Bitcoin credit card

Bitcoin debit & credit cards: comparison of the most important providers

Anyone looking for a Bitcoin credit card wants to spend their Bitcoin in everyday life – when shopping, in restaurants or online. Strictly speaking, however, this is almost always a Bitcoin debit card. A real credit card with a classic credit limit is rare in the crypto sector. Instead, Bitcoin is sold when making payments or deposited as collateral.

Nevertheless, the term Bitcoin credit card has become established in German-speaking countries.

In the first section of this article you will find out:

- How a Bitcoin credit card works technically

- how the models differ

- Which fees, spreads and cashback programs exist

In the next chapter: Overview of the most important Bitcoin debit card providers we then present the 12 most important providers:

What is a Bitcoin credit card?

In practice, a Bitcoin credit card is a debit or prepaid card that is linked to a crypto account. When paying, the merchant receives euros – in the background, Bitcoin is converted or used as collateral.

This means:

You can pay with Bitcoin wherever Visa or Mastercard is accepted – i.e. at millions of merchants worldwide.

Precisely because not many stores accept Bitcoin or Lightning directly, Bitcoin debit cards have established themselves as a practical bridging solution.

Why are Bitcoin credit cards so popular?

A key reason for this success lies with long-term Bitcoin owners.

Many holders have had their Bitcoin in their portfolio for several years. They want to use their coins without:

- actively sell them on a stock exchange

- wait for a bank transfer

- or shift their entire portfolio into fiat

With a Bitcoin credit card, you can use your Bitcoin directly in everyday life – without having to manually exchange it into euros first.

The merchant does not receive Bitcoin, but euros. This contradicts the ideal of a closed Bitcoin economy. Nevertheless, the card offers a convenient way to use Bitcoin assets in real terms.

Bitcoin debit cards are therefore not a solution for a pure Bitcoin circular economy – but a bridge to the existing Visa and Mastercard system.

How does a Bitcoin credit card work technically?

Three models have become established in Europe.

1. sale upon payment (“Sell on Spend”)

This is the most common model.

Your Bitcoin remains in the provider’s account.

The required amount is only converted into euros and sold at the moment of payment.

You therefore remain exposed to Bitcoin until the time of payment.

Typical providers with this model:

Wavecard and Bringin in particular are strongly positioned as Bitcoin-focused solutions. The approach is clearly focused on Bitcoin and not on a broad multi-asset offering.

2. conversion during charging (“pre-conversion”)

Bitcoin is already sold here when the card is topped up.

The card then contains a euro balance. No further crypto transaction takes place during payment.

This model is sometimes used by providers such as Crypto.com, Bringin or 2Fiat when users convert to fiat in advance.

Advantage:

-

No price risk after the top-up

Disadvantage:

- Bitcoin exposure ends with the deposit

3. bitcoin as collateral for a credit line

The Nexo Card offers a special model.

Bitcoin is deposited here as collateral. You receive a credit line in fiat without Bitcoin being sold immediately.

Liquidation only takes place if the loan-to-value ratio is too high.

Advantage:

- No immediate sale

Disadvantage:

- Liquidation when prices fall sharply

What you really need to look out for in a Bitcoin credit card

When choosing a Bitcoin credit card, the fees are the most important decision criterion. Many providers advertise with “0% fees” or “free card”. In practice, however, the costs are incurred in several places – and are not always transparent.

In order to understand the actual total costs, a distinction must be made between four levels.

1. conversion fee – the visible fee

Every time you pay with a Bitcoin debit card, Bitcoin is converted into euros. Many providers charge a conversion fee for this conversion.

Typical values are between 0.5 % and 2.5 %.

Example:

You pay €100 in the store.

With a 2% conversion fee, the transaction costs you an additional €2.

Your Bitcoin holdings will therefore be reduced by the equivalent of €102.

This fee is often the most transparent part of the costs.

The so-called spread is more complex.

There is no official Bitcoin reference price. Each provider uses its own liquidity sources or internal exchange prices. The spread is the difference between the market price and the price at which your Bitcoin is actually sold.

Example:

Bitcoin is quoted at €100,000 on major exchanges.

Your card provider calculates internally with €99,000.

This corresponds to a spread of 1 %.

You will not see this fee separately on your statement.

You will only receive slightly less euros per Bitcoin sold.

This is hardly noticeable because card payments usually involve small amounts. Over the course of many transactions, however, such “invisible” surcharges add up considerably.

A small spread of 0.5 % is customary in the industry. Significantly higher deviations should be questioned.

3. foreign currency fees (FX)

If you pay outside the eurozone – for example in Switzerland, the USA or on vacation – there is often an additional foreign currency fee.

This is often between 1 % and 3 %.

Example:

You pay 100 US dollars.

Your provider charges an additional 2% FX fee.

This further increases the total cost of the transaction.

Some providers combine conversion fee, spread and FX fee. This can make what is actually a small card payment significantly more expensive than expected.

4. fixed transaction fees

Less common, but particularly insidious, are fixed fees per payment, around €0.30 per transaction.

This has a major impact on small amounts.

Example:

You buy a coffee for €3.

An additional € 0.30 fixed fee will be charged.

This corresponds to 10 % costs – even before conversion or spread are taken into account.

This can add up considerably, especially for everyday micropayments.

How high can the total costs really be?

Let’s calculate a realistic scenario:

-

-

2 % conversion fee

-

1 % spread

-

2 % foreign currency fee

-

When paying abroad, the effective charge can therefore be 4-5% or more.

This means:

An annual expenditure of €1,000 via the card can result in indirect costs of €40-50 – or significantly more if several fees apply at the same time.

Many users do not check the actual exchange rate applied in detail, as card payments are convenient and fast. This is precisely where the risk of confusing marketing promises with real costs lies.

Transparency as the most important selection criterion

A good Bitcoin credit card is not characterized by the fact that it promises “0% fees”, but by the fact that it:

-

-

Clearly shows conversion fee

-

Spread explained clearly

-

FX fees communicated transparently

-

does not charge any hidden fixed costs

-

If a provider combines several types of fees, it should be clear how high the effective total costs are on a day-to-day basis.

Cashback and token rewards with Bitcoin credit cards

Many Bitcoin credit cards advertise cashback programs of 0.5% to 2% or more. Unlike traditional credit cards, however, the payout is often not made in euros or Bitcoin, but in the platform’s own tokens.

Examples are CRO at Crypto.com, BEST at Bitpanda or NEXO at Nexo.

- Crypto.com: Cashback depending on CRO staking

- Bitpanda: Cashback via BEST level

- Nexo: Cashback in BTC or tokens

- Coinbase: Temporarily changing rewards

- Wavecard: Focus on low fees rather than token models

This means that the “bonus” is not a stable amount of money, but an asset with its own price risk. The value can rise – but it can also fall significantly. An advertised cashback of 2% is only actually worth 2% if the token remains stable.

In addition, higher cashback levels are often linked to conditions, such as token staking or certain account models.

Tax treatment, DAC8, travel rule and transparency

The use of a Bitcoin credit card is not only a technical decision, but also a tax decision.

In principle, the following applies:

Bitcoin debit cards convert Bitcoin into fiat at the moment of payment. In economic terms, this is a sale of Bitcoin. Whether this actually results in taxes depends on the respective country, the holding period and the individual situation.

In Germany, gains are generally tax-free after a holding period of more than one year. Within the one-year speculation period, however, a card payment may be subject to tax.

In Austria, cryptocurrencies are subject to capital gains tax regardless of the holding period.

In Switzerland, private capital gains are generally tax-free, but Bitcoin is considered an asset and is subject to wealth tax.

Regardless of the country of residence, card payments should be documented, as every payment – technically speaking – can be a tax-relevant transaction.

DAC8, Travel Rule and reporting obligations

The introduction of DAC8 (EU directive on the tax reporting of crypto transactions) and the implementation of the travel rule will significantly increase regulatory transparency in the crypto sector.

So-called crypto-asset service providers (CASP) are subject to reporting requirements. These also include Bitcoin debit card providers or work together with corresponding regulated partners.

This means:

For regulated Bitcoin debit cards, every crypto-to-fiat conversion is reportable under DAC8. Whether reporting is transaction-based or aggregated depends on the national implementation. For the user, this means de facto complete tax transparency.

The classification is important:

A regulated Bitcoin debit card is not an anonymous payment instrument. Identity, account transactions and crypto sales are documented by the provider and are part of statutory reporting obligations.

KYC-free prepaid models or gift card solutions may have a different structure, but usually offer limited functionality and higher fees.

Bitcoin debit cards make it possible to spend Bitcoin in the existing fiat system. However, those who use Bitcoin directly with merchants who accept BTC do not need a detour via crypto-to-fiat conversion – and avoid additional fees and regulatory intermediaries.

- More info about DAC8

- Further information on the Travel Rule

Visa or Mastercard?

The network hardly plays a role for the user. Both systems are accepted worldwide.

Current distribution:

Not every “Bitcoin credit card” is a Bitcoin debit card

There are numerous lists of alleged “Bitcoin credit cards” on the Internet. However, not all of these solutions actually meet the criteria of a genuine Bitcoin debit card.

The reason is simple: Many of these solutions are either classic bank cards with an integrated crypto function (e.g. Revolut), pure prepaid euro cards with immediate BTC sales upon deposit (e.g. holyheld) or marketing-driven white label programs without an independent Bitcoin payment concept.

In such cases, the user does not actually hold a Bitcoin balance until payment is made or it is primarily a fintech card with a crypto option – not a structured Bitcoin debit card in the narrower sense.

That is why we have not included cards such as: Wirex card, holyheld, or Ledger CL Card.

Infrastructure in the background: Striga & Lightspark

Some of the European Bitcoin debit cards are based on the same technical and regulatory infrastructure. Striga Technology AS, now part of Lightspark, offers banking-as-a-service solutions for crypto businesses – including vIBAN, card processing, compliance and conversion mechanisms between Bitcoin and fiat.

Providers that use the Striga infrastructure in whole or in part include Wave.space, Bringin, Bitwala and Bitrefill. Striga acts as a technical and regulatory backend partner, while the respective brand defines the frontend, the fee model and the product strategy.

However, this does not mean that the cards are identical. There are still differences in the fee structure, spread, cashback programs, range of functions and strategic orientation – for example, whether the focus is clearly on Bitcoin-only or a broader crypto offering.

Even if the same infrastructure partner is sometimes behind the scenes, the products differ significantly in terms of their market presence and economic design.

KYC-free card solutions

In addition to regulated Bitcoin debit cards with full identity verification, there are also KYC-free alternatives. These solutions advertise anonymity and simplified access, but are structurally very different from traditional debit cards.

One example is 2Fiatwhich offers virtual Mastercard prepaid cards without identity verification. The card is topped up with cryptocurrencies, which are immediately converted into fiat. It is a prepaid model without a bank account, without an IBAN and with clearly defined limits. The fee structure is significantly higher compared to regulated debit cards, especially when topping up.

Another variant is the prepaid gift card from The Bitcoin Company. This is not a classic debit card, but a virtual Visa or Mastercard reward card with a fixed USD balance. The card is purchased once with Bitcoin (Onchain or Lightning) and cannot be reloaded. There are also restrictions on subscriptions, ATM use, 3D Secure and, in some cases, merchant acceptance.

Both solutions enable payments without formal identity verification, but are functionally limited and usually less attractive economically than regulated Bitcoin debit cards. Those who value complete anonymity must therefore expect higher fees, lower acceptance and limited functionality.

Bitcoin debit card or direct Bitcoin payment?

Bitcoin debit cards build a bridge between the Bitcoin world and the existing fiat system. They make it possible to spend Bitcoin wherever Visa or Mastercard are accepted – even if the merchant does not accept cryptocurrencies.

Technically speaking, however, most cards involve a crypto-to-fiat exchange in the background. Bitcoin is sold, euros are paid out and the merchant receives fiat money. This is convenient for the user – but in economic and regulatory terms, it remains a detour via the traditional financial system.

However, if you pay directly to a merchant who accepts Bitcoin, you use the network as it was originally intended: peer-to-peer, without intermediate conversion, without card infrastructure, without additional spread or exchange costs. With lightning payments in particular, transactions are fast, inexpensive and possible without a fiat bridge.

There is also a difference from a regulatory perspective: while regulated card providers are subject to reporting obligations as crypto-asset service providers (CASP), a direct Bitcoin payment is made between the wallet and the merchant without an intermediary crypto-fiat service provider. This does not change the tax classification in the respective country, but reduces the number of intermediaries involved.

Bitcoin debit cards are therefore a practical transitional instrument. They allow Bitcoin to be used flexibly in today’s economic system. However, the real Bitcoin economy is created where merchants accept and hold Bitcoin directly.

The more companies accept Bitcoin directly, the less the detour via cards, banks and conversion is needed.

And this is precisely where the long-term perspective lies:

Do not exchange Bitcoin for euros everywhere – but use Bitcoin directly.

Overview of the most important Bitcoin credit cards

Bitpanda Visa debit card

The Bitpanda Card is a debit card that is linked to the Bitpanda account. Users can spend funds from their wallets, including:

-

- Cryptocurrencies

- Fiat (EUR)

- Precious metals

- Bitpanda Stocks

If payment is made in cryptocurrencies or other assets, an automatic conversion into euros takes place during the payment process. The normal trading premiums of Bitpanda apply.

The card can be used worldwide, wherever Visa is accepted.

Network:

Visa

Issuer:

Issued via a regulated e-money partner in the EEA. Bitpanda is a regulated provider in Austria (FMA registration as VASP/CASP).

Model:

Sell-on-Spend (assets are automatically converted into EUR upon payment)

Fees for physical card

- Ticket issue: Free of charge

- First shipment: Free of charge

- Replacement card: 5,90 €

- Replacement of expired card: free of charge

- Delivery time: Usually 5-10 working days

Fees for virtual card

- Bitpanda primarily offers a physical Visa debit card.

- Apple Pay can be used directly with the card.

General fees

- Account opening: Free of charge

- Monthly fee: None

- Foreign currency fee (FX): 0%

(Visa surcharges outside EUR possible) - Conversion: The normal Bitpanda trading premiums apply for automatic conversion to EUR

- ATM fee: 2% or €2 (depending on which amount is higher)

Cashback

- 1 % cashback for payments with cryptocurrencies

- Cashback for crypto assets only

- No cashback for payments with EUR, stablecoins, metals or stocks

The cashback is paid out in BEST (Bitpanda Ecosystem Token) and depends on the BEST level.

Map

- Physical card: Yes

- Virtual use via Apple Pay: Yes

- Apple Pay: Yes

- Google Pay: Yes

- 3D Secure: Yes

Card limits

- Daily ATM withdrawal: 500 €

- Daily expenditure: € 10,000

- Weekly limit: € 70,000

- Monthly limit: € 280,000

Special feature

- Use of over 600 crypto assets possible

- Precious metals and tokenized assets can also be issued

- No monthly fixed costs

- 0 % FX fee (Visa surcharges possible)

- Real-time push notifications

- Card can be managed directly in the Bitpanda app

To the Bitpanda Visa card

Coinbase prepaid debit card

The Coinbase Card is a Visa debit card that is directly linked to the Coinbase account.

The desired payment asset can be selected in the app (e.g. Bitcoin). When paying, the selected crypto asset is automatically converted into euros. The merchant receives EUR, while Bitcoin is sold in the background.

Important:

The payment asset must be actively selected in the app. The card can also be set to the EUR wallet by default.

Network:

Visa

Issuer:

Regulated e-money institution in the EEA (depending on region via partner structure)

Model:

Sell-on-Spend (Bitcoin is only automatically converted into EUR upon payment)

Fees for physical card

- No monthly card fee

- No explicit “crypto issue fee”

- There is a spread when selling Bitcoin

- Foreign currency fees possible depending on region

- ATM charges by operators possible

Coinbase points out that there is no separate transaction fee, but a spread is included in the conversion rate.

Cashback

- Changing crypto rewards (varies by region)

- No mandatory staking

- Rewards can be customized

Map

- Virtual card: Yes

- Physical card: Yes

- Apple Pay: Yes

- Google Pay: Yes

- Integrated 2-factor authentication

Special feature

- Major international brand

- Fully regulated environment

- Flexible asset selection

- Spread-based fee model

- Sell-on-Spend also available in Germany

to the Coinbase Card

Crypto.com Visa Card

The Crypto.com card is a prepaid Visa card. It is not directly linked to a bank account or wallet in the sense of a sell-on-spend model.

The card must be actively topped up before it can be used:

-

- from the crypto wallet (crypto is converted into fiat)

- from the cash account

- by debit/credit card

After topping up, the card holds a fiat balance. No new crypto conversion takes place during payment.

The cards are available in six different levels, which are primarily characterized by:

-

- CRO staking / Lockup

- Cashback amount

- Additional services (Spotify/Netflix rebates etc.)

differentiate.

The Midnight Blue is the free entry-level card.

Network:

Visa

Issuer:

Regulated e-money institution in the EEA (via Crypto.com partner structure)

Model:

Prepaid / pre-funding (crypto or fiat is loaded onto the card before use and converted into fiat)

Fees for physical card

- Midnight Blue: 4,99 €

- Higher card levels: €24.99 or free of charge depending on plan / staking

- Card replacement:

- Midnight: 45,01 €

- Other levels: 50 €

- Account closure: 50

Fees for virtual card

- Virtual maps are available depending on the region.

- The structure corresponds to the prepaid logic of the physical card.

General fees

Top-up by debit/credit card: 1 %

ATM withdrawals:

- Free of charge up to the respective monthly limit (depending on card level)

- Thereafter 2 %

- Additional possible ATM operator fees

Foreign currency fees:

Midnight Blue:

- Within EU/UK: 0.2 %

- Outside EU/UK: 2.0 %

Other card levels:

-

No additional foreign currency fee

Inactivity fee:

€5 per month after 12 months without activity

Cashback

Cashback is paid out in CRO (Crypto.com Token).

The amount depends on the card level and the CRO lockup.

Example (monthly reward caps):

- Basic (Midnight): no classic cashback

- Ruby / Plus: up to USD 1,250 per month eligible for rewards

- Jade/Indigo: up to 2,500 USD

- Higher levels: unlimited

In addition, Spotify or Netflix rebates can be granted in CRO (depending on the plan).

Important:

Cashback is not in Bitcoin or fiat, but in CRO – a volatile platform token.

Map

- Physical card: Yes

- Virtual map: Yes (regional)

- Apple Pay: Yes

- Google Pay: Yes

Card limits

- Monthly ATM withdrawal: Midnight €200

- POS limit: €25,000 daily

- Maximum card balance: € 25,000

- Crypto-to-card transfer: up to €25,000 daily

Special feature

- Six map levels with different CRO staking

- Prepaid model (no live sell-on-spend)

- High limits

- CRO-based reward structure

- Partial token lockup required

- 3D Secure

- Integration into the Crypto.com ecosystem

In contrast to sell-on-spend cards (e.g. Coinbase or Wave), the Crypto.com card is a classic prepaid structure. Bitcoin or other cryptocurrencies are already converted into fiat when topping up.

This means:

-

- No further Bitcoin exposure after top-up

- Charges are primarily incurred when topping up

- The focus is more on the CRO rewards program than on Bitcoin usage in the narrower sense

to the Crypto.com Card

Wavecard by Wave.Space

The Wavecard is a Bitcoin-focused debit card. Bitcoin remains in the credit balance until the payment process and is only converted into fiat at the moment of the transaction.

A special feature is the integration of Nostr Wallet Connect (NWC). This allows the card to be connected to its own Lightning wallet so that payments can also be made from self-custody.

The card can be used under a pseudonym – the card name is freely selectable.

Network:

Visa

Issuer:

Issued via a regulated card structure in the EEA (specific issuer depending on region via partner bank/e-money institution).

Model:

Sell-on-Spend (Bitcoin is only converted when payment is made)

Fees for physical card

- Card issue: € 29.99 (payable in BTC)

- ATM withdrawal: €2 + 3% per withdrawal

Fees for virtual card

- Virtual maps can be created directly in the app

- Issue fee from approx. 2.99 €

- Multiple virtual cards possible

General fees

- Conversion fee: 1 %

- Spread: up to 0.5% (passed on by liquidity providers according to the provider)

- Total conversion costs: approx. 1.5%

- Foreign currency fees (FX): 0%

- No fixed transaction fees

Cashback

- Currently no active cashback program

- Bitcoin cashback planned according to provider

- Regular Bitcoin Reward promotions

Map

- Virtual: Yes

- Physical: Yes (depending on region)

- Apple Pay / Google Pay: Yes

Special feature

- Bitcoin-only focus

- Lightning integration via NWC

- Pseudonymous card use possible

- 0 % FX fees

- Multiple virtual cards can be created

- Worldwide acceptance via Visa

- Bitcoin account with its own IBAN for buying and selling Bitcoin, e.g. to top up the card.

to the Wave.Space Card

Nexo Crypto Card

The Nexo Card is a combined crypto credit and debit card. Users can switch between two modes in the app at any time:

Credit Mode

-

- No direct sale of Bitcoin or other assets

- Instead, a credit line based on deposited cryptocurrencies is used

- The deposited assets serve as collateral

- Flexible repayment possible

- Interest on credit line from approx. 2.9% (depending on loyalty level)

The advantage:

Bitcoin does not have to be sold – the price risk remains the same.

Debit Mode

-

- Classic sell-on-spend model

- Cryptocurrencies or stablecoins are automatically converted into fiat when paying

- No borrowing

- Use of your own credit

Network:

Mastercard

Issuer:

Regulated e-money institution in the EEA (via Nexo partner structure)

Model:

Dual model

– Credit Mode (crypto-collateralized credit line)

– Debit Mode (Sell-on-Spend)

Fees for physical card

- No monthly fee

- No annual fee

- No inactivity fee

- Physical card: free shipping (from Gold Loyalty Tier & > $5,000 balance)

Fees for virtual card

- Activation possible from $50 credit

General fees

ATM fees (monthly allowances depending on Loyalty Tier)

-

- Base: 200 €

- Silver: 400 €

- Gold: 1.000 €

- Platinum: 2.000 €

After exceeding:

2 % fee (min. € 1.99)

Foreign currency fees (FX)

Weekdays:

-

- EEA / UK / CH: 0.2 %

- Rest of the world: 2 %

Weekend:

-

- EEA / UK / CH: 0.7 %

- Rest of the world: 2.5 %

Cashback

Cashback is only granted in credit mode.

Prerequisite:

At least $5,000 account balance.

Cashback depending on Loyalty Tier:

-

- Platinum: 2 % in NEXO or 0.5 % in BTC

- Gold: 1 % in NEXO or 0.3 % in BTC

- Silver: 0.7 % in NEXO or 0.2 % in BTC

- Base: 0.5 % in NEXO or 0.1 % in BTC

Important:

Cashback in BTC is significantly lower than in NEXO tokens.

Map

- Virtual card: Yes

- Physical card: Yes (from Gold Tier)

- Apple Pay: Yes

- Google Pay: Yes

- EEA & UK available

Special feature

- Switchable between debit and credit mode

- Borrowing without a credit check

- Bitcoin does not have to be sold in credit mode

- Interest costs for credit utilization

- Loyalty tier system depending on the NEXO token share

- Earn function (interest on unused credit possible)

The Nexo Card is not a pure Bitcoin debit card, but a hybrid financial product.

In credit mode, no Bitcoin is sold – instead, a collateralized loan is used. This preserves the Bitcoin exposure, but incurs credit costs.

In debit mode, it corresponds to a classic sell-on-spend card.

The structure is therefore much more complex than Wave, Coinbase or Bitpanda and is aimed more at users who want to combine credit and yield models.

To the Nexo Crypto Card

Kraken Card

The Krak Card is a Mastercard debit card that is linked to Krak Everyday credit.

A spending sequence is defined in the app. The card automatically uses the first available asset from this sequence.

If cryptocurrencies or foreign currencies are used, the conversion is made into the card’s main currency at the time of transaction authorization:

-

- EU: EUR

- UK: GBP

If one asset is not sufficient, further assets from the list are combined.

This is a genuine sell-on-spend model.

Network:

Mastercard

Issuer:

Monavate (e-money institute in the EEA)

Model:

Sell-on-Spend (assets are automatically converted into the main currency when paying)

Card fees

- No annual fee

- No monthly fee

- No transaction fee

- No FX fee on the part of Krak

Spread

Krak takes into account a spread in the conversion rate when assets are sold.

This spread is included in the transaction price and can be viewed in the transaction details in the app.

Foreign currency (FX)

- No own FX fee

- Mastercard exchange rate is passed on without surcharge

- Nevertheless, a conversion can be made between the main currency and the fiat held

Important:

The card is always billed in the main currency (EUR or GBP).

ATM fees

- No ATM fee through Krak

- Third-party provider fees possible

Cashback

- Up to 1 % cashback

- Optionally in EUR, GBP or Bitcoin

- Credited directly after transaction processing

No staking required.

Map

- Virtual card: Yes (immediately available)

- Physical card: Yes (orange or black)

- Apple Pay: Yes

- Google Pay: Yes

- EEA & UK available

Special feature

- Over 400 assets to choose from

- Individual output sequence via drag & drop

- Assets can be blocked for spending (e.g. do not spend BTC)

- No monthly fees

- Spread can be viewed transparently in the app

- Support for cash and crypto balances

The Krak Card is a classic sell-on-spend card without prepaid top-up.

Fee model:

No explicit transaction or FX fees, but an integrated spread on asset sales.

Bringin Bitcoin Debit Card

The Bringin Card is a Bitcoin debit card with a personal vIBAN account in your own name.

The model works as follows:

-

Users receive a personal Euro-IBAN.

-

Bitcoin is deposited via on-chain or Lightning.

-

Bitcoin is immediately converted into euros.

-

The euro credit is used on the card.

There is no sell-on-spend conversion when paying.

The card works with a pre-converted euro balance.

Network:

Visa

Issuer:

Regulated e-money institution in the EEA (via Bringin partner structure)

Model:

Pre-conversion with vIBAN (Bitcoin is immediately converted into euros upon funding)

Card fees

- 37.69 € per year (approx. 3.49 € per month)

- 10 % discount campaigns possible

- Physical and virtual card included

General fees

- 0 % usage fee per payment

- 0 % FX fee for card payments

- 1% Bitcoin to Euro conversion fee

- In addition, up to 0.5% markup in the Bitcoin price (according to the provider)

- Total costs for BTC funding therefore effectively approx. 1-1.5 %.

ATM fees

Standard limits (depending on the KYC level):

-

Card payments:

€10,000 per day

€15,000 per month -

Cash withdrawal:

€350 per day

€3,000 per month

Cashback

- no cashback

Map

- Virtual card: Yes

- Physical card: Yes (included free of charge)

- Google Pay: Yes

- Samsung Pay: Yes

- Garmin Pay: Yes

- Apple Pay: Only via Curve (no direct integration)

Special feature

- Personal vIBAN in your own name

- Funding via SEPA or Lightning

- Multiple physical and virtual cards possible

- One-time virtual cards (one-time cards) for online payments

- Self-custody connection advertised

- 0 % FX fee worldwide

Bringin is not a classic sell-on-spend card like Kraken or Coinbase.

Bitcoin is already converted into euros during the funding process.

This means that there is no further Bitcoin exposure after the deposit.

Advantages:

-

- Clear, transparent 1 % conversion fee

- vIBAN in its own name

- Lightning funding possible

- No ongoing transaction fees

Disadvantages:

-

- Annual basic fee

- No cashback program

- No holding of Bitcoin until the payment point

To the Bringin Bitcoin Debit Card

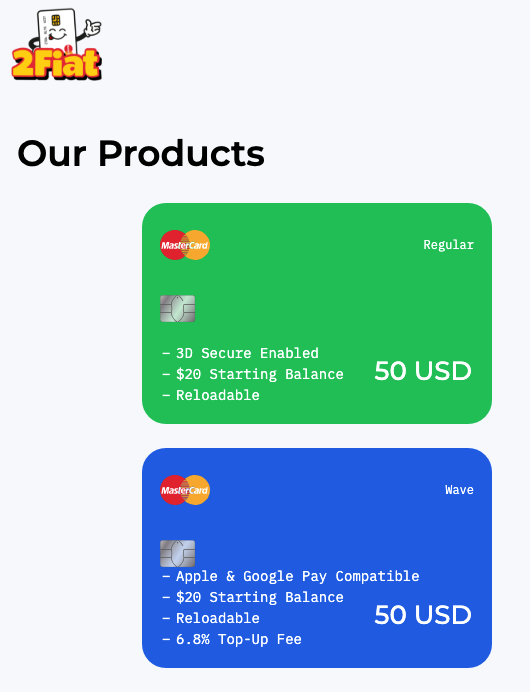

2Fiat Card

The 2Fiat card is a virtual prepaid Mastercard that can be topped up with Bitcoin, Monero, USDT or other cryptocurrencies.

An immediate conversion to fiat takes place during the top-up.

The card then holds a fiat balance – there is no live conversion during payment.

The cards are issued without traditional identity checks (no KYC). According to the provider, no ID documents are required. An e-mail address may be required for Apple Pay.

The cards are reloadable and support 3D Secure (3DS).

Network:

Mastercard

Issuer:

Not transparently disclosed. It is a virtual prepaid Mastercard that is issued via an external card infrastructure. A specifically named regulated EEA issuer is not clearly communicated to the public.

Model:

Prepaid / Pre-Conversion

(crypto is immediately converted to fiat when topped up)

Fees for physical card

- No physical card available.

- These are exclusively virtual cards.

Fees for virtual card

Mastercard Regular

- Card issue: 50 USD (including 20 USD starting credit)

- Transaction fee: USD 0.50 per authorization (also in case of rejection or cancellation)

- Top-up fee: 6 %

- No KYC required

Mastercard Wave (Apple Pay & Google Pay compatible)

- Card issue: 50 USD (including 20 USD starting credit)

- Transaction fee: USD 0.50 per authorization

- Top-up fee: 6.8 %

- Apple Pay & Google Pay compatible

- 3D Secure activated

General fees

- Top-up fee: 6 % or 6.8 %

- Fixed transaction fee: USD 0.50 per payment

- No clearly communicated FX fee

- Spread not shown separately in the conversion rate

The combination of a percentage top-up fee and a fixed transaction fee can significantly increase the effective costs – especially for smaller amounts.

Cashback

- No cashback program.

Map

- Virtual card: Yes

- Physical card: No

- Apple Pay: Yes (for Wave variant)

- Google Pay: Yes (for Wave variant)

- 3D Secure: Yes

Special feature

- No KYC according to provider

- Anonymous output possible

- Support for multiple cryptocurrencies

- Several cards can be ordered

- Worldwide use via Mastercard

- Prepaid structure (no Bitcoin exposure after topping up)

To the 2Fiat Card

Bybit Card

The Bybit Card is a debit card that is directly linked to the Bybit Funding account. There is no separate card wallet.

When a payment is made, the existing fiat balance (e.g. EUR for EU users) is used first. If this is not sufficient, stored cryptocurrencies are automatically sold. The conversion takes place at the time of transaction authorization via the Bybit one-click sell system.

It is therefore a sell-on-spend model with fiat prioritization.

Network:

Mastercard

Issuer:

Regulated e-money institution in the EEA (via Bybit EU structure; specific issuer partnership depending on region)

Model:

Sell-on-Spend (fiat-first logic)

Cryptocurrencies are automatically converted into the main card currency during payment if there is insufficient fiat balance.

Fees

-

Annual fee: None

-

Inactivity fee: None

-

Card issue:

-

Virtual: free of charge

-

Physical: first free of charge, replacement 5 €

-

-

Crypto conversion fee: 0.9%

(in addition to the Bybit EU one-click sell rate) -

Foreign currency fee: 0.5%

(in addition to the Mastercard exchange rate) -

ATM withdrawal:

-

First €100 per month free

-

Thereafter 2 %

-

Cashback

- 2 % – 10 % depending on Bybit VIP level

- Partly 100% cashback on selected promotions

- Monthly cashback caps

- Cashback structure strongly linked to trading volume and VIP status

Map

- Virtual card: Yes

- Physical card: Yes

- Apple Pay: Yes

- Google Pay: Yes

Special feature

- No separate card top-up necessary

- Individual payment priority can be set for cryptocurrencies

- Supports multiple crypto assets (including BTC, ETH, USDC)

- High spending limits (up to €50,000 per month)

- Exchange-integrated fee model

- Spread in the one-click sell rate in addition to the 0.9 % fee

To the Bybit Card

Bitrefill Card

The Bitrefill Card is a Visa debit card that is operated with a euro balance.

Cryptocurrencies (e.g. BTC, ETH, USDC, BNB) are converted into euros when the card is topped up. The conversion takes place at the time of the top-up confirmation.

After topping up, the card holds a EUR balance. No new crypto conversion takes place when paying.

It is therefore a pre-conversion model.

Network:

Visa

Issuer:

Regulated e-money institution in the EEA (via partner structure; infrastructure according to publicly available information via Striga)

Model:

Prepaid / Pre-Conversion

Crypto is converted into EUR when topping up.

Fees

- Account setup: Free of charge

- Virtual map: Free of charge

- Physical card: Free of charge

- Monthly fee: None

- Card transactions: None

- Foreign transactions: No additional FX fee

Crypto conversion

- 1.99 % fixed custody account fee

- Additional variable exchange costs (spread of the card partner)

- This effectively results in total costs of over 2% for BTC → EUR conversion.

ATM withdrawal

- 2,49 %

- Only with physical card

Cashback

- No cashback program

Map

- Virtual card: Yes

- Physical card: Yes

- Google Wallet: Yes

- Apple Wallet: announced / available soon

- NFC payments: Yes

- SEPA payment to bank account possible

Special feature

- Very simple structure

- No annual or monthly fees

- SEPA payout from card balance possible

- Crypto → EUR conversion with transparent fixed fee

- High daily and monthly limits (starter: € 7,500 per day/month)

- No token or staking model

- No FX fees for foreign transactions

The Bitrefill Card is not a sell-on-spend card. Bitcoin or other cryptocurrencies are already converted into euros when topping up.

The cost structure is simple, but comparatively high at 1.99 % + spread. It is more suitable for occasional use or for users who are looking for an uncomplicated prepaid solution without staking or a complex rewards structure.

To the Bitrefill Card

Bitwala Card

The Bitwala Card is a Visa debit card that is linked to the Bitwala account.

Payments can be made directly with EUR or with cryptocurrencies (BTC, ETH, USDC). If payment is made in crypto, automatic conversion into euros takes place at the time of the transaction.

It is therefore a sell-on-spend model.

Network:

Visa

Issuer:

Regulated e-money institution in the EEA (via Striga infrastructure)

Model:

Sell-on-Spend

Cryptocurrencies are automatically converted into EUR when paying.

Fees

- Account setup: Free of charge

- Monthly fee: None

Card fees

- Virtual card: € 0.99 one-off

- Physical card: €9.99 one-off (+ shipping)

Payments

- in Euro free of charge

- in crypto €2,- + 1% per transaction

ATM withdrawal

- €2,- + 1 %

Cashback

- No cashback program

Limits

-

Card payments:

-

10,000 € daily

-

15,000 € per month

-

-

Cash withdrawal:

-

350 € daily

-

3,000 € per month

-

Map

- Virtual card: Yes

- Physical card: Yes

- Visa network

- Apple Pay / Google Pay (depending on regional integration)

Special feature

Bitwala is a clear sell-on-spend solution with a transparent fee structure.

The 1% + €0.20 per crypto transaction is understandable, but relatively expensive for smaller amounts due to the fixed €0.20 component.

Bitwala thus positions itself as a simple, transparent solution without a token model or staking elements.

To the Bitwala Card

The Bitcoin Company – Visa / Mastercard Gift Card

The Bitcoin Company Gift Card is a virtual prepaid reward card (Visa or Mastercard) that can be purchased with Bitcoin (Lightning or on-chain).

A fixed USD balance (e.g. 10-750 USD) is loaded when the purchase is made. After the purchase, Bitcoin no longer plays a role. The card works like a classic prepaid gift card.

There is no automatic crypto conversion when paying. The card is not rechargeable.

Network:

Visa or Mastercard (depending on the card selected)

Issuer:

yourrewardcard.com (rewards/loyalty program provider; not a traditional bank or EMI account)

Model:

Prepaid gift card

Bitcoin is exchanged once for USD credit at the time of purchase.

Fees

- No monthly fee

- No card issue fee (included in the purchase price)

- No ATM access

Costs arise implicitly through:

- Exchange rate / spread on purchase

- Possible USD to EUR conversion for use outside the USA

- Merchant holds (e.g. petrol station up to USD 100, restaurant up to 20 %)

Cashback

- 0.21 % Rewards (in Satoshis, according to the provider)

- No classic cashback program

Map

- Virtual map

- No physical card

- Apple Pay / Google Pay: partially possible, but not guaranteed

- No 3D Secure

- No ATM withdrawal

Special feature

- KYC-free purchase (via e-mail or Lightning Login)

- Purchase via Lightning or on-chain possible

- Not rechargeable

- Not suitable for subscriptions

- Not for wallet top-ups (PayPal, Revolut etc.)

- Increased probability of rejection at certain retailers

- Cards can be deactivated if terms of use are violated

The Bitcoin Company Gift Card is not a Bitcoin debit card in the traditional sense, but a prepaid gift card that is purchased in exchange for Bitcoin. It is suitable for occasional online payments, but is not comparable to a fully-fledged Bitcoin debit card in terms of functionality and regulation.

Revolut crypto card

The Revolut crypto card is linked to a crypto wallet within the Revolut app. When a payment is made, the selected cryptocurrency (e.g. Bitcoin) is automatically exchanged for fiat and the merchant is paid in the local currency. Each payment is technically considered a sale of crypto.

Network:

Visa or Mastercard (depending on region and card type)

Issuer:

Revolut Bank UAB (Lithuania)

Crypto service: Revolut Digital Assets Europe Limited

Model:

Sell-on-Spend within a bank structure

Bitcoin is sold at the moment of payment.

Fees

No separate card fee for crypto payments.

Costs are incurred via the regular Revolut crypto trading fees:

- Standard plan: approx. 1.49 %

- Premium: approx. 0.99 %

- Metal: approx. 0.49 %

- Ultra: 0 % (within the limit)

In addition:

- Spread included in the price

- Weekend surcharges possible

- Fair usage limits depending on subscription

Effectively mostly between approx. 1-2.5 %.

Cashback

- No cashback for crypto payments.

- Cashback only in certain fee-based subscription models (not specifically for crypto).

Map

- Immediately available virtually

- Physical card can be ordered

- Apple Pay & Google Pay supported

- No business/pro cards can be linked to crypto pocket

Special feature

- Fully regulated EU bank

- Complete KYC

- BTC can be deposited and withdrawn onchain

- No Lightning support

- No self-custody model

- Classic all-in-one fintech with crypto function, not a Bitcoin-only approach

To the Revolut crypto card

All Bitcoin card providers at a glance

| Solution Provider | Network | Model | KYC | Conversion | Fees (crypto) | Cashback | ATM | Special features |

|---|---|---|---|---|---|---|---|---|

| Bitpanda | Visa | Sell-on-Spend | ✅ | When paying | Trading-Premium (integrated) | 1% (BEST) | ✅ (2% / €2) | 600+ Assets, Metals |

| Coinbase | Visa | Sell-on-Spend | ✅ | When paying | Spread | Variable Rewards | ✅ | Asset selection in app |

| Crypto.com | Visa | Prepaid | ✅ | With the Top-Up | Spread + 1% top-up if applicable | Up to 2%+ (CRO) | ✅ | Staking/animal model |

| Wave.card | Visa | Sell-on-Spend | ✅ | When paying | 1% + up to 0.5% spread | ❌ | ✅ | Lightning via NWC, BTC-only |

| Nexo | Mastercard | Hybrid (debit + credit) | ✅ | Debit: when paying / Credit: no sale | Spread (debit) / interest (credit) | Up to 2% (NEXO/BTC) | ✅ | Credit against BTC |

| Kraken (Krak) | Mastercard | Sell-on-Spend | ✅ | When paying | Spread | Up to 1% (EUR/BTC) | ✅ | No FX fee |

| Bringin | Visa | Pre-conversion | ✅ | Funding | 1% + up to 0.5% spread | ❌ | ✅ | vIBAN, Lightning |

| 2Fiat | Mastercard | Prepaid | ❌ | With the Top-Up | 6-6.8% Top-Up | ❌ | ❌ | No identity verification |

| Bybit | Mastercard | Sell-on-Spend (Fiat-First) | ✅ | When paying | 0.9% + spread | 2-10% (VIP) | ✅ | Exchange integration |

| Bitrefill | Visa | Prepaid | ⚠️ (depending on use) | With the Top-Up | 1.99% + spread | ❌ | ❌ (no ATM) | Lightning top-up |

| Bitwala | Visa | Sell-on-Spend | ✅ | When paying | 1% + €0,20 | ❌ | ✅ | Striga infrastructure |

| The Bitcoin Company | Visa / MC | Giftcard (prepaid) | ❌ | When buying | Spread implicit | 0,21% | ❌ | Not rechargeable |