10 reasons why you should accept Bitcoin payments as a merchant.

10 reasons why you should accept Bitcoin payments as a merchant. Are you a merchant considering whether you should accept Bitcoin payments?

Or you are a Bitcoiner who would like to pay with Bitcoin in your favourite shop, then here are 10 reasons why a shop should accept Bitcoin payments.

It is possible to make Bitcoin payments from private to private.

Be it as a remote payment, such as a bank transfer to the other side of the world, or as a local payment, when you send a payment from a smartphone wallet to the other person’s smartphone wallet.

However, we want to concentrate here on commercial payments. Be it for payments in bricks-and-mortar shops or online payments.

In the case of payment in stationary retail, the buyer and seller meet in person and payment and delivery of the goods take place immediately.

When paying via the Internet, buyer and seller are physically separated and the goods are delivered after successful payment.

The goods are then either sent physically by post or, in the case of digital goods, delivered immediately via the Internet.

This distinction is therefore important in order to demonstrate the advantages of Bitcoin payments for brick-and-mortar retail and e-commerce.

Because if Bitcoin wants to establish itself as a means of payment, it has to solve a problem. Bitcoin must be better than the established payment methods.

In bricks-and-mortar retail, for example, Bitcoin competes with cash and payment by bank or EC card. In online retail, the competition is credit cards and PayPal.

For this reason, we will always explain the special features of the competing payment methods when naming the reasons in order to better emphasise the advantages of paying with Bitcoin.

On-Chain Vs. Lightning

Before I start, I also need to clarify that when it comes to Bitcoin payments, we can distinguish between Bitcoin payments via the blockchain, which are called on-chain payments, and Bitcoin payments via the Lightning Network, which we refer to as Lightning payments.

We have to be honest and realise that Bitcoin payments via the blockchain, i.e. on-chain payments, are not suitable for commercial payment processing.

Firstly, it takes too long for such a payment to be confirmed on the blockchain. Nobody wants to wait for confirmation on the blockchain if they just want to pay for a quick coffee.

The second reason is the transaction fees. Even if the costs of the payment are borne by the sender of the payment, a high fee in the mempool leads to frustration on the part of the buyer and to cancelled purchases.

So if you want to accept Bitcoin payments, you have to accept Bitcoin payments via the Lightning network. When I talk about Bitcoin payments in this video, I’m talking about Bitcoin payments via the Lightning network.

YouTube Video: 10 reasons why you should accept Bitcoin payments

On the YouTube channel of Coincharge+Coinpages we have published a German-language video entitled: “10 reasons why you should accept Bitcoin payments.” published.

1. innovative edge

Over 90% of the German-speaking population has heard of Bitcoin.

In 2023, 21% of the population in Switzerland, 14% in Austria and 12% in Germany will own bitcoins. For most people, Bitcoin is an object of speculation or a store of value. But a means of payment for very few people

Companies that accept Bitcoin payments are perceived as innovative and progressive, which has a positive effect on the company.

2. marketing – increasing awareness

Those who accept Bitcoin payments have the opportunity to increase their profile in the Bitcoin community by listing their business in Bitcoin directories such as Coinpages, Coinmap or btcmap.

By accepting Bitcoin payments and publicising this with stickers in the shop or a corresponding notice on the website, you are also promoting Bitcoin.

As already mentioned, Bitcoin is a well-known term, but there is still a lot of ignorance and many people do not yet know that you can also pay with Bitcoin.

By referring to Bitcoin, you have the opportunity to enter into dialogue with your customers, talk about Bitcoin and raise awareness.

Those who accept Bitcoin payments benefit from the popularity of Bitcoin and can attract new potential customers to their business and at the same time promote Bitcoin as a means of payment.

3. sales increases

Accepting Bitcoin payments will definitely increase interest in your business. But is this also reflected in higher sales?

At the moment, we have to be realistic and say: hardly.

Due to the increased awareness and familiarity, there are more interested parties, but they do not necessarily pay with Bitcoin.

However, this does not mean that there will be no customers.

This is because a prospective Bitcoin customer may become a customer, but still pay with conventional payment methods.

Paying with Bitcoin is still in its infancy and many Bitcoiners still find it difficult to spend and hodl their own Bitcoins, so they prefer to save.

However, those who specifically target the Bitcoin community with their products can certainly report increases in sales. Be it a restaurant where the local Bitcoin Meetups take place or online shops that sell Bitcoin accessories or Bitcoin merchandise.

A considerable proportion is already paid for with Bitcoin and Lightning.

4. global reach

There are hundreds of national and local payment methods worldwide. Payers must have this payment method available and merchants must fulfil the requirements to be able to accept payments via this payment method.

One example is the Swiss solution Twint. Swiss citizens can use and pay with this payment method and Swiss companies can accept payments from Swiss Twint users via Twint.

A German online merchant who also wants to sell his products in Switzerland needs Twint acceptance so that Swiss customers can order from him. German retailers in the Swiss border region also need to accept Twint so that Swiss people can pay with Twint when they visit Germany.

What sounds so simple is in practice very complicated and time-consuming, so that in most cases these special payment methods are not used.

However, this problem also exists with widely used payment methods such as credit cards and PayPal. Not everyone has a credit card and while we mainly use Visa and Mastercard in Europe and America, Unionpay is used in China.

Paypal is also not available everywhere. In Turkey, for example, Paypal is not available.

How should customers from Turkey pay in your German online shop or customers from Europe in a Turkish online shop?

Then we have the problem that 20 per cent of the world’s population do not have their own bank account.

If you don’t have your own bank account, you can’t get a credit card or PayPal account to pay with. In the same way, merchants without their own bank account cannot get a credit card or PayPal acceptance contract.

Bitcoin is a digital currency that can be used globally. No matter where you are in the world, you can pay with Bitcoin or accept Bitcoin payments. Both offline and online.

By accepting Bitcoin payments, you open up your business to customers from all over the world.

5. fast transactions

A fast transaction means that the payee is quickly informed that the payment has been successfully executed.

This is not yet about crediting the amount, but initially only about providing information about the payment. Ideally with the certainty that the payment is secure, i.e. that it will arrive.

When making a payment in a bricks-and-mortar shop, it has to be done quickly to avoid a traffic jam at the checkout.

In online retail, the merchant also needs to know whether the order has been completed in order to dispatch the goods or deliver them digitally immediately.

Although we are only looking at bricks-and-mortar and online retail here, let’s take a brief look at international payment transactions.

The problem with international transfers is that a payment may take several days to arrive and the recipient may not know for several days whether the payment is actually on its way.

A national or European bank transfer can also take one bank working day.

To get back to the problem of the missing bank account, expensive service providers such as Western Union have to be used.

Bitcoin transactions can be processed quickly. With a Bitcoin payment via the Lightning network, a payment reaches the recipient as quickly as an email – anywhere in the world.

6. immediate credit note

We have just learnt that a Bitcoin transaction is executed quickly and the merchant is informed of the expected payment.

But when will the merchant be credited the amount? As the payer, you may think that once you have paid, the payee has the money immediately. But this is not the case with other payment methods.

In stationary retail, there is the option of cash payment, where the merchant has the money immediately in the till and can dispose of it freely.

With other payment methods, however, the payout only takes place after several days and can take up to 1-2 weeks.

In bricks-and-mortar retail, the merchant is credited somewhat faster than in online retail.

In online trading in particular, it depends on the respective business model and the risk of a chargeback. In the case of digital goods or micropayments, which have a higher risk than physical mail-order products, payment is delayed and in some cases a security deposit of up to six months is levied on parts of the turnover.

The payer expects immediate delivery of the goods upon completion of payment, which means that the merchant must pre-finance the goods.

The advantage of Bitcoin is that the merchant is credited immediately. As with a cash payment in a brick-and-mortar shop, the merchant receives the turnover immediately credited to his wallet in both online and offline retail and can dispose of it freely.

7. Permissionless

Merchants who wish to accept payments via a specific means of payment must conclude an acceptance contract with the provider of this means of payment.

To do this, the merchant must “apply”, submit his business documents, undergo a legitimisation check for his company, the owner and the persons acting.

The business model is then examined and how payments are processed.

It is then checked whether the expected sales are acceptable. This is because the provider of the payment method must justify the cost of connecting the new customer and the expected turnover.

With Bitcoin, this examination of the company, the people involved or the business model is not required. Anyone can pay with Bitcoin and anyone can accept Bitcoin payments.

Nobody needs to be asked for permission to accept Bitcoin payments.

No requirements need to be fulfilled. While all other payment methods require the merchant to have a bank account to which the turnover is transferred, this is not necessary with Bitcoin.

This is particularly important for e-commerce, as it is not possible to pay with cash. If you do not have a bank account, you will not be able to accept Paypal or credit cards.

More than 20 per cent of the world’s population do not have a bank account and are therefore unable to operate an online shop. However, a Salvadoran coffee farmer can now open an online shop and sell his coffee worldwide in exchange for Bitcoin.

Anyone who wants to can accept Bitcoin as a means of payment without having to obtain authorisation.

8. low fees

The costs of payment processing are generally perceived by the customer, the payer, as non-existent. These costs are borne by the merchant and not the payer.

The German Bundesbank has calculated the payment costs for bricks-and-mortar retailers and found that a cash payment costs an average of 24 cents. I bet any merchant would have replied to this question: “It doesn’t cost me anything. But there are costs for transport to the bank, for buying change, for counting the money manually and so on.

The bank card is cheaper than a credit card payment and costs the merchant around 30 cents per payment and around €1 for a credit card payment.

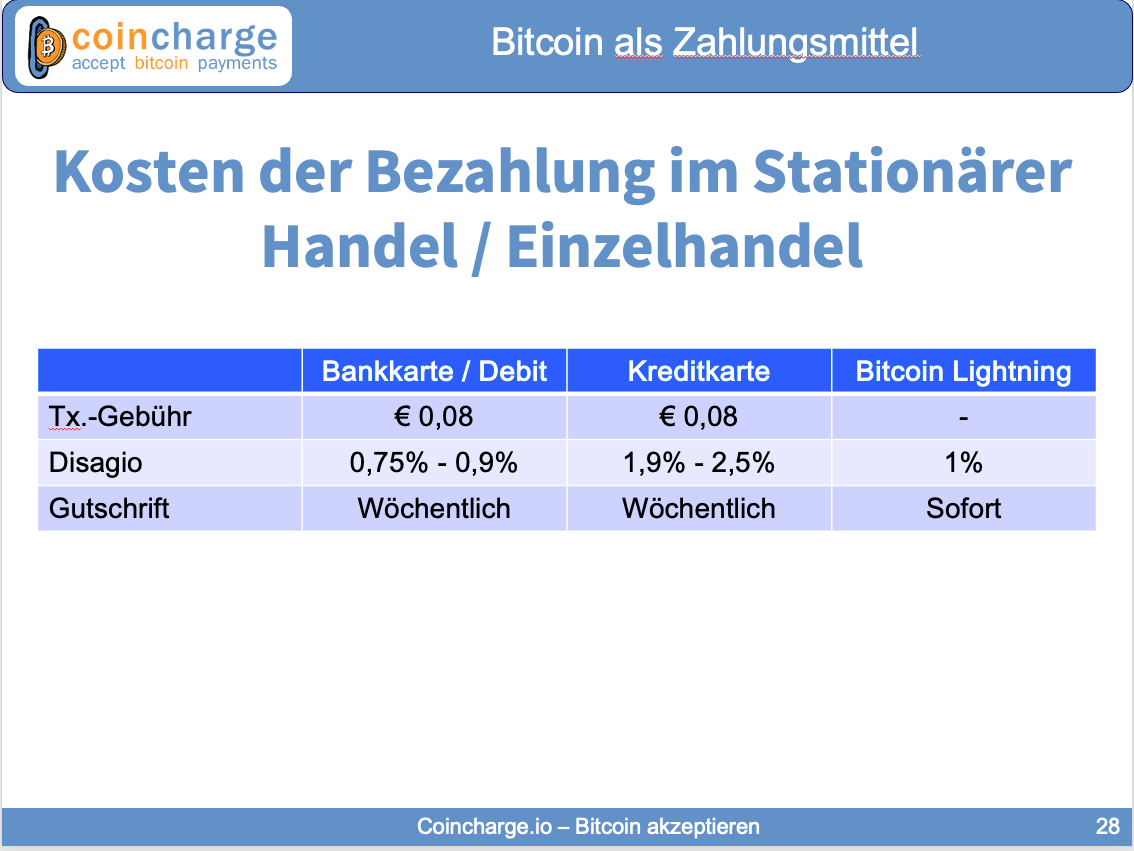

How are the costs incurred by the merchant? A fixed fee of approx. 8 cents is payable per payment, plus a turnover-based fee. This discount is less than 1% for debit cards and around 2% for credit cards.

For a payment with Bitcoin, we have set an amount of 1% for the merchant. A transaction fee is generally not charged. This roughly corresponds to the amount that payment service providers charge for the Bitcoin payment processing service.

In this chart we can also see when the turnover is credited to the merchant. For card payments after approx. one week, for Bitcoin payments immediately.

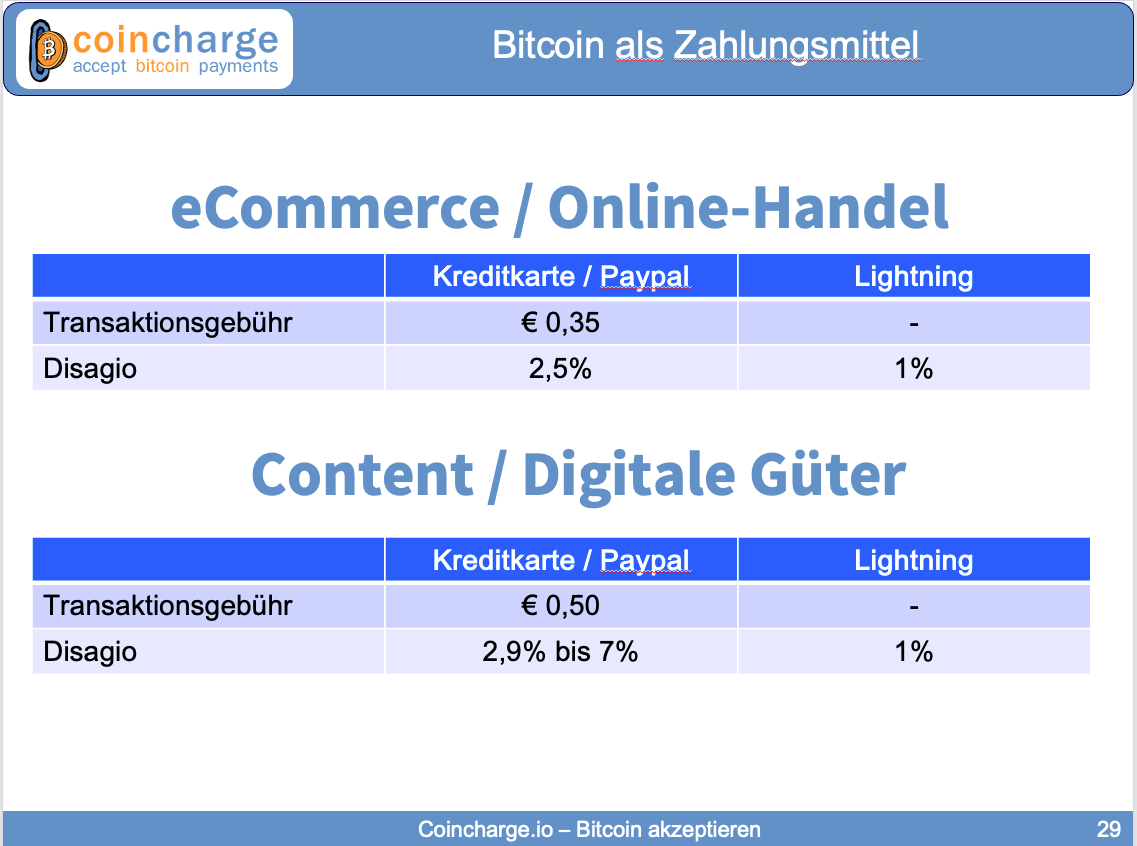

These are the figures for bricks-and-mortar retail. Looking at payments in online retail, merchants have to pay higher fees. This is due to the increased chargeback risk and the associated costs for the payment service provider.

In traditional mail order business, where physical products are sent to the customer by post, this amounts to approx. 35 cents per payment and approx. 2.5 % of turnover for credit cards and Paypal.

For digital goods that are made available immediately and digitally via the Internet, the transaction fees rise to 50 cents and the percentage then starts at 3% and can rise to 7%.

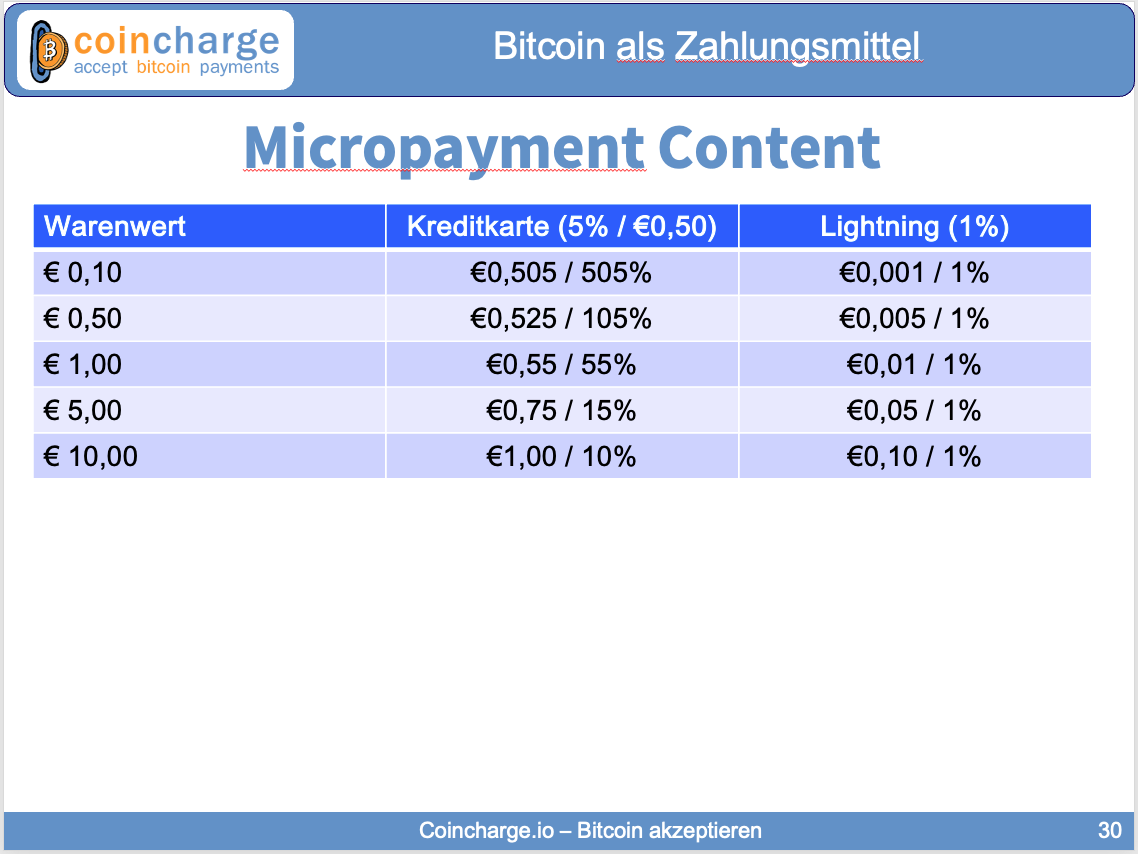

As we have seen, a fixed transaction fee plus a percentage surcharge is always paid. This fixed transaction fee makes micropayment products unattractive for merchants.

Here is an example of the costs of payment processing in relation to the value of the goods.

Now it is perhaps understandable that merchants often say that card payments are only accepted from €10.

Compared to all payment methods, including cash, payment with Bitcoins is always cheaper for the merchant. The cost benefits are not so great for bricks-and-mortar retailers, but the cost benefits are particularly evident in online retail.

9. no chargeback

A merchant sells his goods, the payment was successful and then there is a chargeback and the amount is deducted back from the merchant and credited to the customer.

A process that does not occur very often in stationary retail, but is a major problem in online retail.

This is because the end customer can reverse such a payment at any time, at the merchant’s expense.

The end customer does not have to explain this to the provider of the payment method. The reversal is made to the merchant without consultation and then the merchant and customer must come to an agreement.

Whatever the reason for the chargeback. The customer has the goods and the merchant has no money and must now try to get his money by civil law.

There can be no chargebacks for Bitcoin payments. Once a Bitcoin or Lightning payment has been credited to the merchant’s wallet, it can no longer simply be reversed by the payer.

If the payer is dissatisfied with the service, he must seek dialogue with the merchant and find a solution.

10. easiest way to receive Bitcoin

The easiest way to get Bitcoin is to accept Bitcoin.

If you want to get Bitcoin, and without KYC, then you have to accept Bitcoin.

Unfortunately, I very rarely hear this reason in discussions, but in my conversations with merchants it always turns out that it is the merchants who want to keep the Bitcoin they receive.

So if you would like to receive Bitcoin, why not accept Bitcoin payments in your shop or online shop? And if you want to know what options are available, take a look at our numerous videos in which we present the various options. As for stationary trading with solutions from Opago, Lipa or Bitcoinize.

Or in the online shop with the solutions from Coinsnap.

And when will you start accepting Bitcoin or Lightning payments in your shop or online shop?