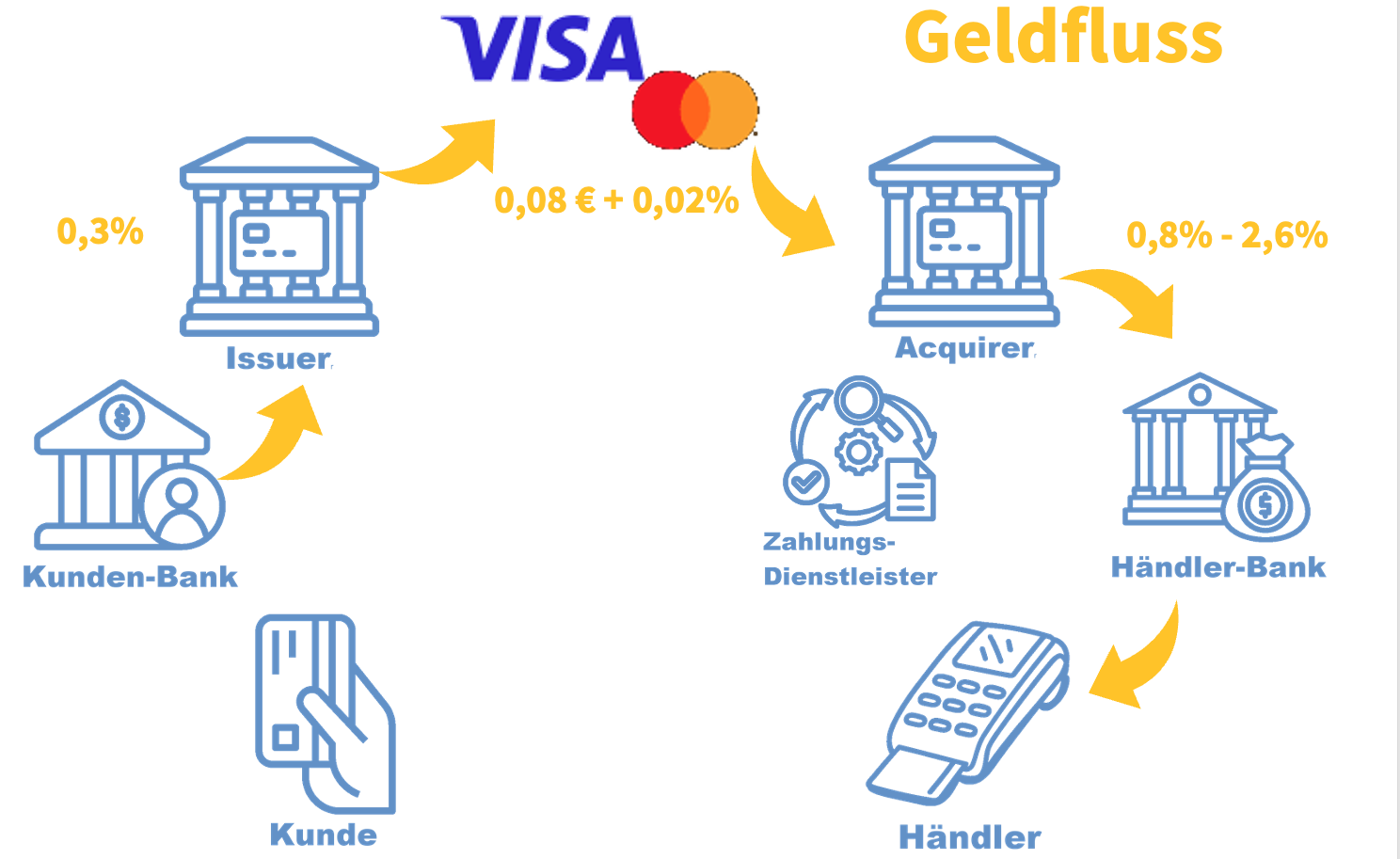

Cash flow of the credit card payment

Now that we have looked at how the data flows between the partners involved, let’s take a look at how the money flows. With a debit card, the payer’s bank account is debited immediately. With a credit card payment, the bank account is debited once a month.

The credit card transactions of the previous month are forwarded to the issuer, who receives an interchange fee of 0.3 percent of the credit card transactions. This amount is capped for issuers within the EEA for personal credit cards. Foreign issuers and for business cards may charge a higher interchange fee. The issuer keeps its fee and forwards the rest to Visa or Mastercard. These in turn retain a transaction fee of 8 cents and 0.02% on the turnover. The remaining amount is forwarded to the acquirer. The acquirer has made individual agreements with its merchants about the conditions. These vary depending on the chargeback risk and business model. This fee is retained and the remaining amount is transferred to the merchant’s bank account at his bank. The acquirer passes on part of its income to the payment service provider if the latter has referred merchants to the acquirer. Otherwise, the payment service provider receives payments from the merchant for the rental of hardware terminals or additional services for transaction processing.

Credit card payment on the Internet

When paying by credit card online, the credit card details are entered on a payment page provided by the payment provider. In addition to the credit card number, the expiration date and the cardholder’s name, the buyer’s address details are also transmitted. The so-called CVC code must also be provided. This is a three- or four-digit number printed on the back of the credit card. There is also the 3-D Secure procedure. Here, the payer confirms the payment on another device.

As with payments in bricks-and-mortar stores, the data is then transmitted to the acquirer via the payment provider, forwarded to the issuer via the Visa Mastercard network and the payment is approved.

The online merchant then receives confirmation of the successful credit card payment and can send the desired goods.

Credit card fee

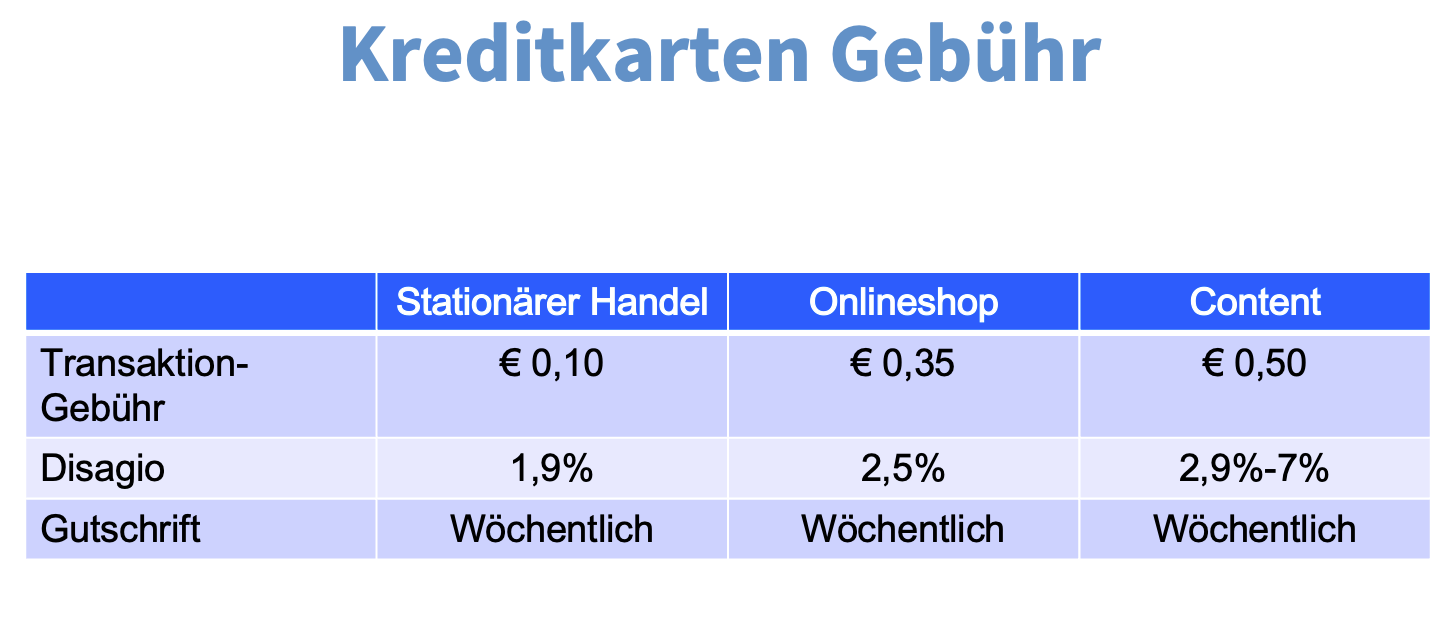

The fees for processing credit card payments can be roughly divided into stationary commerce with physical card-present payments. Then into e-commerce with the sale of physical products that are sent to a specified postal address, and separately into the sale of content and digital goods via the Internet. The fees for card-present payments are most favorable in stationary retail. The risk of fraud is very low here, as a physical card must be present and a PIN or other security function must also be confirmed.

In addition, the strong competition with other means of payment such as cash and bank cards leads to moderate fees. Credit card fees in stationary retail are up to 10 cents per transaction and less than 2% of turnover. The turnover-based fee is known as a discount. Transactions are usually billed on a weekly basis. In so-called card-not-present transactions, the physical card is not present and the transactions are processed via the Internet, but also for orders by telephone, fax or letter. The chargeback risk is higher here and the fees are correspondingly higher. For Internet purchases where the ordered goods are physically delivered by post, the transaction costs are around 35 cents and 2.5% of turnover. In the case of online purchases of digital goods, content, subscriptions and downloads, the transaction costs are around 50 cents and the discount can be between 3% and 7%. This essentially depends on the business model and the associated chargeback risk.

Why merchants refuse payment by micro-payments

In brick-and-mortar stores in particular, customers are informed that credit card payments are only possible from a certain minimum amount.

The reason for this is the fees for credit card payments, which depend on the value of the goods.

Assuming credit card fees of 1.9% on the turnover and 10 cents per transaction, the retailer has to pay 2 cents on the turnover and 10 cents for the transaction, i.e. a total of 12 cents, for a merchandise value of €1 for the credit card payment. For a merchandise value of €1, this is 12% of the merchandise value. If the value of the goods is €10, it is only just under 3% of the value of the goods and this percentage decreases with the amount of the purchase. This example clearly shows that credit card payments are unsuitable for micropayments.

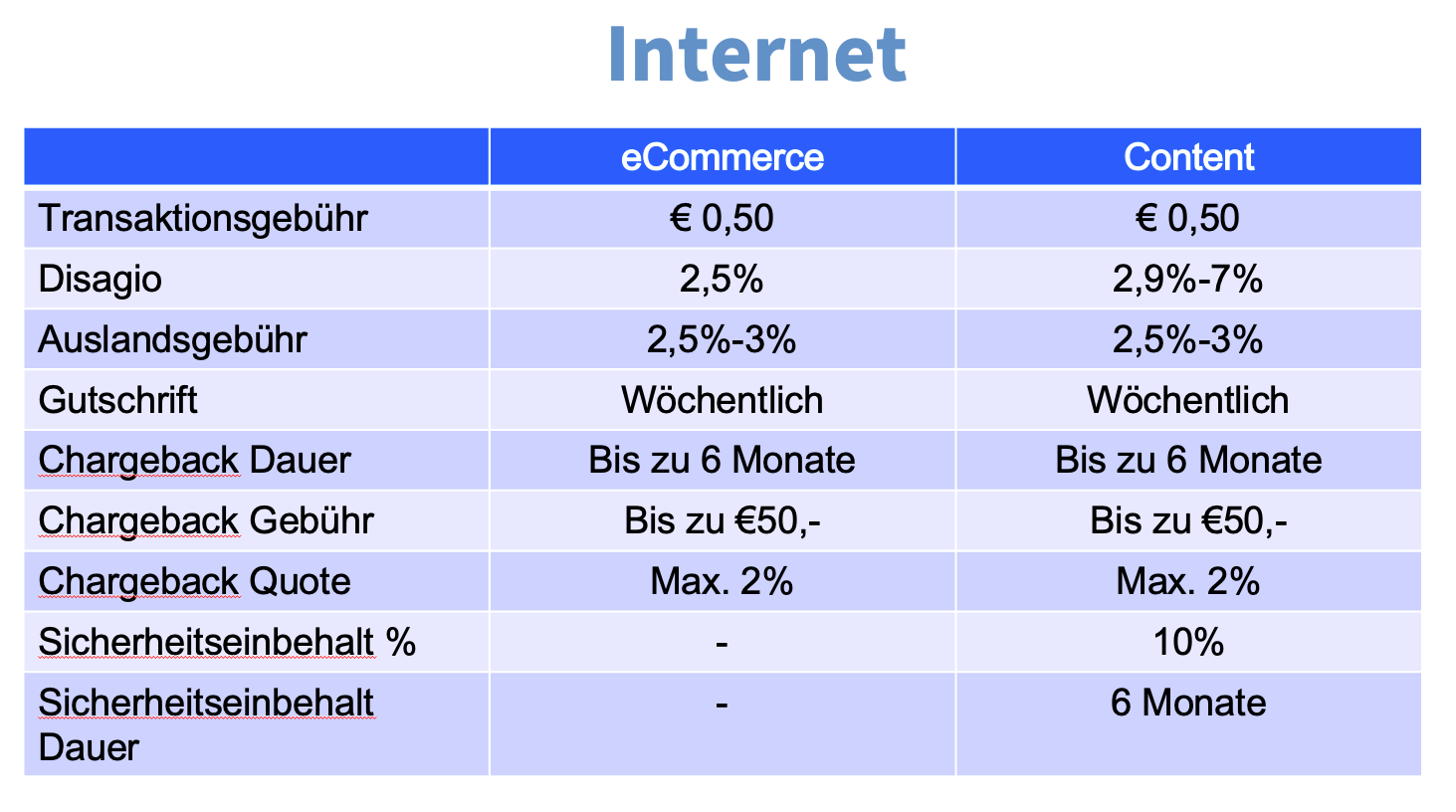

Credit card fee Internet

Looking at credit card fees for e-commerce, there are clear differences between online stores that send physical goods by post and websites with digital content that is delivered via the internet.

The difference arises from the chargeback risk involved in processing credit card payments. Only a few acquirers accept these high-risk business models and are remunerated accordingly for the additional expense. While a normal eCommerce merchant has to pay a fee of around 2.5%, this can be up to 7% for providers of digital content, as is common in the entertainment industry, for example.

What is a chargeback risk?

But what is this chargeback risk? With credit card payments, there is a risk of fraud by buyers who pay with stolen credit card data. There is also a risk from merchants who want to profit from fraudulent business models. The risk of fraud varies depending on whether the credit card payment is made in stationary retail or online and which business model is involved. To minimize the risk of fraud, there are numerous checks and controls that run in the background. If fraud occurs or the credit card payment is rejected by the cardholder, the amount is deducted from the merchant. This process is called a chargeback. The merchant always bears the full risk of such a chargeback and therefore has no guaranteed payment, as is the case with a Bitcoin payment. The higher the risk of fraud, the higher the fees that a merchant has to pay for credit card processing. Acquirers justify this with the considerable processing effort involved in a chargeback. Chargebacks are very important for online retailers of digital goods from the entertainment sector. End customers can easily initiate a chargeback with their issuer up to 6 months after payment. A short notification is sufficient for the end customer. For the merchant, however, this has far-reaching consequences. They already pay very high credit card fees and have to pay additional fees of up to €50 per chargeback. In addition, there is a chargeback risk of 6 months. There is therefore no guarantee of payment for the merchant. Due to the chargeback risk, merchants do not pay out the full amount, but retain a security deposit for up to six months. If the total chargeback rate exceeds a certain limit, there is a risk of considerable additional penalties, including termination of credit card acceptance by Visa Mastercard. These risks only exist for so-called high-risk merchants and are not relevant for merchants and operators of normal online stores. This fact is probably not relevant for most people. However, we will mention it here when we discuss the differences to Bitcoin payments later on.

Bitcoin Payment

Now that we have dealt with credit card payments from a merchant’s perspective, let’s take a look at the Bitcoin payment process.

Wallet to wallet payment

For a stationary merchant, the simplest form of accepting Bitcoin payments is to use a normal Bitcoin wallet. The merchant enters the purchase price in euros into their Bitcoin Wallet. The Bitcoin wallet converts the amount into Sats and generates a QR code, which the customer scans with their Bitcoin wallet and makes the payment. The bitcoins are then transferred directly and the customer bears the costs for the bitcoin transfer.

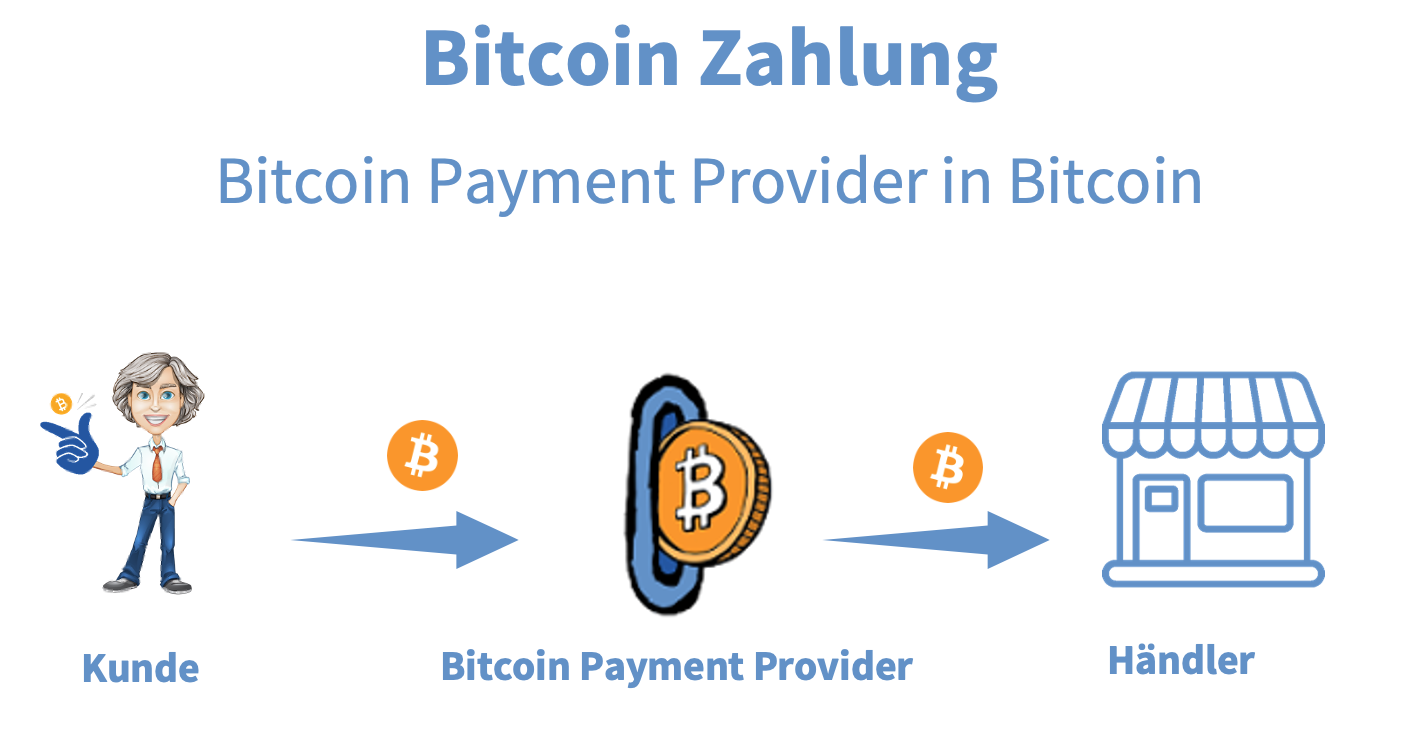

Bitcoin payment provider with payout in Bitcoin

If the merchant wants a more professional solution or operates an online store, a Bitcoin payment service provider can be involved to handle Bitcoin payment processing for the merchant. Hardware terminal solutions or special smartphone apps are then used for Bitcoin payment processing in brick-and-mortar stores. Online stores use plugins that are integrated into the online store software as an additional payment method.

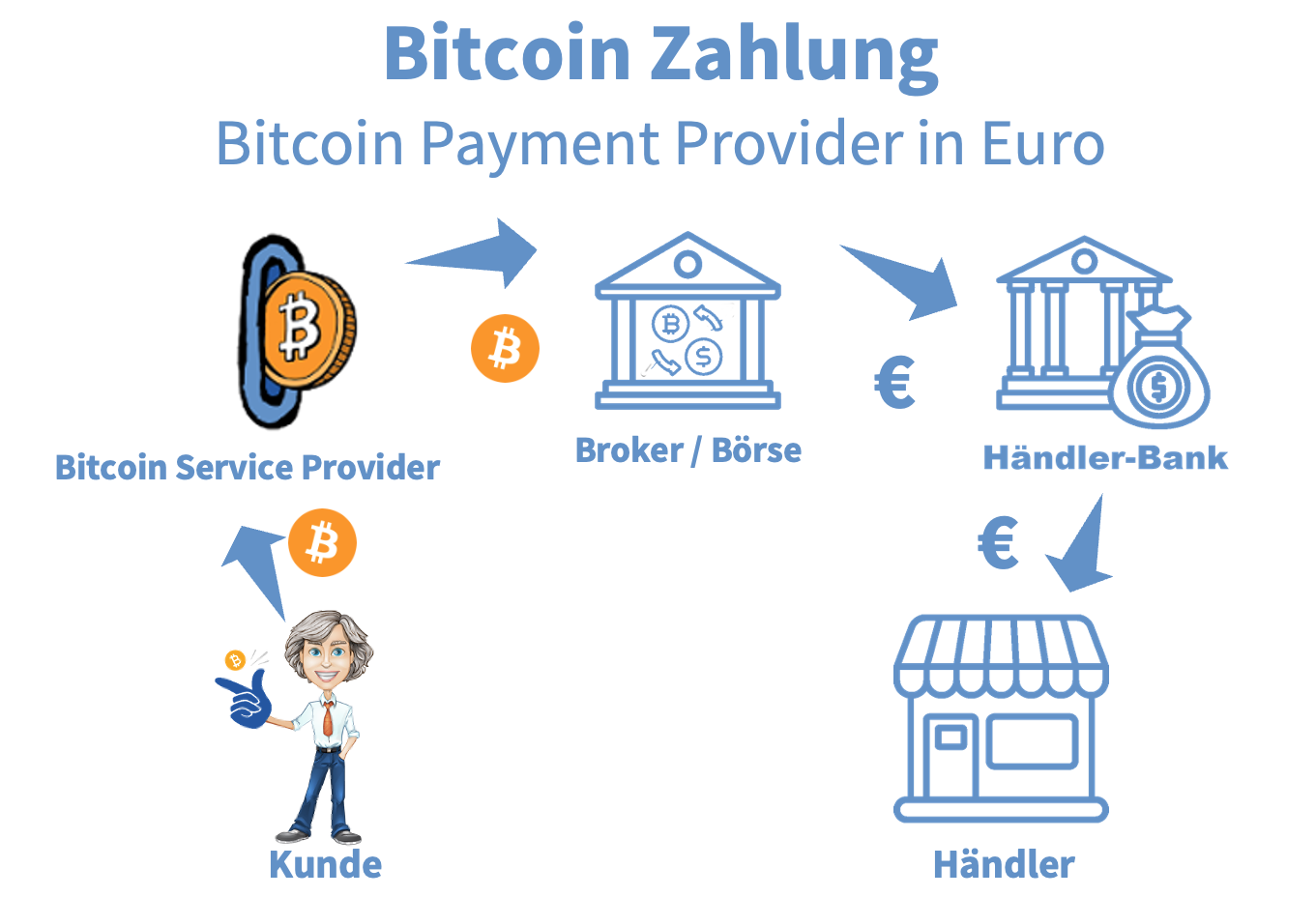

Bitcoin payment provider with payout in euros to your own bank account

If the trader wants to receive a payout in euros to their bank account instead of bitcoins, a broker or exchange comes into play. The technical process is the same as for a payout in bitcoins, except that bitcoins are also exchanged for euros. A Bitcoin broker accepts the Bitcoins received, exchanges them into euros and transfers the equivalent value to the trader’s bank account.

Credit card payment vs. bitcoin payment

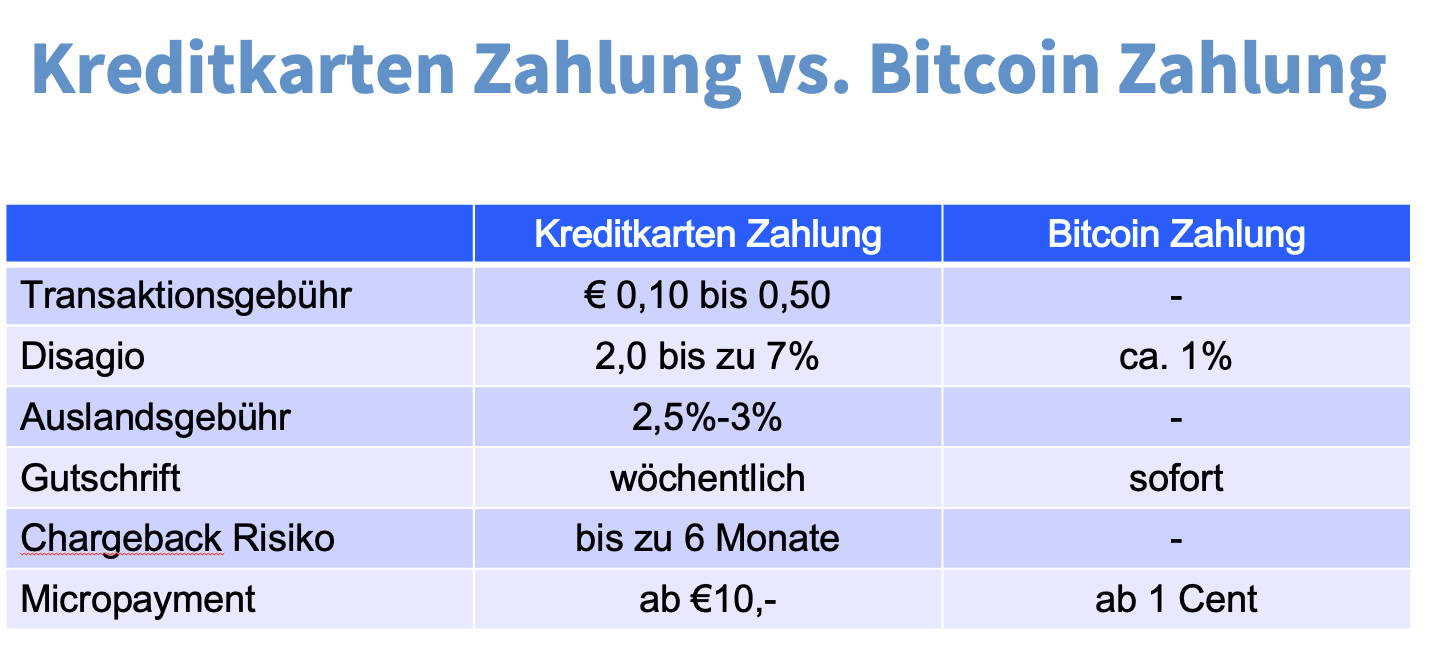

When paying by credit card, transaction fees of between 10 and 50 cents are charged to the merchant, regardless of the invoice amount. In the case of a Bitcoin payment, the merchant does not incur any transaction fees for receiving Bitcoin payments. The fees for a Bitcoin payment are external network fees that are borne by the payer. Depending on the business model and risk class, a merchant must pay a discount. This is a percentage fee on the invoice amount. This fee can be between 2 % and up to 7 %. When paying with Bitcoin and using your own Bitcoin or Lightning wallet, the fee can be zero. If you use the services of a Bitcoin payment provider, a small percentage fee of around 1% is charged. There are no regional limits for Bitcoin payments and no additional fees for foreign payments. Credit card payments are subject to additional fees for foreign cards. Credit card transactions are usually transferred to the merchant’s bank account on a weekly basis. In the case of a Bitcoin payment, the final credit is made after confirmation on the blockchain and ideally after just 10 minutes. In the case of a Bitcoin payment via the Lightning network, it is even immediate. In the case of a credit card payment, the payer can contact their issuer at any time and arrange for the payment to be reversed. The associated costs are borne by the merchant. The issuer does not check whether the reason is justified. This chargeback risk exists for the merchant for up to 6 months. There is no chargeback risk when paying with Bitcoin. Every payment with Bitcoin is final and irrevocable. If a payer wishes to reverse the purchase and receive a credit note, they must contact the merchant, who can do so after clarifying the facts. Due to the fixed transaction fees, business models in the micropayment sector cannot be realized with credit card payments. Credit card payments only make economic sense from an invoice amount of €10. Many business models cannot be implemented with credit cards and other means of payment, but this is now possible with Bitcoin and Lightning payments.

Conclusion: How does a credit card payment work and how does it differ from a Bitcoin payment?

In this article, we have shown how a credit card payment works from the perspective of a merchant. We hope that it was also helpful for those who only know a credit card payment from the payer’s perspective. Anyone who has dealt with the process and the special features of a credit card payment can understand the advantages of a payment with Bitcoin and Lightning even better. If you are a merchant and already accept credit card payments, start accepting Bitcoin and Lightning payments in your store or online store now. If you have any questions or need support with implementation and integration, we at Coincharge are here to help.