Accept and pay with Tether

Lately, I’ve been coming across payments with Tether – the stablecoin from Tether – more and more often.

At first, I wanted to pay a supplier with Bitcoin – instead, I got a QR code for Tether.

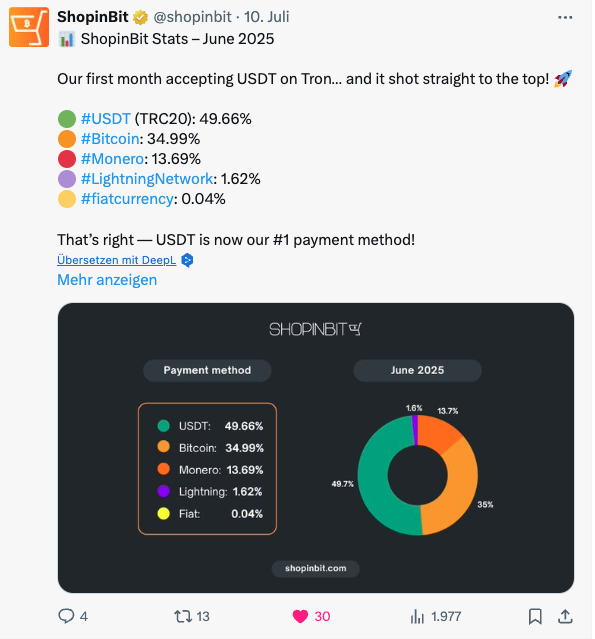

Shortly afterwards, I saw that almost half of all payments at Shopinbit, a well-known online store, were made with Tether in the first month after its launch.

That made me curious:

Is Tether a useful addition to Bitcoin and Lightning – especially for merchants?

And: Is it worthwhile for customers to pay with Tether?

In this article, we clarify:

- hat is Tether?

- Which blockchain version is used?

- For which business models is Tether useful?

- In which regions is Tether particularly popular?

- How does paying and receiving Tether work?

- Which wallets and payment providers are recommended?

YouTube Video: Accept and pay USDT

We have published a video on the Coincharge YouTube channel with the topic“Accepting and paying with USDT“

What is Tether?

Tether stands for Tether US dollar – a so-called stablecoin whose value always corresponds exactly to one US dollar.

This means that Tether is free from the exchange rate fluctuations associated with Bitcoin – and is particularly attractive for merchants who invoice in dollars or work internationally.

In addition to Tether, there is also USDC, the stablecoin from Circle. However,

Tether clearly dominates the market – with over 400 million users worldwide.

These two providers dominate the entire USD stablecoin market.

Tether is the undisputed top dog with around 109 million wallets and a total user base of around 400 million.

USDC has just under five million users and wallets.

Tether

| On-chain wallets | Central accounts | Total users (active) | |

| ≈ 109 million | ≈ 86 million | ≥ 400 million | |

| USDC | ≈ 4.9 million | (Exchange usage unknown) | At least ~5m, significantly more through B2B & Fintech |

What is Tether covered with?

According to Tether, all USDT is collateralized 1:1 with US dollars, government bonds and a small amount of Bitcoin.

Around USD 127 billion is held in US government bonds, which also generates interest – this is how Tether earns its money.

As of August 2025

Which blockchain for Tether?

Tether is a so-called multi-chain stablecoin.

It runs on several blockchains, but the Tron blockchain (TRC20) dominates – with around 70-75% of all Tether transactions.

Other blockchains:

- Tron (TRC20) – 70-75% of all USDT transactions

- Ethereum (ERC20): ~15-20% (often in the DeFi space)

- Other chains (e.g. Solana, Avalanche): <10 %

New developments such as USDT via Lightning (e.g. with the Speed Wallet) are still in their infancy.

You cannot simply send USDT between blockchains. A wallet on Tron cannot receive USDT on Ethereum – it must be exchanged first.

Numerous wallets support the most important blockchains and can then make this change internally. When making a USDT payment, however, you should always make sure that it is the same blockchain.

So if you want to use USDT for payment processing, you should do so via the Tron blockchain.

What is Tether used for?

USDT is used in many areas – especially where payment in US dollars is desired but traditional bank transfers are not practical.

Typical use cases:

International transfers

USDT is particularly suitable for international transfers and for settling USD invoices. A USDT transfer is not only faster, but also cheaper than any bank transfer and independent of bank regulations.

A company can pay its international developers with USDT instead of Swift. Especially for larger amounts for cars, technical devices or even mining products that quickly cost a few thousand US dollars, USDT is a popular payment method.

Crypto trading / OTC / Arbitrage

USDT is often used to transfer funds back and forth between different exchanges. In this way, price differences on the various exchanges can be exploited to achieve arbitrage profits.

Online Gaming & Gambling

Users pay on gambling sites with USDT. This is particularly popular in countries with high online gambling restrictions.

eCommerce and digital products in emerging markets

In emerging countries in particular, few people have their own bank account and therefore no access to online payment methods such as PayPal or credit cards. As a result, no e-commerce market has been able to develop to date. In emerging countries, the US dollar is already the most common payment method as cash. With USDT, the US dollar becomes the digital dollar for the internet world and e-commerce.

Stablecoin savings products & lending

Many long-time Bitcoiners do not want to part with their Bitcoins and lend them instead. To do this, you deposit your bitcoins as collateral and receive the loan amount in the form of Tether.

Regional use of Tether

The distribution varies greatly depending on the region:

| Region | Share | Type of use |

| Asia | >45 % | P2P, remittances, B2B |

| Latin America | ~18 % | Retail, hedging, P2P |

| Europe | ~14 % | E-commerce, B2B |

| North America | ~11 % | Institutional, Fintech (mainly USDC) |

| Africa | high | Retail, capital preservation, P2P |

Today, Asia is the largest market for Tether payments, accounting for over 45% of global Tether transactions. Tether is particularly widespread in China, Vietnam, South Korea and the Philippines and is often used for cross-border transfers, micropayments and P2P transfers.

Latin America follows in second place with 18%. There, USDT is mainly used in Argentina and Venezuela to offset currency instability.

Latin America follows in second place with 18%. Tether is mainly used there in Argentina and Venezuela to offset currency instability.

In North America, USDC dominates and is mainly used by institutional users.

USDT in practice: wallets and fees

USDT Wallet

I tested two wallets:

To pay with USDT you need:

- USDT (natural)

- Additionally some Tron (TRX) for the network fees

- Optional: Energy, if you want to save on fees (through TRX staking)

A normal transfer costs around 1-2 TRX – that’s currently around 60-70 cents.

As a Bitcoiner, I don’t have any USDT and first had to get USDT to deposit it into my Trust Wallet.

To access USDT, I use the Fixed Float (ff.io) service.

I bought USDT and also Tron (TRX) there. Because both are required to send USDT.

Once USDT as the asset I want to send and additionally Tron to pay the network fee for using the Tron network.

To use the Tron network, you also need energy. This is obtained by keeping Tron for a longer period of time. If you do not have Energy, the network fee may be slightly higher.

As a rule, you pay 1-2 TRX for a USDT payment, which currently corresponds to around 60 cents.

USDT sending and receiving

To receive a USDT payment now, we use TronLink as a second USDT wallet. I have installed TronLink as a browser extension.

When I now send a USDT payment from my Trust Wallet to the TronLink Wallet, I scan the QR code, enter the amount and send the USDT from one wallet to the other.

We already know this from our Bitcoin payments.

The difference is that we need two wallets for USDT to transfer value and one wallet with Tron funds to pay network fees.

Always make sure that the sender and recipient addresses are on the same blockchain!

Accept USDT payments with the BTCPay server

In a separate step-by-step guide, we explain how you can offer not only Bitcoin and Lightning, but also USDT (Tether) as a payment method with the BTCPay Server.

You will learn:

– How to install the USDT plugin in the BTCPay Server

– How to store your USDT wallet address

– How USDT payments are credited directly to your own wallet

Click here for the article: Accept USDT payments with the BTCPay Server

Crypto payment providers that support USDT

If you want to offer Tether as a payment method for your customers in your online store or eCommerce project, you can use the services of various payment providers.

As already seen, it is also possible to accept USDT if you operate your own BTCPay server.

Other crypto payment providers are NowPayments, CoinPayments, Cryptomus and Lunu Pay.

In our list of the most important payment providers, we have mentioned BTCPay Server and CoinPayments, as these providers also support Lightning payments. The providers NowPayments, Cryptomus and Lunu Pay do not support Lightning payments and can therefore not necessarily be recommended.

However, if you offer rather high-priced products for which USDT payments are particularly suitable, the Lightning payment is of secondary importance and a crypto payment provider that does not support Lightning payments can be considered.

Our recommendation: BTCPay Server or CoinPayments, as they also integrate Bitcoin & Lightning.

| Provider | Supports USDT | Supports Lightning |

| BTCPay Server | ✅ | ✅ |

| CoinPayments | ✅ | ✅ |

| NowPayments | ✅ | ❌ |

| Cryptomus | ✅ | ❌ |

| Lunu Pay | ✅ | ❌ |

Conclusion & summary

The US dollar stablecoin Tether from Tether is increasingly developing into an interesting payment coin.

Tether is a useful addition to Bitcoin – especially for high-priced products, international customers or customers from emerging countries who do not have access to credit cards or bank accounts.

If you are active in these target markets, it is definitely worth accepting Tether.

If you have any questions or need help with integration, you are welcome to book a consultation with me

If you have any questions, please write them in the comments. Please leave another like and subscribe to this channel so you never miss another video where we talk about how to pay with Bitcoin and how to accept Bitcoin in your business, on your website or in your online store.