Which cryptocurrency to accept? – Which cryptocurrency should you accept in your online store?

You’ve decided that you want to accept bitcoin and cryptocurrency in your store, then you’re faced with the question, “Which cryptocurrency to accept?“.

What cryptocurrency do your potential customers own and would they pay with?

This article explains which cryptocurrencies are suitable as a means of payment and which cryptocurrencies accepting makes sense.

Satoshi Nakamoto referred to Bitcoin as a “peer-to-peer electronic cash system.”

A digital payment system (electronic cash system) that enables people to make payments directly to each other (peer-to-peer).

There are now thousands of different cryptocurrencies, coins, currencies and tokens for a wide variety of applications.

But which cryptocurrencies are specifically suitable for payment? Which cryptocurrencies can be used like digital money, or even better, like digital cash?

You have decided to be a merchant and want to accept one or more cryptocurrencies besides Bitcoin?

But which of the numerous currencies should be offered in the own store?

As a merchant, you’re also faced with the question, “Which cryptocurrency will your customer use for payment?”

End users, in turn, are faced with the question, which cryptocurrency is accepted by most merchants? Which cryptocurrency will meet the requirements for fast, cheap secure and convenient payment?

There are 160 fiat currencies worldwide and Coinmarketkap lists over 6,000 different cryptocurrencies.

However, not all cryptocurrencies listed on Coinparketcap are intended for payment processing.

Which cryptocurrency accept makes sense? Which of these cryptocurrencies play a relevance and are predestined for payment processing between end customers and merchants?

Which of these cryptocurrencies have a corresponding distribution so that numerous end customers can also pay with them in my store.

It is recommended for the dealer to make a targeted selection. Too much choice of different cryptocurrencies can confuse a customer and cause them to abandon a purchase. When selecting the cryptocurrencies offered, the motto should be, less is more.

In any case, Bitcoin, as the mother of all cryptocurrencies, must be offered. Bitcoin definitely needs to be accepted as a cryptocurrency.

Then it should be well weighed whether to accept and offer more cryptocurrency.

This is because end customers who have cryptocurrencies definitely also own Bitcoin and can pay with it.

So do more cryptocurrencies make sense or does it become confusing and confuse my customers?

If one decides to offer additional cryptocurrencies for payment, the question arises as to which of the cryptocurrencies have relevance with the target group to be addressed.

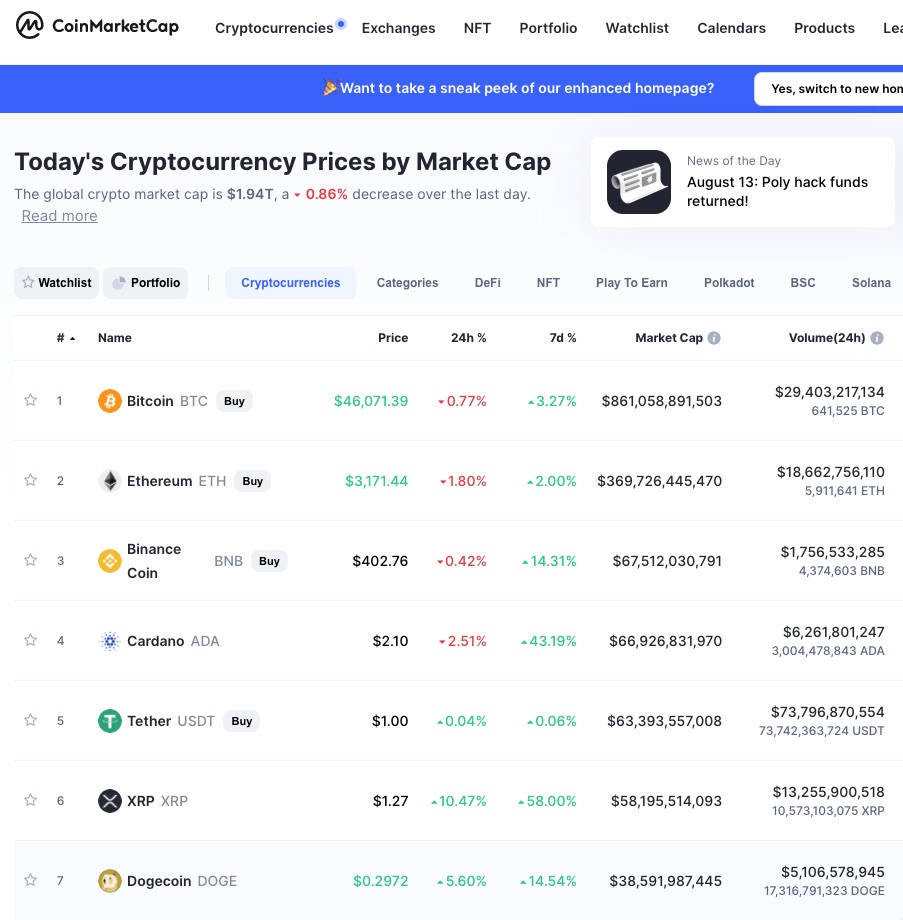

Most important cryptocurrency as a means of payment according to Coinmarketcap

Coinmarketcap distinguishes between coins and tokens for cryptocurrencies. The market capitalisation by coin therefore offers an initial guide.

The cryptocurrencies in the top 20 play a real relevance here. Accepting as a cryptocurrency, you can exclude the coins on the places behind it.

All cryptocurrencies listed below are something for speculators or enthusiasts, but have no relevance for payment processing.

However, the market capitalization only tells you what the total value of the coins in circulation is. No statement is made about the spread and acceptance as a payment method.

The most important coins by market capitalisation in 2019

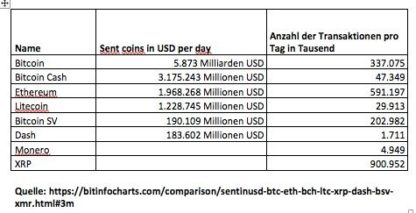

Most important cryptocurrencies as a means of payment by transactions

A better guide can be the number of transactions or the transfer volume that a coin is transferred per day.

As of the analysis date of October 4, 2019, the following transactions have been executed globally:

Most important cryptocurrency as a means of payment by transactions

However, even this presentation only shows what amounts have been transferred and does not allow any conclusions to be drawn about the use for payment.

Which cryptocurrency do my customers pay with?

As a merchant, when I have to decide which cryptocurrency my store should accept, it’s essentially a matter of how prevalent the cryptocurrency in question is among my target audience.

A user who wants to use their cryptocurrency for payment will be guided by the following considerations when making their choice:

- Is the cryptocurrency supported by major wallets?

- At which exchanges, bureaus de change and vending machines can I quickly and easily buy the corresponding cryptocurrency?

- Does the payment processor support the appropriate cryptocurrency for payment processing?

- At which merchants can I pay with which cryptocurrency?

Acceptance of cryptocurrencies in online shops

What experiences have other online shops had with accepting cryptocurrencies?

Based on the entries listed on Coinpages and the cryptocurrencies offered, it can be said for the German-speaking region that Bitcoin is the undisputed cryptocurrency.

The second and third places are shared by Ethereum and Litecoin. Dash is becoming increasingly widespread in German-speaking countries and has now displaced Bitcoin Cash.

The Bitcoin SV solution, on the other hand, plays an insignificant role. Only one merchant actively supports this payment method.

Lightning, as a payment method based on Bitcoin, has also been developing more and more recently.

The listed cryptocurrency only tells how often the respective cryptocurrency is offered as an option for payment.

No statement is made as to how often the respective cryptocurrency is actually used by the user as a means of payment.

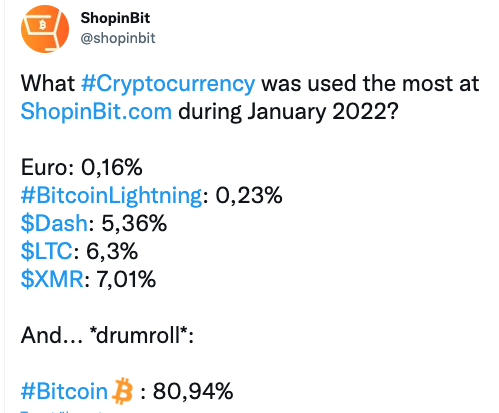

The mail order retailer ShopinBit has published an analysis of ordering and payment behavior in its store.

ShopinBit is Europe’s largest Bitcoin store with over 300,000 products and accepts cryptocurrencies such as Bitcoin, Lightning, Dash, Monero, Bitcoin Cash and Litecoin.

Shopinbit launched as an online store that exclusively accepts cryptocurrencies. Meanwhile, PayPal and credit card is also accepted.

Of all payment methods, Bitcoin is the undisputed leader with over 80% in terms of revenue.

The return rate is also interesting. While customers paying with Bitcoin have a return rate of less than 1%, the return rate for PayPal payments is over 12%.

The most important cryptocurrencies as a payment method

Which cryptocurrency is suitable as a means of payment depends on factors such as target group or business model. Likewise, whether the cryptocurrency as a means of payment in an online store or in a retail store was explained, which cryptocurrency is suitable as a method of payment in their own Internet store or retail store.

In the following article, the most important cryptocurrencies as a means of payment are presented in more detail. This is about specific characteristics and peculiarities. Which cryptocurrencies are particularly suitable for which business model or customer target group.

Which cryptocurrency to accept?

Listed below are the main cryptocurrencies used for payment processing.

- Bitcoin (BTC)

- Bitcoin Lightning

- Dash

- Bitcoin Cash (BCH)

- Litecoin

- Monero

- Ethereum (ETH)

- XRP-Ripple

- Bitcoin SV (BSV)

- Stellar

Cryptocurrency as a payment method – Which cryptocurrency should you accept as a payment method?

Cryptocurrency as a means of payment

Bitcoin (BTC)

In 2009, Bitcoin was developed as a peer-to-peer electronic cash system.

The idea behind this is a digital payment system (electronic cash system) with the help of which payments can be made directly among each other (peer-to-peer).

Critics of Bitcoin see some drawbacks to payment processing, and other cryptocurrencies have emerged that attempt to address these drawbacks.

Some Bitcoiners also no longer see Bitcoin as a means of payment (Medium of Exchange), but see it as a store of value (Store of Value) and refer to it as digital gold.

For adherents of the store of value approach, Bitcoin is an investment in the future and tend to hold (hodl) rather than spend Bitcoin.

But what is the criticism of Bitcoin as a means of payment?

Essentially, the high costs of a transaction and the long transaction duration are criticized.

With Bitcoin, transactions made are written to a block and confirmed every 10 minutes.

Due to the block cycle, the confirmation of a transaction can take from 10 minutes to several hours, depending on the amount of the transaction fee paid by the payer.

Accordingly, Bitcoin payments may be unsuitable for business models where immediate confirmation is required. As an example, the purchase of a coffee is described, where a shopkeeper does not want to wait 10 minutes to give out the goods.

There are solutions for such instant payments. This means that the goods can be handed over to the customer as soon as the transaction is recorded in the mempool.

However, in the case of high-value and expensive goods, it is advisable to wait for the corresponding confirmations in the blockchain.

Corresponding settings are made when configuring the payment process with the payment provider.

Another point of criticism is the high transaction fees for payers. These high fees have arisen because the place of the transaction in the next block is purchased as in an auction. If there is a high volume of transactions and space becomes scarce, the fees increase.

To solve this problem, it has been discussed to increase the block size and reduce or combine the size of individual transactions.

The supporters of the idea after increasing the size of the blocks implement this in new cryptocurrencies such as Bitcoin Cash or Bitcoin SV.

In Bitcoin, SegWit increased the size of the block and made optimizations to the transaction size. As a result, there has been a significant reduction in transaction fees and is currently at a level of a few cents per transaction.

Since every transaction on the blockchain (on-chain) incurs a transaction fee, Lightning was developed as a transaction solution that does not require transactions to be recorded on the blockchain (off-chain).

The original points of criticism could be solved technically and are therefore no obstacle to accept bitcoin payments.

Bitcoin in recent years has asserted itself as a robust, most reliable and most important payment method.

Bitcoin is the world’s most widespread digital currency and therefore Bitcoin has no alternative as a payment method and belongs in every store that offers cryptocurrencies to its customers.

At Coinpages you can find all German-speaking merchants that accept Bitcoin.

Bitcoin Lightning

Lightning is not another cryptocurrency, but a new feature for Bitcoin payments.

With the success of Bitcoin and the associated increase in Bitcoin transactions, three problems became apparent:

(1) Bitcoin can only process about 7 transactions per second due to block size limitations, (2) the cost of a transaction increases, and (3) confirming a transaction can take 10 minutes or longer.

These disadvantages are solved with the help of Lightning.

Bitcoin Lightning is the technology that makes Bitcoin payments faster, easier and cheaper than using Bitcoin directly.

In a Bitcoin payment, every single transaction is written to the blockchain (on-chain) and documented there for all the world to see for eternity.

When two parties make payments to each other, there is no need for each of these transactions to be recorded individually in the blockchain. These transactions are recorded separately (off-chain) from the actual blockchain. The intermediate transactions are documented as lightning transactions in a sidechain.

The opening and closing balances of Lightning transactions are recaptured and completed on the blockchain.

Through Lightning, payments can be confirmed in seconds and transaction fees are reduced to a few satoshi.

Thanks to Lightning, the original Bitcoin idea can be optimized.

Payments can be sent and received anonymously, almost for free, worldwide over the Internet.

Lightning payment processing is particularly suitable for paying for newspaper articles behind so-called paywalls.

When choosing the right cryptocurrency as a means of payment for products and services with a few cents to a few euros, who can not do without the payment of Lightning.

At Coinpages you can find all German-speaking merchants that accept Bitcoin Lightning.

Bitcoin Cash (BCH)

The Bitcoin Cash currency has been on the market since summer 2017. Due to a difference of opinion on the optimal block size, supporters of large blocks split off from Bitcoin.

Under the name Bitcoin Cash, supporters of Big Blocks gathered to be able to process more transactions in one block.

The pioneer Bitcoin “only” allows a maximum of seven purchases or sales per second. Bitcoin Cash is expected to enable eight times more transactions – in the same amount of time.

One of the key people behind Bitcoin Cash is Roger Ver. He is one of the first investors in various Bitcoin companies.

Bitcoin Cash sees itself as the only true Bitcoin and confuses numerous newcomers through the well-known website bitcoin.com.

Bitcoin Cash advertises that it is not just for speculation, but as a peer-to-peer electronic currency. Accordingly, it should be used, or in other words, it should be spent.

Bitcoin Cash is a fast way to pay, as transactions are credited almost instantly. Bitcoin Cash payments cost only a few cents, regardless of the amount and size.

For Bitcoin Cash, numerous payment providers offer payment processing for online stores. For brick-and-mortar stores, there are mobile apps that turn a smartphone into a POS terminal.

The spread of Bitcoin Cash among merchants in the DACH region is still very manageable.

Bitcoin Cash is from the technical characteristics a cryptocurrency suitable as a means of payment. A disadvantage is the low penetration in the DACH region. In Australia and the Pacific region, this cryptocurrency is more widely used as a means of payment.

At Coinpages you can find all German-speaking merchants that accept Bitcoin Cash.

Bitcoin SV (BSV)

Bitcoin SV is a fork created from Bitcoin Cash. The addition SV stands for Satoshi Vision and wants to show that one is committed to the original vision of Satoshi Nakamoto.

The original name was Bitcoin Cash SV, but now the common name is Bitcoin SV.

The inventor of Bitcoin Satoshi Vision is Craig Wright. He calls BitcoinSV the real Bitcoin and he himself is the mysterious Bitcoin inventor Satoshi Nakamoto.

With Bitcoin SV, unlike Bitcoin, the block size is not limited. This means that the number of transactions is not limited and thus the scaling problem should be solved.

Bitcoin SV offers the possibility of splitting payments. Thus, it can be said that when a payment is made, a partial amount is sent to another address. For example, commissions or fees can be paid into separate accounts.

For payment processing it is recommended to use the so-called Moneybutton. This application makes it very easy to integrate the payment function into your own store.

Mainly customers from Russia and Asia use Bitcoin SV for payment.

Accordingly, Bitcoin SV is hardly widespread among traders in the DACH region. Only one merchant at Coinpages accepts this cryptocurrency as a means of payment.

At Coinpages you can find all German-speaking merchants that accept Bitcoin SV.

Ethereum (ETH)

The second most important cryptocurrency by market capitalization and the main competitor of Bitcoin is Ether from Ethereum.

Created in 2013 by then 19-year-old Vitalik Buterin, the technology is also based on the blockchain, but is more powerful than Bitcoin’s and capable of executing smart contracts itself.

Ethereum thus has a different goal: it is less about paying with Ether and more about building entire organizations on an electronic, decentralized foundation.

Ethereum is considered less suitable for pure payment, yet numerous stores offer payment by Ether.

Ethereum’s technical advantages are not in payment processing. Nevertheless, the second most important cryptocurrency enjoys a wide distribution. Thanks to its wide distribution among potential customers, this cryptocurrency should be shortlisted as a means of payment.

At Coinpages you can find all German-speaking traders who accept Ethereum.

Ripple (XRP)

Ripple is a payment system for businesses, banks and payment institutions. For payment processing between individuals and businesses, Ripple’s solution is not suitable. Therefore, this cryptocurrency as a means of payment will not be considered in more detail here.

At Coinpages you can find all German-speaking traders who accept Ripple XRP.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Litecoin (LIT)

Litecoin was released on 07 October 2011 and along with Bitcoin one of the oldest cryptocurrencies.

Litecoin calls itself “The Cryptocurrency for payments” and a peer-to-peer internet currency that allows one to send payments to anyone in the world in real time and almost for free.

Technically, Litecoin is almost identical to Bitcoin. Litecoin is often referred to as Bitcoin’s little brother.

Just like Bitcoin, a maximum of 21 million Litecoins can be produced and is divided into 100,000 units.

The only technical difference is that a block is verified not every 10 minutes, but already every 2.5 minutes. Thus, a transaction can be confirmed more quickly.

Litecoin’s distinctive features are faster transaction times and improved storage efficiency.

Litecoin enjoys extensive trade and commercial support, as well as significant trading volume and liquidity. Thus, Litecoin is often used as a complement to Bitcoin.

At Coinpages you can find all German-speaking merchants that accept Litecoin.

Monero (XMR)

Monero (XMR) put a strong focus on privacy (anonymity) and decentralization and takes a different approach to scalability.

Transactions are confirmed after about 2 minutes.

The distinctive feature of Monero is its anonymity and privacy. To ensure anonymity, ring signatures and stealth addresses are used.

Stealth addresses mean that the addresses for incoming and outgoing payments are not publicly visible. This is possible only with the help of the private key, which the owner can publish or share.

The ring signature obscures and mixes the transactions, thus it is not possible to trace the money flows by analyzing the blockchain.

When paying with Monero, the payee cannot see what other payments you have made. Likewise, it is not possible to determine which credit balance one has.

Transactions on the Monero blockchain cannot be linked to individuals or identities.

Monero sees itself as a “private digital currency” and the money for a connected world. It’s fast, private and secure.

Monero is a popular cryptocurrency as a payment method for very tech-savvy customers who place a lot of emphasis on anonymity. Thus, more suitable for digital goods where a customer does not have to disclose his personal shipping address.

At Coinpages you can find all German-speaking merchants that accept Monero.

Dash

The term Dash stands for digital cash.

The most important characteristics of cash is its speed, its low transaction fees, and its anonymity in each individual payment transaction.

Dash offers the two main functions InstandSend and PrivateSend.

InstantSend is the fast, guaranteed payment within 1-4 seconds. This makes Dash perfect for retail and direct payments – it works like decentralized digital cash.

With the PrivateSend feature, Dash protects private payment transactions and corporate payments through decentralized shuffling. This mixes up transactions and thus disguises them, making the payment anonymous to third parties.

Both methods can optionally be used for particularly fast transactions (InstantSend) or anonymous transactions (PrivateSend).

Dash has raised its profile in the DACH region with an intensive public relations campaign. Numerous payment providers, Bitcoin vending machines and POS terminal solutions have integrated Dash as a payment method.

Dash is a cryptocurrency well suited as a means of payment.

At Coinpages you can find all German-speaking merchants that accept Dash.

Recommended cryptocurrency as a means of payment:

The most important message from merchants to their customers should be that they accept cryptocurrencies. This message should be clearly communicated on the website alongside the other payment methods.

As a minimum, Bitcoin must be offered as the most important cryptocurrency. As a minimum, Bitcoin must be offered as the most important cryptocurrency.

If the amounts involved are very small, it is advisable to accept Lightning.

If the store is aimed at tech-savvy crypto fans who also appreciate privacy, the payment methods Dash and Monero should be offered.

The integration of additional cryptocurrencies does not necessarily expand the number of potential new customers. But gives a positive signal to some crypto community and you benefit as a trader from appropriate inclusion in blog posts and directories.

Merchants who want to offer cryptocurrencies other than Bitcoin as a means of payment should shortlist the following cryptocurrencies:

- Bitcoin (BTC)

- Bitcoin Lightning

- Dash

- Bitcoin Cash (BCH)

- Litecoin

- Monero

- Ethereum (ETH)

Recommendation

As a first step, we recommend integrating Bitcoin as a payment method.

There are over 1000 coins that are suitable for payment processing.

Bitcoin is the undisputed number 1.

Every potential customer who has cryptocurrencies also has at least Bitcoin and can pay you with it.

If you offer too large a selection of different cryptocurrencies in your online store, this usually leads to irritation and purchase cancellation on the part of the potential customer.

We therefore recommend that in the checkout, next to the already existing payment methods, Bitcoin is displayed directly.

Since every crypto owner also owns Bitcoin, no potential customer is excluded.

If the customer so desires and with the experience gained, additional cryptocurrencies can be subsequently integrated at any time.

Leave a Reply

Your email is safe with us.