Bitcoin taxes and accounting when accepting Bitcoin payments in an online store.

Bitcoin taxes and accounting when accepting Bitcoin payments in an online business or on the Internet.

You accept Bitcoin payments via the Internet in your online business or via your eCommerce project and would like to know how to record these Bitcoin payments in your accounting.

- How to document the individual Bitcoin transactions with Euro and Bitcoin equivalent at the respective conversion rate.

- How to withdraw the Bitcoin you receive to your bank account.

- How you can prove your company’s Bitcoin holdings if you prefer to keep the Bitcoin in your company.

This article is aimed at all online retailers and those who accept Bitcoin payments on the Internet – i.e. wherever buyers and sellers do not meet in person, i.e. where payment cannot be made in cash.

YouTube Video: Bitcoin tax & accounting for online traders

We have published a video on the Coincharge YouTube channel with the topic “Bitcoin tax and accounting for online merchants”

Order in the online store

Anyone who already accepts payments via their website or online store already does so by credit card or PayPal, for example.

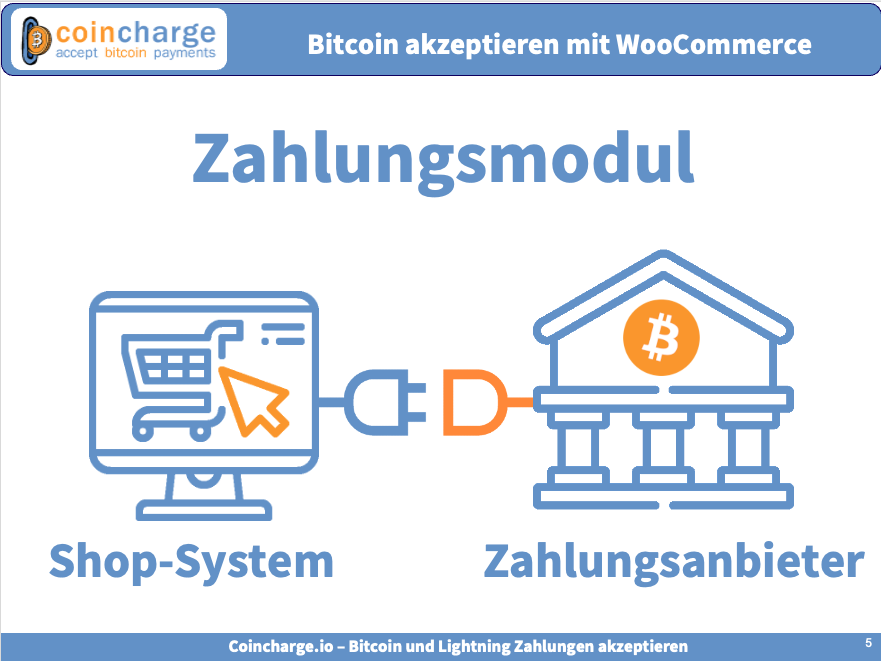

This involves using a store software solution that is connected to a payment service provider via payment modules, which takes care of payment processing for you and credits the sales collected to your bank account.

If you want to offer your customers the option of paying with Bitcoin, you can also integrate a Bitcoin payment module for a Bitcoin payment provider into your online store and then receive the incoming Bitcoins on your own Bitcoin wallet or alternatively have the Bitcoin sales paid out to your bank account.

Regardless of which payment method the customer uses, the process is identical. The store software solution creates an invoice that is sent to the customer and the company’s own accounting department. This invoice states how the invoice was paid. By credit card, Paypal or, in our case, by Bitcoin. The equivalent value received is then credited to the bank account or, if you want to keep the Bitcoins, credited to your own Bitcoin wallet.

Payment in online business

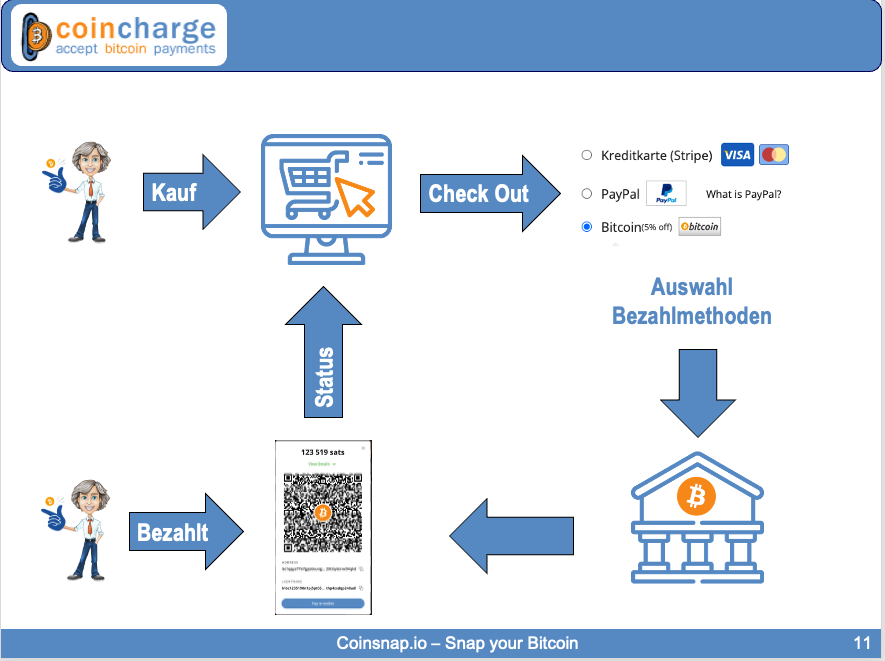

After the customer has placed their order in the shopping cart and clicked on Checkout, the payment methods supported by the store system are listed. Depending on the payment method selected, this payment request is sent to the payment gateway of the respective payment service provider. This processes the payment transaction with the customer in the background and reports back to the store system after successful payment that the payment was successful.

In our store system, the positive feedback from the payment gateway changes the status of the payment from open to paid.

At the same time, the store system creates an invoice in the respective national currency, i.e. in euros in Europe, showing VAT and all legal and tax information required for issuing an invoice.

This invoice is noted as paid based on the feedback from the payment system, handed over to the customer and the store operator’s own accounting department and the store operator can start delivering the ordered goods.

Transaction overview

Now we have an invoice in our accounting system with the note “Paid – with Bitcoin”, but our accounting system needs a transaction view, comparable to a bank statement, which lists all transactions.

We receive such a transaction view several times. Once from our store system and additionally from our Bitcoin wallet and our Bitcoin payment provider.

Every Bitcoin payment provider provides a transaction overview in which the Bitcoin amount received, the equivalent value in euros and the underlying exchange rate are listed. This is combined with the order number or the details of the customer in order to be able to allocate the online order.

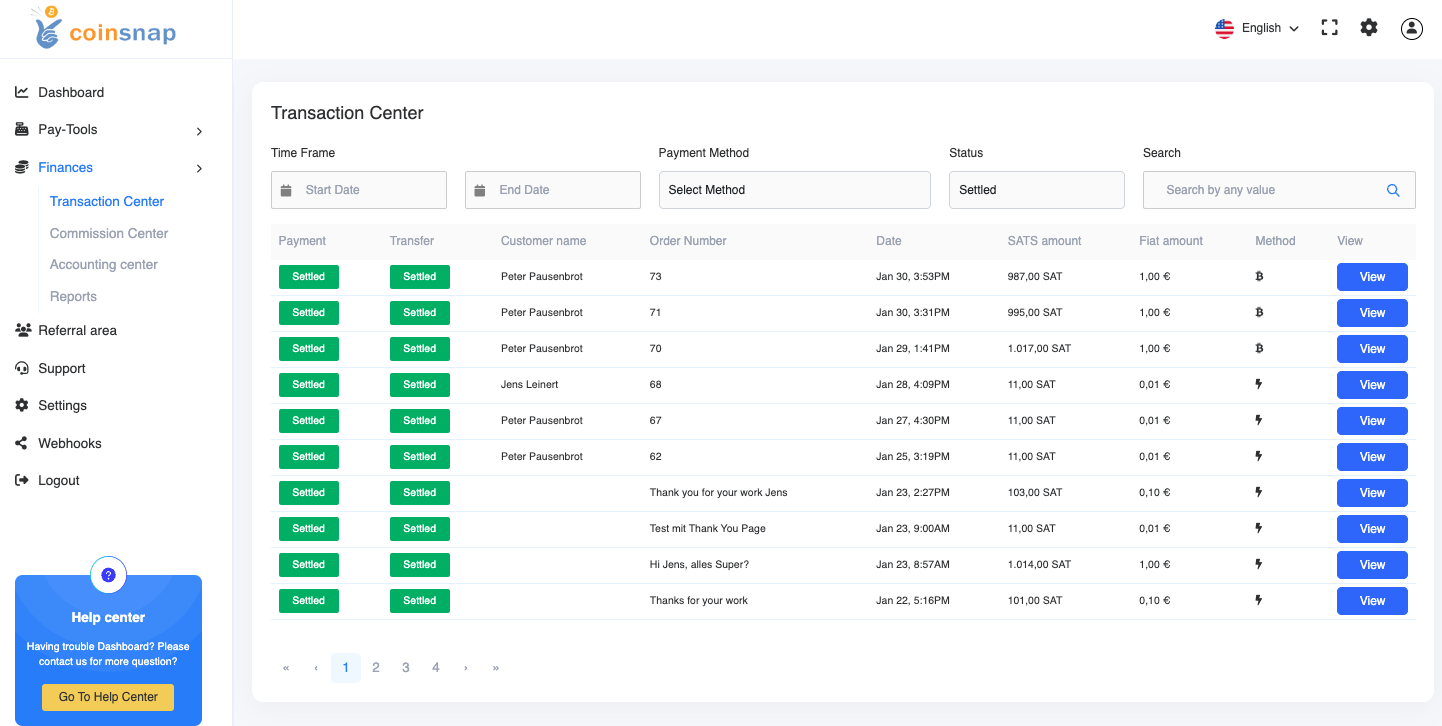

Here is an example from Coinsnap. These transactions can then be exported as a CSV file and imported into other applications for further processing.

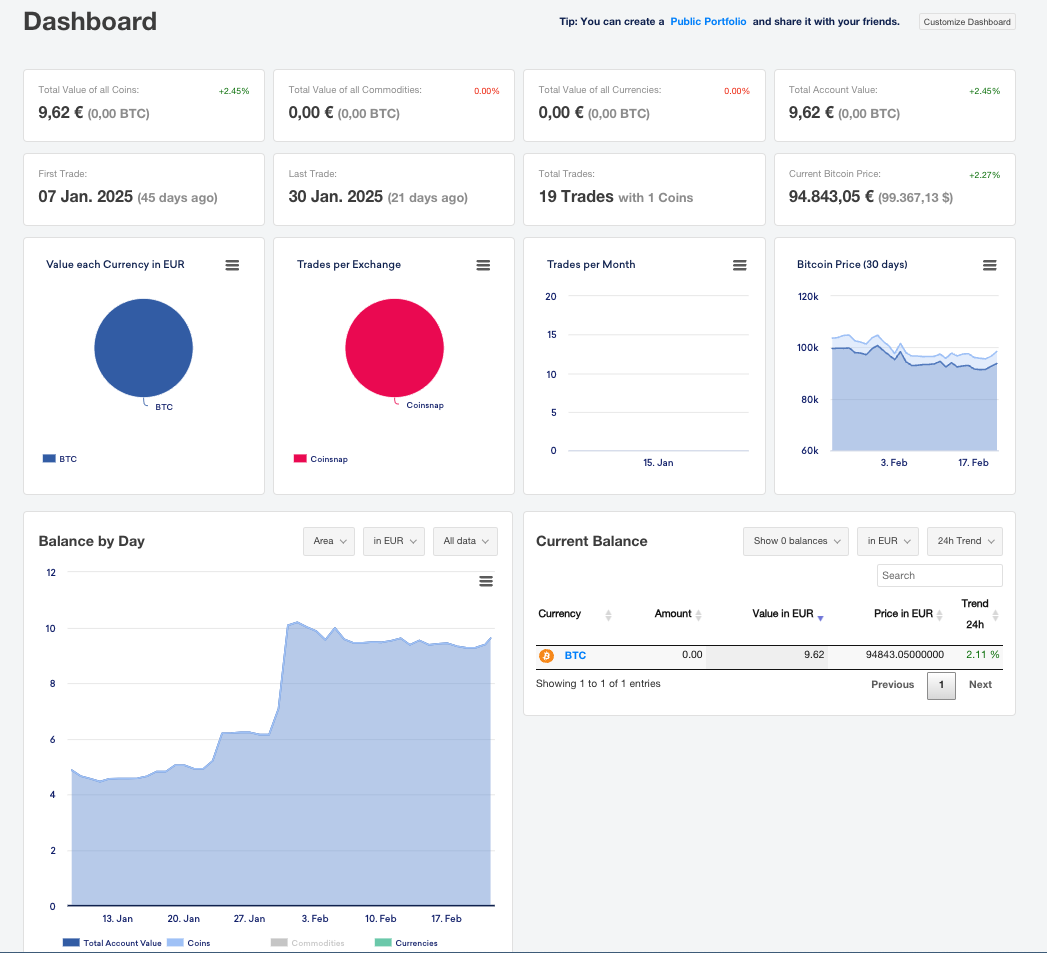

For example, in the Cointracking solution, which provides tax evaluations that are also very useful for tax documentation. The software is free of charge for up to 200 transactions per year. If you place more than 200 orders in your online store per year, you can upgrade to a paid version and save 10% with the discount code coinsnap.

Payout to the bank account

Now we can decide what we want to do with the Bitcoin we receive.

Do we want to keep the Bitcoin as a company, buy it privately from our company or have it credited directly to our bank account?

If you don’t want to hold the Bitcoin as a company, are perhaps afraid of the volatility of the Bitcoin price and the effort involved in holding the Bitcoins on your own balance sheet, it makes sense to exchange the Bitcoins for fiat immediately and have the equivalent value credited to your own bank account.

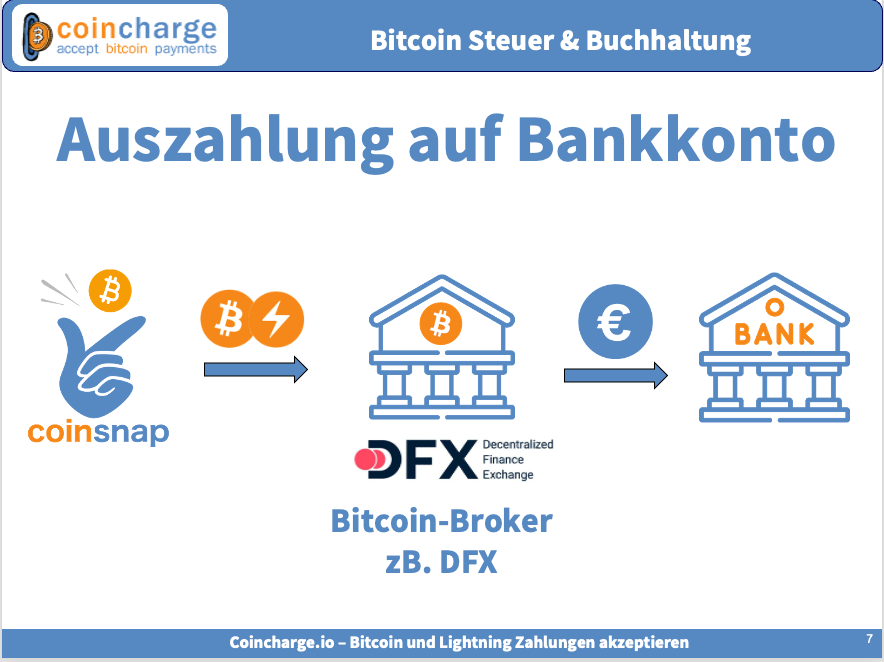

Some Bitcoin payment providers offer direct crediting to your own bank account or, as is the case with Coinsnap, work together with a Bitcoin broker. In this case, the bitcoins received are forwarded to the Bitcoin broker DFX, which converts the bitcoins into euros and transfers the euro amount to the company’s bank account.

The advantage is that you do not have to worry about the accounting or balance sheet recording of bitcoins. The disadvantage is that you do not hold any bitcoins in the company and cannot participate in the long-term appreciation potential.

Holding Bitcoin as a company

If you decide to keep the Bitcoin you have received as a company for the long term, you should store this Bitcoin on a secure Bitcoin hardware wallet.

Please make sure that you store the company’s Bitcoin separately from your private Bitcoin.

If you use a BitBox, you can create several accounts on a Bitcoin wallet and thus separate private and business accounts.

If you don’t have a Bitbox yet, you will receive a 5% discount if you order a Bitbox via this link.

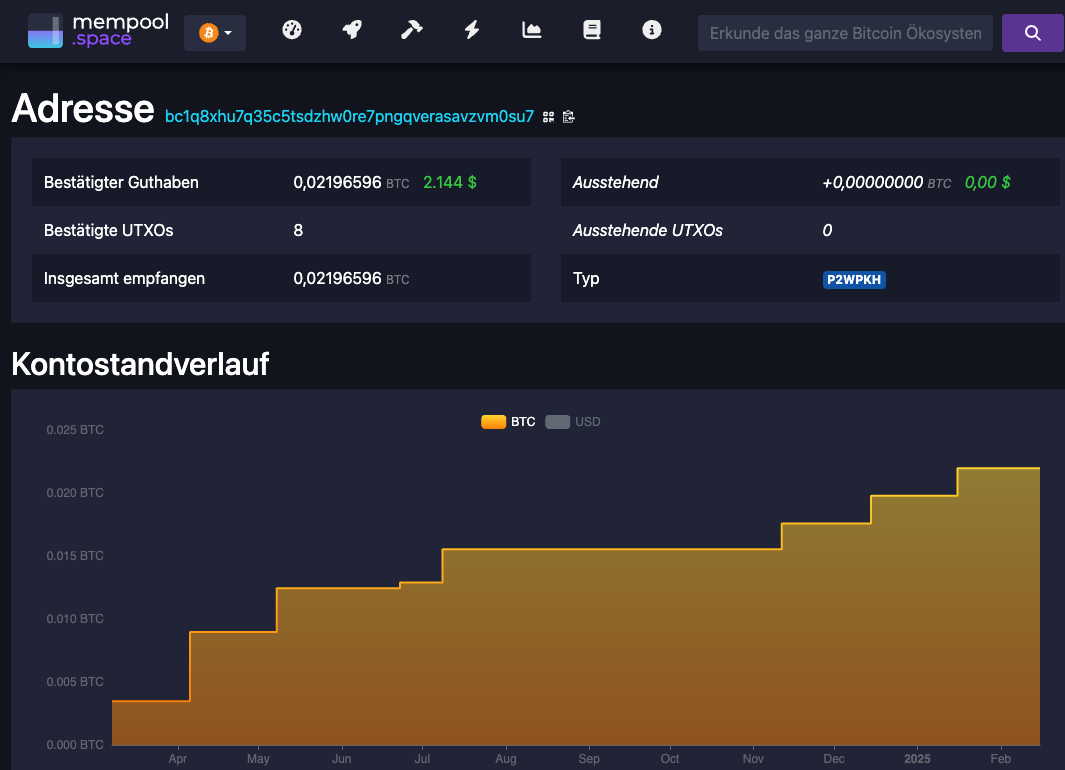

Then you should always use the same Bitcoin address when transferring Bitcoins to your Bitcoin hardware wallet.

Otherwise, we advise against always using the same Bitcoin address in order to achieve greater privacy. In this case, however, we would like to be able to prove how many Bitcoin are on our Bitcoin hardware wallet.

So when we receive Bitcoins from our Bitcoin payment provider or send Bitcoins from our Bitcoin Lightning Wallet to the Bitcoin Hardware Wallet, we always use the same Bitcoin address.

We then share this Bitcoin address with our tax advisor and they can see for themselves via the blockchain how many Bitcoin are in our Bitcoin wallet.

We use this to document how many Bitcoin the company has in its portfolio on a specific reporting date. Your tax advisor can tell you how these bitcoins are valued on the respective reporting date.

Buy Bitcoin privately from the company

It is also possible to buy the bitcoins from the company privately.

The price at which the company has effectively bought the bitcoins is fixed.

It results from the rate that the customer paid in the online store.

If the customer has paid for a product for €100 with bitcoin at a bitcoin rate of €100,000, the company has received 100,000 sats.

The company has therefore received 100,000 sats for €100.

The question now arises as to the price at which you buy the Bitcoin privately from your company. This purchase price must of course correspond to the current Bitcoin price at the time you buy the Bitcoin from your company.

It is important that you keep a precise record of the Bitcoin rate so that you can prove what the Bitcoin rate actually was at the time of payment.

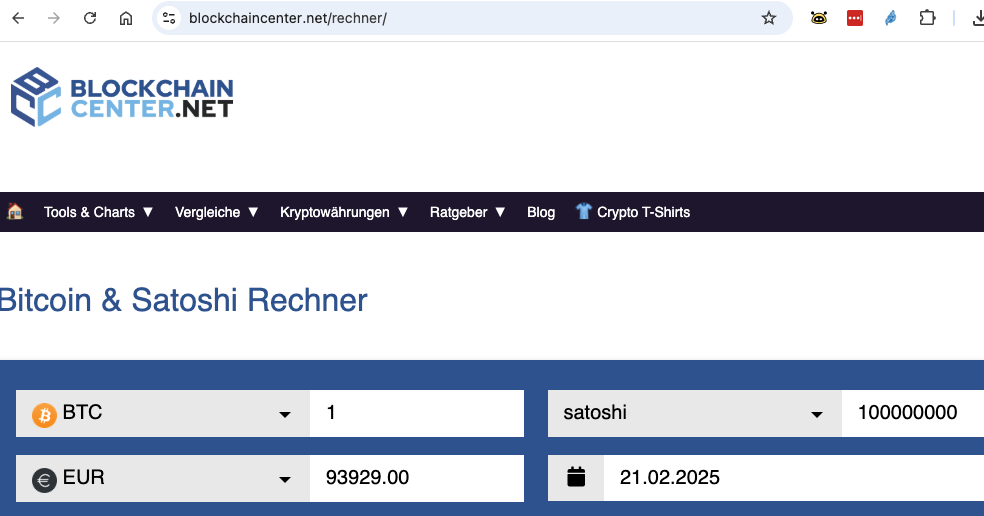

I like to use the Bitcoin calculator of the Blockchaincenter at https://www.blockchaincenter.net/rechner/.

If I want to buy the equivalent of €1000 from my Bitcoin, I enter the amount in euros and then see the equivalent value in sats. I then take a screenshot of this with the date and attach it to my documents as a receipt.

I then transfer €1000 from my private bank account to the company’s bank account and transfer the amount in Stas from my business Bitcoin wallet to my private Bitcoin wallet.

Please ask your tax advisor beforehand whether you can proceed in the same way.

The company must recognize the difference between the purchase price and the selling price as a profit or loss accordingly.

You may also be able to conclude a kind of framework agreement with the company in which you declare that you will purchase all incoming Bitcoin payments from the company at the Bitcoin rate paid by the customer until further notice.

This way, you have a private Bitcoin savings plan and have kept the bookkeeping effort away from your company.

You can do this as long as the Bitcoin revenue for the company does not exceed your personal financial resources.

If the company’s Bitcoin revenue is so high in the future that you can no longer buy all the Bitcoin privately, you can easily switch over. You can then either include the Bitcoins in the company balance sheet or sell them directly to a Bitcoin broker.

Summary: Bitcoin tax for online traders

Uncertain tax and accounting issues still prevent many online merchants from accepting Bitcoin payments.

As with every purchase transaction, the accounting department wants to know which invoices have been paid, where the payment was received and how much money is in the account or, in the case of bitcoins, in the wallet.

As with credit card and PayPal payments, this can also be easily documented for Bitcoin payments and the obligation to provide proof fulfilled.

Every Bitcoin payment is booked at the current Bitcoin exchange rate.

Each Bitcoin transaction in the wallet is documented individually, similar to a bank statement.

These transactions can be exported and imported and used for other applications.

The stock of bitcoins is precisely recorded like an account balance and can be viewed and checked by anyone via the blockchain.

So there is no longer any reason not to offer your customers Bitcoin payments.

You should inform your tax advisor whether you want to hold the bitcoins privately or for business purposes and explain to them how you intend to comply with the documentation obligation.

It is not absolutely necessary for your tax advisor to be an expert in cryptocurrencies or Bitcoin.

Don’t be discouraged if your tax advisor initially waves you off because they may not be convinced by Bitcoin themselves and are reluctant to get involved.

If your tax advisor knows how foreign currencies are accounted for and recorded for tax purposes, then he also knows how to deal with Bitcoin.

Perhaps you can also turn your tax advisor into a bitcoiner. Why don’t you ask him if you can pay for his services with Bitcoin?

Tax is a very individual topic and can only be answered seriously by someone who knows your situation in detail and can assess it. As I’m not a tax advisor, I’m not allowed to give advice and have therefore explained in this video how you can get the information so that you can document the payment transaction with Bitcoin and your accountant and tax advisor can then act accordingly.