Paying without a data trail: why Bitcoin Lightning is superior to traditional payment methods

Privacy when paying is no longer a matter of course today

People who pay online today rarely pay with money alone.

They pay with data. Lots of data.

Name, address, IP address, payment amount, purchasing behavior, location, device information – all of this has long been standard with bank transfers, credit cards or PayPal. Privacy when paying is not intended, but rather a disruptive factor.

This is exactly where Bitcoin comes in.

And the difference becomes even clearer when making a Bitcoin payment via the Lightning network. Because Bitcoin payment privacy is not a marketing promise, but a direct consequence of the technical architecture.

In this article, we take a look at

which data is generated by traditional payment methods, why this data is passed on – and why Bitcoin Lightning offers significantly greater privacy for payers and merchants.

YouTube: The Transparent Payer: Why your bank knows everything (and Bitcoin doesn’t)

We have published a video on the Coincharge YouTube channel entitled“The transparent payer: Why your bank knows everything (and Bitcoin doesn’t)“

Today, paying means delivering data

Many people are surprised when they hear that Bitcoin is being talked about in regulatory terms. The real surprise, however, should be how transparent traditional payments have always been.

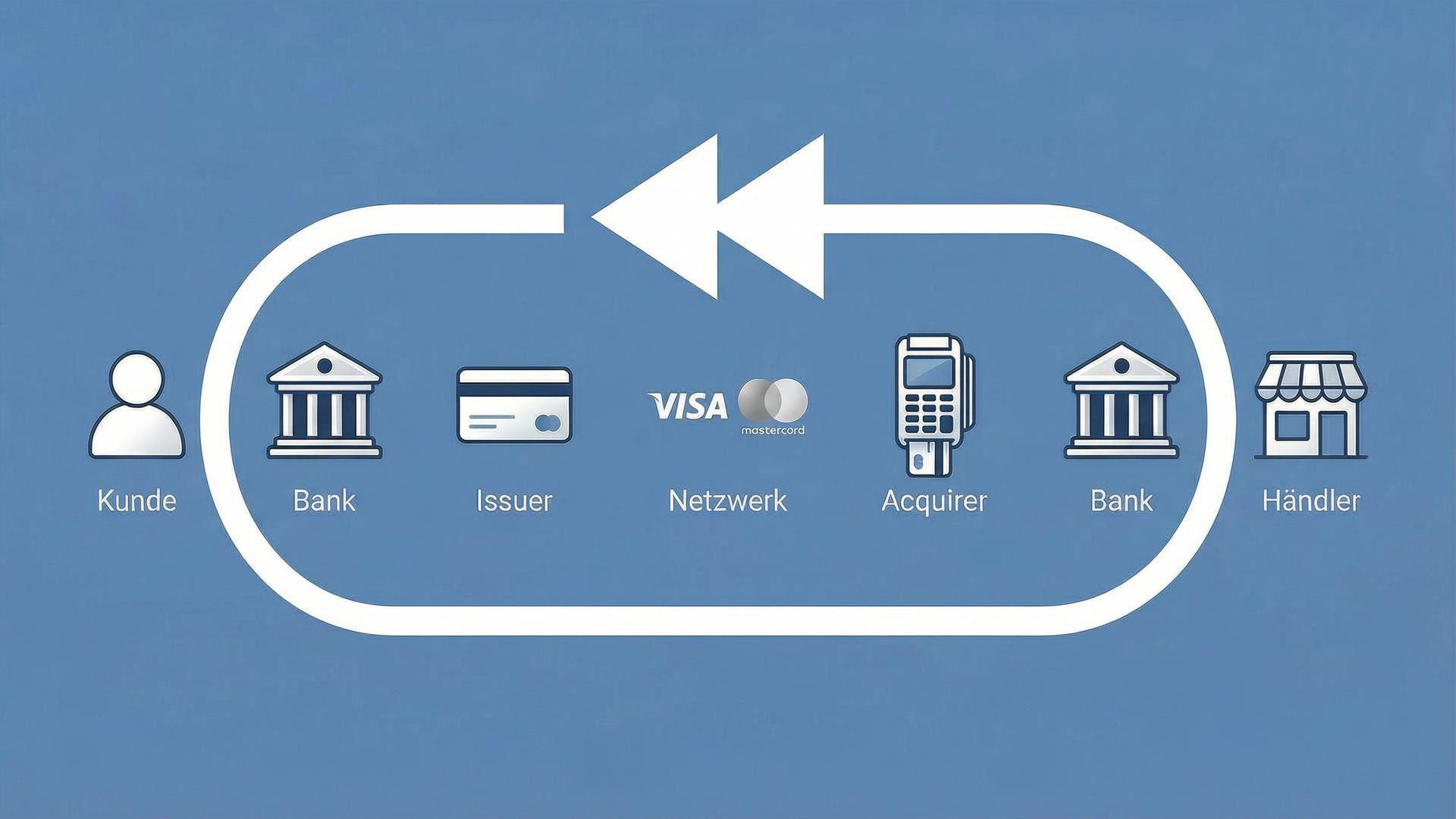

When paying by bank, credit card or PayPal, all payment information is passed on along the entire chain:

from the payer’s bank to payment service providers, card organizations, risk systems and the merchant.

This transparency is intended by law. Officially to combat money laundering and terrorist financing. Critics would add: at least as effective for comprehensive financial monitoring.

With regulations such as DAC8, Travel Rule and MiCAR, this model is now also being applied to crypto and Bitcoin payments.

The difference: In the traditional system, this data collection has always been a reality – it has rarely been questioned.

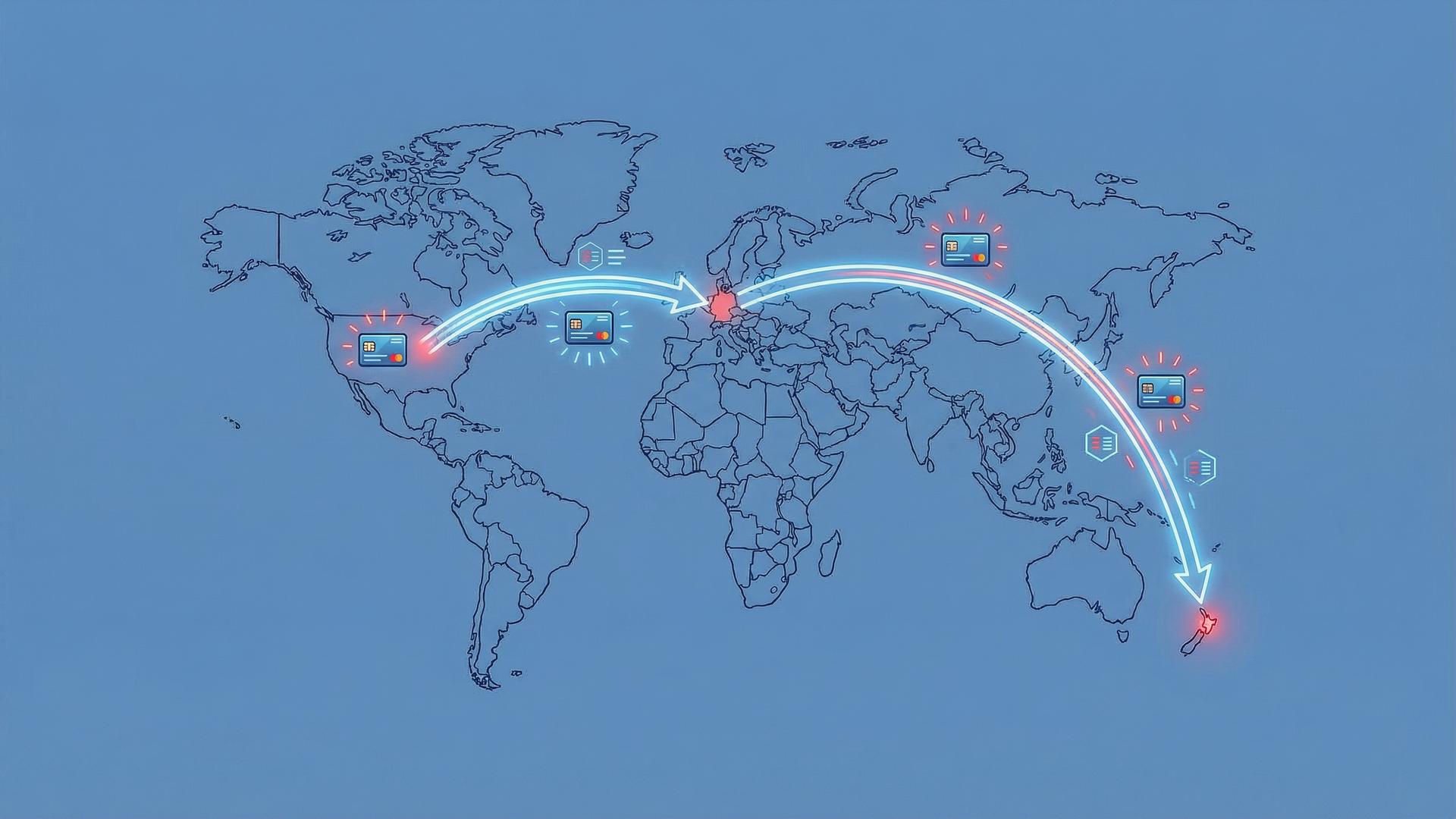

A nice example was recently provided by an X-Post from “Der Helper”:

He wanted to buy a powerbank from Germany with a German credit card – delivery to New Zealand.

The payment? Rejected.

Why?

Because all the alarm bells were ringing in the background.

This is because a credit card payment is not a direct exchange between the payer and the merchant.

It is a complex risk process with many parties involved:

card issuer, acquirer, payment network, fraud detection systems, PayPal or other intermediaries if necessary.

Among other things, the following are tested:

-

Where is the buyer located (IP address)?

-

In which country was the card issued?

-

Who is the cardholder?

-

Which goods are purchased?

-

Which category does the retailer fall into?

-

Where is the delivery made to – and does this match the identity of the payer?

What happened?

In the background, all alarm bells were ringing at the credit card company and the service providers involved. Not because a power bank is dangerous. But because the pattern “Germany → German credit card → delivery to New Zealand” occurs in many fraud scenarios.

And this brings us to an important point:

Credit card and PayPal payments are not direct payments between payer and merchant.

It is a controlled payment with a built-in rewind function – and that needs monitoring.

Shipping to the other end of the world?

From the point of view of fraud systems: highly suspicious.

The real reason for this data collection: chargebacks

Numerous credit card and PayPal checks run in the background to prevent fraudulent payments. After all, if a card is stolen or a PayPal account is hacked, the perpetrator can use the data to make purchases and have the goods delivered.

As soon as the actual cardholder realizes that something is wrong, they call their credit card company or report the case to PayPal – and the payment is reversed: Chargeback.

This only works because there is always an intermediary between the payer and the recipient. A middleman. An entity that not only “passes through”, but can also influence payments at any time.

This is convenient for consumers. For retailers, it is constant stress.

Because a chargeback is not just “theft protection”. In practice, it is also a kind of “joker”:

One call, one click, one “I wasn’t” – and the retailer no longer has the amount in their account, even though the goods may already be out.

And now comes the part that is rarely said so clearly:

For this system to work at all, it has to collect massive amounts of data and recognize patterns.

No fraud detection without data. Without fraud detection, chargebacks explode. Without chargebacks, no credit card model.

You don’t just pay – you are described

Back to the New Zealand powerbank. What was tested?

More than you might think. For example:

-

From where was the store visited (IP, Geo)

-

which country and which bank issued the card (issuer)

-

who is the cardholder

-

Which merchant is used for purchases (Merchant)

-

which merchant category (Merchant Category Code)

-

Delivery address vs. cardholder address

-

Purchase history / deviations in behavior

All this information not only goes into a “check”, but is also stored, correlated and often passed on to several participants in the chain. This is not a conspiracy – it is simply the technical reality of the traditional payment infrastructure.

And this is where it gets exciting, because this is exactly where the contrast to Bitcoin lies.

Banks are transparent – but not “just a little”

It’s similar with bank payments. Many people believe that a bank transfer is “private” because not everyone can see it. True – but in the banking system, private does not mean “data-poor”, but “centrally collected”.

In the case of a bank transfer, your bank knows:

-

your identity

-

Your address

-

your account

-

the payee

-

the intended use

-

the amount

And this information is passed on: at least to the recipient bank – and if necessary to the authorities.

Why is KYC-Light enough?

If you buy Bitcoin from a Swiss provider, a KYC-light is sufficient:

Because if you pay by bank transfer, your own bank has already carried out this identity check.

The necessary information is already available and is transmitted during the payment process anyway.

This is why Swiss lawmakers allow KYC-Light, as the relevant data is already available via the bank.

While the Swiss legislator prohibits double data collection, European Bitcoin providers are required to collect additional data:

-

complete identification of the buyer

-

renewed data storage

-

Forwarding of data to other Crypto Asset Service Providers (CASP)

Data protection?

More like a honeypot for hackers.

A classic payment is not final

Payment by bank, credit card or PayPal is never final, but is always subject to change.

At first glance, this seems like an advantage for the payer. In reality, this advantage comes at the price of a whole list of side effects:

-

Intermediaries that can block your payment

-

Risk and behavior profiles

-

KYC and identity data in several places

-

Chargeback risk for merchants

-

politically/corporate motivated blacklists

Bitcoin payment privacy: final, direct and without intermediaries

With a Bitcoin payment, there is no payment service provider that can intervene.

No hotline. No chargeback form. No central control authority.

As soon as a Lightning payment is completed, it is final.

A refund is only possible if the retailer and customer agree to it voluntarily.

This requires responsibility – on both sides.

This is precisely where the crucial difference lies:

Bitcoin payment privacy is created by eliminating the middleman.

Acceptance contracts: The invisible censorship of payment providers

Reversals are the biggest concern of credit card providers and PayPal. That’s why merchants are checked as soon as they are accepted:

-

Companies and beneficial owners go through KYC processes

-

Products and business model are evaluated

-

some categories are considered “high risk” and receive higher fees or are rejected

Payment providers are not neutral.

They are companies – mostly American – and are subject to political guidelines.

A real-life example:

A Swiss coffee roaster sells Cuban coffee – exclusively within Switzerland.

Despite this, his store is blocked because Cuban products are on US sanctions lists.

PayPal and credit card providers enforce these rules worldwide.

Bitcoin is not interested in this.

A Bitcoin payment is not interested in country of origin, product category or political specifications.

Order data vs. payment data: This is often confused

When ordering online, a distinction must be made between:

-

Data you need for the delivery (e.g. address)

-

Data that you actually only need for the payment

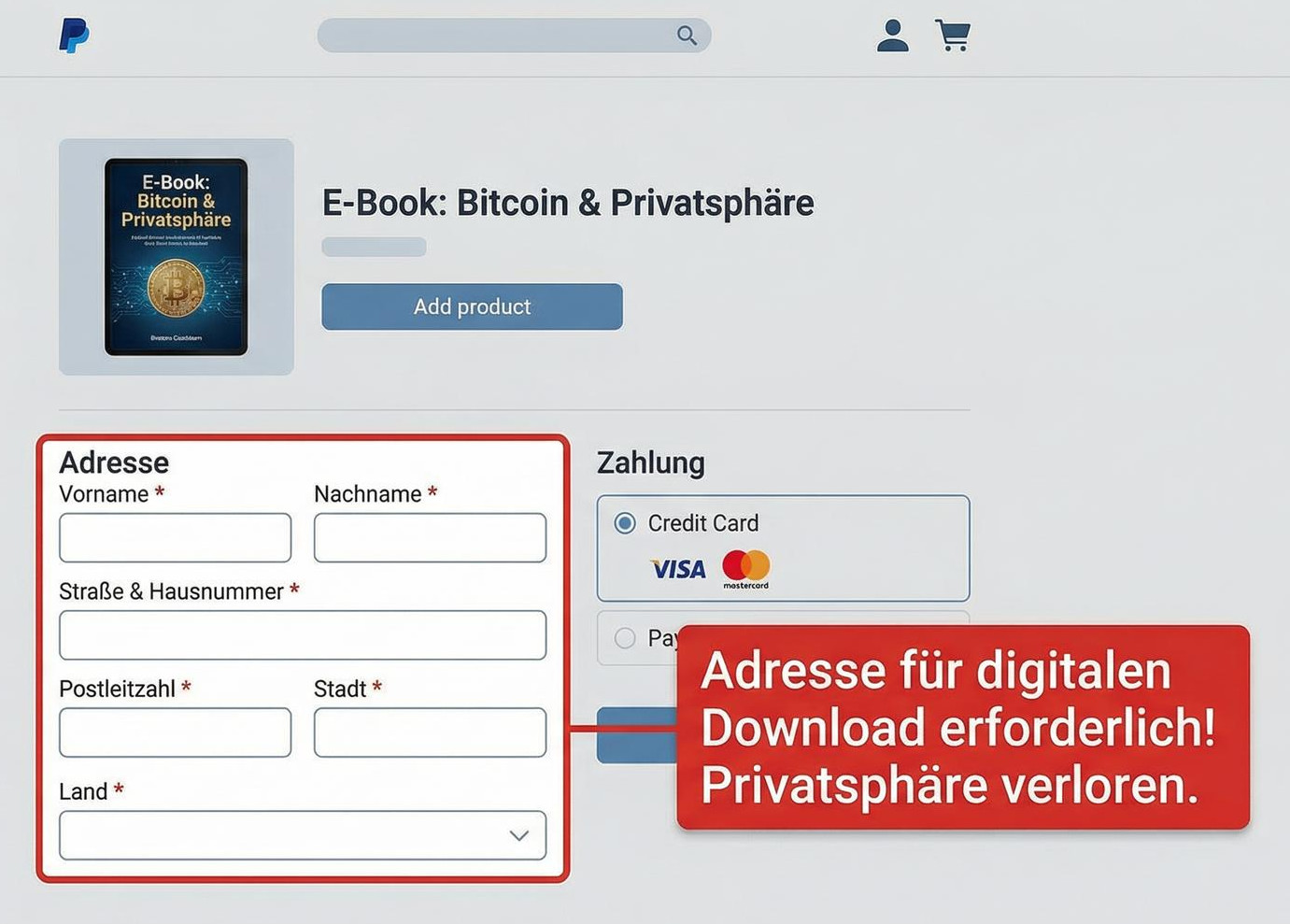

Why do even digital purchases need your address?

Have you ever noticed that you have to give your full address even for a digital product?

For the merchant, the address is often irrelevant for a download, access or digital subscription.

But because PayPal and credit card providers require it – for risk assessment.

This is not necessary for a Bitcoin payment.

If a product is provided via download, e-mail or access, the merchant does not need an address, name or date of birth.

This separation between order data and payment data is a key advantage of Bitcoin.

Lightning: Privacy by design

With Bitcoin, the payment is structured differently. It is not designed as a “retrievable” payment with a central arbiter, but as a direct transfer of value.

Anyone who transfers their Bitcoin to a self-managed wallet and uses a self-custody Lightning Wallet for payments can then pay without disclosing personal data.

If you use a self-managed wallet, much of the data that PayPal & Co. collect simply does not exist.

The process is important here:

-

You buy Bitcoin from a broker (yes, data is collected there – due to regulation).

-

You transfer the Bitcoin to your self-managed wallet (hardware wallet such as BitBox, Trezor or Ledger – depending on the setup).

-

If you want to pay, you transfer an amount to a self-managed Lightning Wallet.

And the following applies to these transfers:

No personal data is sent.

Because there is no customer account structure that binds identity to every payment.

If you then pay by Lightning, the retailer can only receive what you have to give him anyway:

-

for shipping: delivery address (logical)

-

for digital products: often just an e-mail or sometimes no e-mail at all.

And back to the New Zealand delivery:

With Bitcoin, a merchant does not have to worry that a chargeback will come weeks later because “the card was stolen”.

This reduces the need to squeeze delivery addresses into risk models. A New Zealand address is then not automatically an alarm signal – but simply an address.

Conclusion: Privacy is not a bug – it’s a feature

Bitcoin Lightning offers something that traditional payment systems have systematically abolished: Privacy through technical separation of payment and identity.

Bitcoin payment means privacy:

-

Clear separation between order data and payment data

-

No automatically enforced identity disclosure

-

No central authority to reverse payments

-

Fewer data hoards – fewer honeypots for hackers

For merchants, this means: less chargeback risk, less payment censorship, more planning security.

For payers, this means: more control over their own data.

Bitcoin Lightning shows that payment can also work differently:

minimalist, direct and data-saving.

Just as Satoshi Nakamoto envisaged in the white paper.

And this is precisely why Bitcoin is a step forward in digital payment transactions.