Accounting and tax if you accept Bitcoin in your business

What do you need to consider when it comes to taxes and accounting if you accept Bitcoin in your business?

Anyone who accepts Bitcoin in their business fears complications in their own accounting and tax returns. The accounting and tax treatment of Bitcoin is identical to other payment methods. This article is aimed at businesses that accept Bitcoin and provides basic information. This article does not offer tax advice and cannot replace an individual consultation with a tax advisor. It is intended to provide basic knowledge so that you are better prepared for a discussion with your tax advisor. To better illustrate this, let’s take a look at the process of a payment in a store and in an online store.

YouTube Video: Accounting and tax when you accept Bitcoin in your business

There is an explanatory video about the article “Accounting and tax when you accept Bitcoin in your business” on the Coincharge YouTube channel in German.

Treat Bitcoin like foreign currency (e.g. USD, CHF or GBP) or gold

Accepting bitcoin in its business is allowed by law. Bitcoin is considered a crypto-value by BaFin and thus corresponds to a financial instrument, as is the case with foreign exchange (such as dollars, pounds or Swiss francs).

The invoice to the customer, is shown as usual in euros and with VAT. Mit welcher Bezahlmethode der Kunde dann tatsächlich bezahlt, ist unerheblich.

Each store is free to choose whether to accept dollars or bitcoin in addition to euros.

This means that when making a Bitcoin payment, you can proceed in the same way as when a customer wants to pay with dollars in the store.

For example, if the customer has an invoice of €10,- and only has a $10,- dollar bill, then you calculate the conversion rate (e.g. 1:1) and the customer can pay.

Pay with Bitcoin in stores

Even if payment is made with Bitcoin, invoices are still issued in euros or Swiss francs. If the customer wants to pay in a store, the purchases are recorded in the cash register and a normal invoice is created. Then comes the question: “How would you like to pay? In cash or by card?” If the payment is made in cash, this is noted in the till and the cash goes into the till. If payment is made by card, the invoice amount is entered into the credit card terminal. The customer pulls out their card and pays. It is noted in the POS system that the payment was made by card. The accounting department is thus informed that the payment has been received via the credit card company’s statement and will be credited to the bank account in a few days. When paying by Bitcoin, the customer would now be offered the following: “How would you like to pay? In cash, by card or with Bitcoin?” If the customer now wants to pay with Bitcoin, the seller would pull out their smartphone and open the Bitcoin wallet. Enter the invoice amount in euros. The Bitcoin app converts the euro amount into Bitcoin and creates a QR code that the buyer can scan and pay. As an alternative to a smartphone, the customer can also be presented with a Bitcoin terminal, which is comparable to a card terminal. In concept, a Bitcoin payment is like a payment with another currency. For example, if the customer were to pay with euros in a Swiss store. The Swiss merchants who are now watching the video will not be unfamiliar with this. To the stores from the euro area. What would you do if a customer had a bill for €100 but only had a dollar bill? You would check what the current exchange rate is. Let’s assume that it is exactly 1.1, then you would take the 100 USD and note on the euro invoice or in the POS system that the invoice amount was paid in USD. Why not do the same with Bitcoin? You don’t even need to check what the current Bitcoin exchange rate is, because the Bitcoin wallet or the Bitcoin terminal will do this for you automatically. In the POS system, you would now record that the payment was made by Bitcoin so that the accounting department is informed of how the payment was made. A small disadvantage, however, is that the POS terminals do not have a Bitcoin button to record the Bitcoin payment. But perhaps there is another button that can be used for this purpose. As a receipt for the Bitcoin payment, you receive detailed information about the Euro invoice amount, the conversion rate and the number of Bitcoin you received. The only question that arises is what you want to do with the Bitcoin as a merchant? Do you want to keep the Bitcoin or would you rather convert it into euros? But before we look into this question, let’s take a look at the online payment process.

Paying with Bitcoin on the Internet

When paying online, the buyer selects the desired products in their shopping cart. Here too, the prices are all given in euros. A euro invoice is then created at the checkout and the customer is asked to pay this invoice using the payment methods offered. Here, too, there is a euro invoice in accordance with the accounting requirements. If the customer chooses the Bitcoin payment method, the invoice is recorded as paid within the store software after successful payment. In addition, there is a receipt for the successful payment from the Bitcoin payment provider or BTCPay server. This receipt documents the euro amount, the exchange rate and the Bitcoin received. Payment by Bitcoin is therefore easy to record for accounting purposes.

Transaction overview and receipts

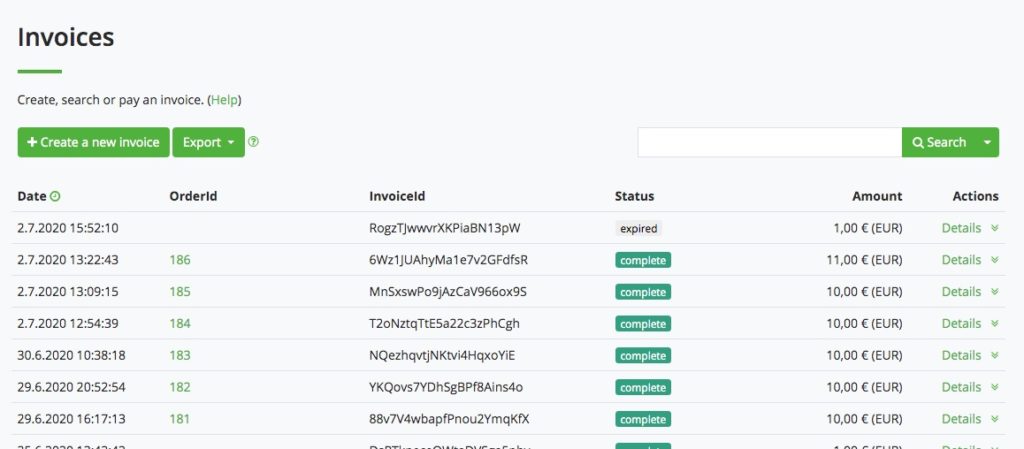

Each order is recorded in the backend by the BTCPay server and displayed as part of a transaction overview.

The transaction overview lists the successful payments with the status Complete. This transaction overview can be used to create an export, which can facilitate the work for the accounting department.

Zusätzlich kann über Details zu jeder Transaktion auf eine Detailansicht gewechselt werden.

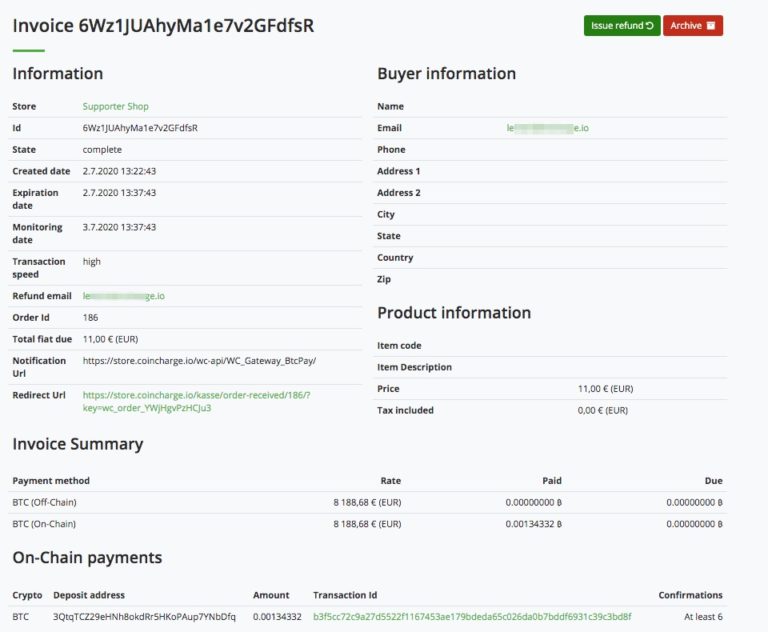

The detailed view shows, among other things, how much Bitcoin the customer has sent, the exchange rate used for the conversion and the amount (in euros) paid by the customer.

Ask your tax advisor or accountant whether this detailed view can be used as a document for accounting purposes.

Bitcoin or euro?

The only question is, what do you do with this Bitcoin as a trader? Do you want to keep the Bitcoin or would you rather have euros?

Keep Bitcoin as a company?

If a company keeps Bitcoin, the question arises as to how the Bitcoin is recorded in the balance sheet. The procedure is identical to that for recording foreign currencies or gold, for example.

A decision must be made as to whether the Bitcoin is to be allocated to fixed assets or current assets.

Bitcoin becomes a fixed asset if it is intended to remain in the company permanently (long-term). It becomes a current asset if it remains in the company only for a short period of time.

Bitcoin is then recognized in the balance sheet in the same way as foreign currency or gold. The Bitcoin is not recorded at the Bitcoin value, but in euros, as each balance sheet item must be stated in euros.

In the context of a revenue surplus statement, the incoming Bitcoin are assessed at the value corresponding to the equivalent value of the delivered goods. If the customer receives goods worth €100 and pays 0.01 Bitcoin for them, the 0.01 Bitcoin is entered in the accounts as €100. The Bitcoin value in euros is known. It is the value that we have recorded in the receipt and corresponds to the value that the customer has paid.

The profit arises only at the time of the sale of the bitcoin.

How the bitcoin should be valued on the balance sheet date, you clarify individually with your tax advisor.

There is also the question of what happens if the Bitcoin is sold at a later date. As a rule, the capital gain is fully taxed.

Keep Bitcoin as a private individual?

When this article was written, private individuals in Germany did not have to pay tax on Bitcoin profits if they held the Bitcoin for longer than a year. It can therefore make sense that the Bitcoin received does not remain in the business, but is better taken over privately. As a private individual, you can buy these Bitcoin from your company. I cannot say whether this still applies when you read this article and how it is handled in other German-speaking countries. Please ask your tax advisor about this. If a customer in a store does not have any euros but wants to pay in dollars, the store owner could exchange the dollars for euros privately and put the equivalent value in the till. The private exchange takes place beforehand and the euros end up in the store’s till.

An analogous approach can be taken for a Bitcoin payment. If a customer wants to pay with Bitcoin, you as the store owner accept the Bitcoin and pay the equivalent value in euros either in cash or as a transfer to your own business account. So if you intend to keep the Bitcoin you receive, you should consider whether you keep the Bitcoin as a company or as a private individual.

Change Bitcoin to Euro

If the Bitcoin turnover is still manageable, then you will want to keep the Bitcoin you earn. After all, earning Bitcoin is the easiest way to obtain Bitcoin yourself. However, as Bitcoin turnover increases, you will not be able to avoid converting at least some of the Bitcoin into euros, as employees and suppliers will probably still want to be paid in euros. Once the Bitcoin received has been credited to your own Bitcoin wallet, you can exchange this Bitcoin yourself at a Bitcoin exchange. This process can also be automated and the Bitcoin received is then forwarded directly to a Bitcoin exchange and sold there. It is a little more convenient if you use the services of a Bitcoin payment provider. A Bitcoin payment provider takes over the entire Bitcoin payment processing and credits all Bitcoin sales directly in euros and pays these euros to the merchant’s account. Just as merchants are already accustomed to with credit card or PayPal payment processing. This offers a further advantage for accounting documentation and, as the merchant does not own Bitcoin at any time, this is not relevant for the tax return.

Summary

Anyone who accepts Bitcoin in their business or online store will be able to fall back on familiar payment processing procedures. Invoicing is carried out as usual in euros and therefore there is no difference in accounting. The only difference is payment processing. But here you can proceed in the same way with Bitcoin as with a payment in another currency or with gold. The important question is whether you want to keep the Bitcoin and if so, whether as a private individual or as a company. If you don’t want to keep the Bitcoin, you can sell it immediately yourself or do this automatically via a Bitcoin payment processor. However, this is a very individual consideration and should be discussed in person with your accountant or tax advisor.

Accepting Bitcoin as a means of payment is unobjectionable for legal reasons. If in doubt, you should clarify with your tax advisor how Bitcoin is recorded in accounting and in the tax return. Here it depends on the individual situation of the dealer, as well as to the legal framework of the respective country.

Accounting requirements are internationally aligned and treating Bitcoin like a foreign currency has proven successful in most countries.

Ask your accountant and tax advisor if this can be handled the same way in your country. If this is the case, the processes for accounting are sufficiently known and do not pose a problem.

Thus, nothing stands in the way of accepting Bitcoin and other cryptocurrencies in one’s own business.

You can usually contact your current accountant or bookkeeper for further questions about accounting and taxes. If you have specific questions about Bitcoin tax, you can find a listing of tax advisors specialized in Bitcoin and cryptocurrency at Coinpages from Germany, Austria and Switzerland.

You can find more products and services from Coincharge in the Coincharge Shop

Leave a Reply

Your email is safe with us.