Strike Business – Business Bitcoin Lightning Wallet for companies

Strike Business – Business Bitcoin Lightning Wallet for companiesStrike Business – In this article, we explain how you can set up and use a business Bitcoin Lightning Wallet with Strike. You may have already got to know Strike by creating a Bitcoin Lightning Wallet for yourself. We have already created a detailed Strike Wallet article for this. Now you can also create a Bitcoin Lightning Wallet for your company and thus separate your company’s Bitcoin turnover from your private turnover. Strike Business is a custody wallet where your funds are held by Strike and you have to go through a KYC process for your company. In return, you receive a Bitcoin Lightning wallet with a Lightning address and can manage both Bitcoin and Lightning in one account and also receive an account for euros. You will receive a Lightning address that you can deposit when you accept Bitcoin payments with the Opago hardware terminal in your shop or when you accept Bitcoin payments via Coinsnap in your online shop or on your website. Strike Business is interesting for all companies that receive Bitcoin payments and want to either keep the Bitcoin received or convert it into euros.

YouTube Video: Strike Business – Business Bitcoin Lightning Wallet for companies

On the German-language YouTube channel of Coincharge + Coinpages we have created a video about Strike Business – Business Bitcoin Lightning Wallet for companies.

Strike Business Wallet Setup

To open a Strike Business account, go to https://strike.me/business

The entire process takes place partly in English, as does the subsequent e-mail communication with the Strike Onboarding Team.

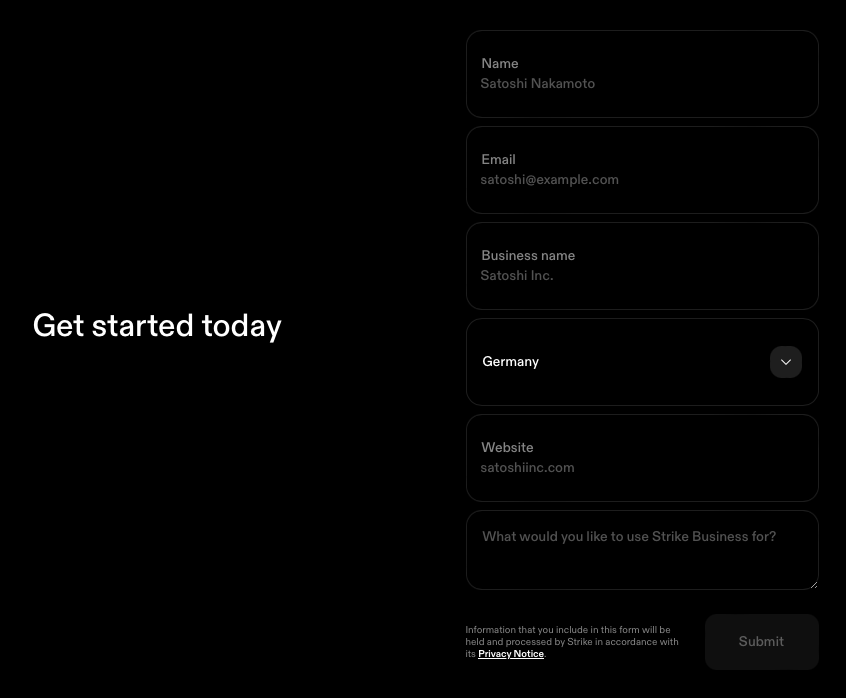

After you have clicked on Get Started, you will be asked to fill out a form.

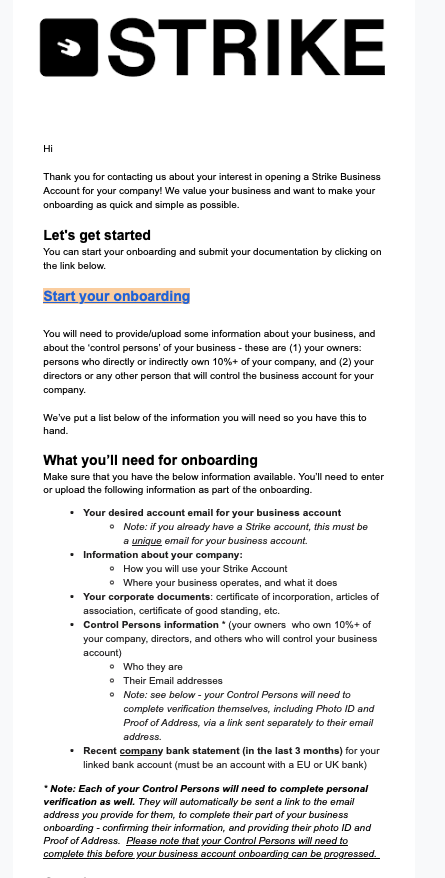

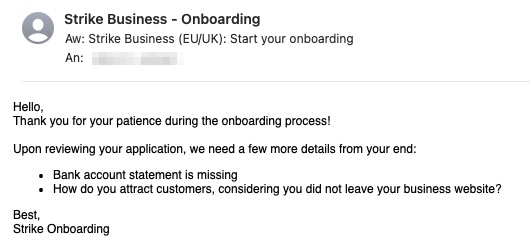

There you will need to fill out a form with your name, your personal email address, the name of the company, the location of the company, the URL of the company’s website and the purpose for which you want to use Strike Business. If you already have a private Strike account, make sure you use a different email address here. Ideally an email address that is associated with the company. You will then have to wait until you receive a message from Strike. A few days later you will receive an email to start the registration process:

It is advantageous to find out in advance what to expect and it is advisable to compile the relevant documents in advance.

Shareholder audit

An audit includes the KYC audit of the acting persons of this company. These are the directors and managing directors and all shareholders who hold more than 10 per cent of the shares in the company. Each of these persons is then asked by e-mail to send a photo of an identification document and to provide proof of their residential address in the form of a bank statement or utility bill.

Company audit

In addition to the persons involved, the company must also be checked. Company documents such as an extract from the commercial register and a current bank statement with the company name and address are requested for this purpose. Once you have prepared everything, click on ‘Start your onboarding’ in the email.

Strike Business Onboarding Process

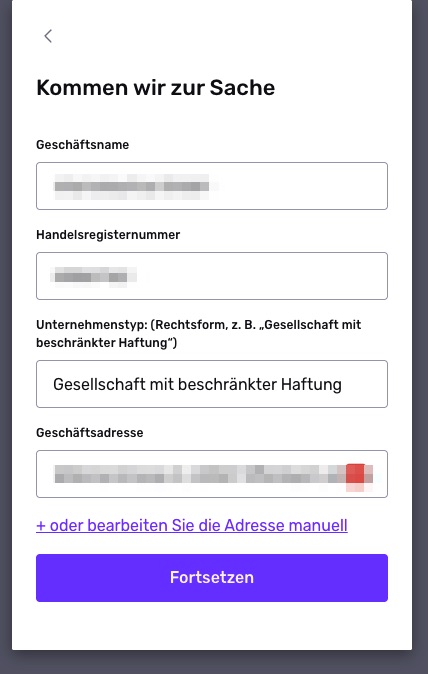

You will be redirected to a website where the onboarding process takes place. The link may have already expired. If so, simply reply to the email you received. I have always received the best email support via this later. Once you’re on the website, you’ll go through several steps where you enter the relevant information we just talked about. It starts with the company details such as name, commercial register number, legal form and address.

On the following pages, you will then be asked for your company’s website and the email address you wish to use for communication. You will then be asked to provide a brief overview of your company. What does the company do and what will Strike be used for? Then you will be asked what you want to use the data for. For business purposes or for the development of services. In most cases, the answer will be for business purposes, unless you want to develop your own services for which you want to programme an API connection.

You will then be asked whether your company is based in a country that is on the OFAC list, which is not the case for a European country.

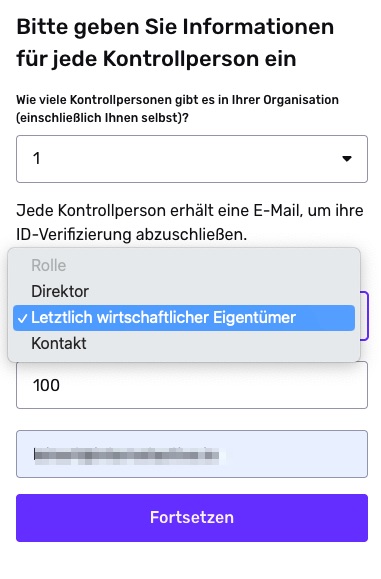

You will then be asked to provide details of the persons involved. You must then provide details of the managing directors and owners. Indicate the percentage of shares held by each owner and the respective e-mail address. You will then be asked to submit additional documents. The exact documents are not specified. Based on the information in the email, I then sent an extract from the commercial register. An upload via PDF did not work, so I photographed the extract from the commercial register again and then sent it. You can download a current extract from the commercial register for your company free of charge at https://www.handelsregister.de/. If you are based outside Germany or are not entered in the commercial register, you will need to obtain the relevant documents elsewhere.

I then received an e-mail asking me to submit further documents.

From this point on, communication took place exclusively by e-mail, which worked very well.

You must then send in a bank statement from the company stating the name and address of the company.

Additional email messages were sent to the email addresses of the acting persons to complete the KYC process for them. All they had to do was upload a photo of their ID card or passport and the process was complete. After a few days, I received a message that the process had been successfully completed and I was able to log into the Strike Business backend.

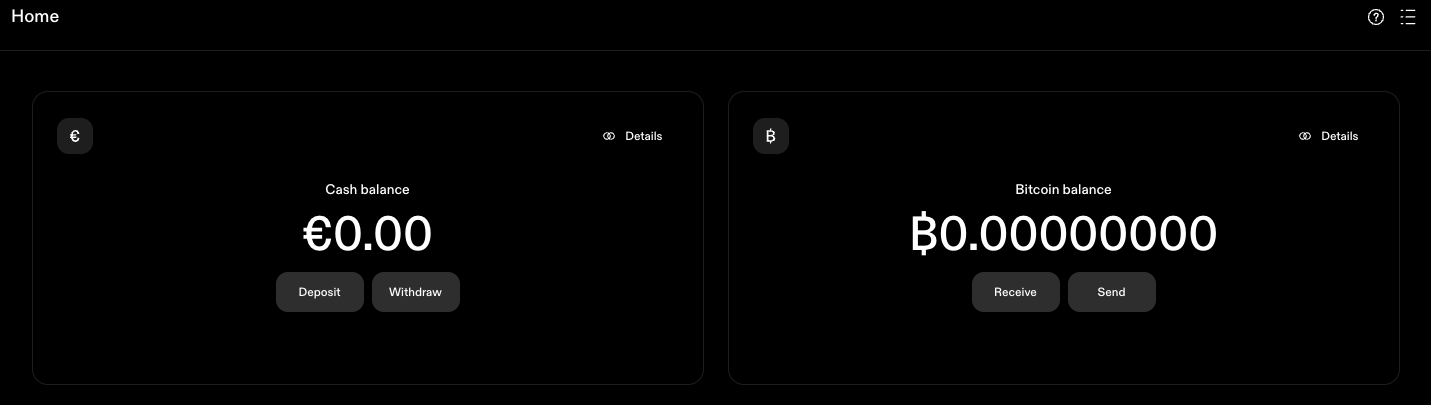

Strike Business Dashboard

Nach erfolgreicher Registrierung können wir uns über die URL https://dashboard.strike.me/login in das Strike Business Dashboard einloggen. Im Gegensatz zum Strike-Konto für die private Nutzung, das als App auf dem Smartphone verwaltet wird, wird das Strike Business-Konto über das Web verwaltet.

Diejenigen, die bereits ein privates Strike-Konto besitzen, werden mit der Handhabung der beiden Konten vertraut sein.

Cash balance account (Euro account)

At Strike you have an account in which the euro balance is managed. You can receive bank transfers to the account. You will receive the relevant bank details when you click on Deposit. Deposits can only be made from a bank account in the same name as the Strike account and Strike only supports Euro currencies for European customers. Withdrawals cannot be made yet, as we have to deposit our bank account first. To do this, go to Accounts and then Add bank account. You can then enter the IBAN of your own bank. Payouts are only made to the company account.

Bitcoin Lightning account

We also have the Bitcoin Lightning account, which supports both Onchain Bitcoin and Lightning. With Onchain, the Bitcoin address is displayed to receive payments. Once as an onchain address and additionally as a QR code.

Receive Bitcoin

To receive payments via Lightning, you must first create a Lightning Invoice. To do this, enter the amount in Bitcoin that you would like to receive. Please note that the entry is made in Bitcoin, i.e. with decimal places. So if you want to create a Lightning Invoice for 100,000 sats, the entry is 0.00100000 or 0.001. Unfortunately, there is no way to switch from Bitcoin to sats yet.

Lightning Address

You can also receive Lightning via your Lightning address. Your Lightning address is username@strike.me But how do you get your username? Click on the three dashes at the top right and your username will be displayed, which unfortunately cannot be changed. If you accept Bitcoin payments with the Opago hardware terminal in your shop or accept Bitcoin payments with Coinsnap in your online shop or on your website, you will enter your Lightning address there.

The credits are credited directly to your Strike Business account via this Lightning address. However, the Lightning credit will not be credited to your Bitcoin account, but converted into euros and credited to your Euro Cash account. If you do not wish to keep the Bitcoin, but prefer to have the Bitcoin turnover credited in euros, then you do not need to do anything. However, if you would like to keep the Bitcoin you receive, you must contact Strike Support and request that the conversion is not carried out and that the Bitcoin is credited directly to your Bitcoin wallet. You can reach Strike support at support@strike.me

Send Bitcoin

You can use the Send Bitcoin button to send Bitcoin via On-Chain or Lightning. If your Bitcoin balance on the Strike Bitcoin Wallet has become too high, it is advisable to transfer this Bitcoin to a secure Bitcoin hardware wallet, such as the Bitbox02. It is pleasing to note that Strike does not charge its own fees for withdrawals via Bitcoin, as is often the case with other Bitcoin wallets. Only the fees for the Bitcoin blockchain that the miners receive are charged. If you want to make a payment to another Lightning address, enter the Lightning invoice you received from the payee in this field. It is currently not possible to make payments to a different Lightning address. But Strike is also working on the implementation for the web version.

Receive Bitcoin – Credit in Euro

If you have deposited the Lightning address you received from Strike with Opagao or Coinsnap, your customers’ Bitcoin payments will be credited directly to the Strike Wallet. The question now arises as to which Strike account the credit should be made to. To the Bitcoin account or to the Euro Cash account? The default setting for Strike Business is to the Euro Cash account. For traders who are wary of the volatility of the Bitcoin price, we recommend retaining this setting. For example, if the end customer pays €50, this amount will be credited to your Euro Cash account minus the fees. These fees are the fees charged by Coinsnap and Opago for their own services, as well as the exchange fee charged by Strike. This fee starts at 1.29% and decreases to 0.49% depending on turnover. The fees will be discussed in more detail later. If you would like to offer your customers the opportunity to pay with Bitcoin, but you would like a credit in euros, Strike offers you an immediate conversion at the most favourable fees. The immediate conversion upon receipt of the Bitcoin payment is very advantageous and you are thus protected against the volatility of the Bitcoin exchange rate. Strike Business is particularly recommended for merchants who receive Bitcoin payments from their customers and want an immediate credit in euros.

Receive Bitcoin – Credit in Bitcoin

Currently, incoming Lightning payments are converted directly into euros via the Lightning address and then credited to the Euro Cash Wallet. However, if you want to keep the Bitcoin you receive, you must contact Strike Support and request that the conversion is not carried out and that the Bitcoin is credited directly to your Bitcoin wallet. You can reach Strike support at support@strike.me I have communicated with Strike support and they have assured me that there will soon be a way to make this setting in the web version itself, just as it is already possible in the app version for private users.

Fees

Strike impresses with its favourable fees and, unlike other Bitcoin Lightning wallets, does not charge any fees for certain services.

Euro deposits and withdrawals

We can make deposits and withdrawals to the Euro Cash account in our Strike Wallet via bank transfer. Strike does not charge any fees for deposits or withdrawals to another bank account.

Bitcoin deposits and withdrawals

You can send and receive deposits and withdrawals from your Bitcoin wallet via Onchain and Lightning. Strike does not charge any fees for deposits and withdrawals of Bitcoin payments.

Lightning

There are no fees for switching from Lightning to Onchain or vice versa. You can therefore receive Lightning credits from your customers, which are credited to the Strike Bitcoin wallet and transferred to your Bitcoin hardware wallet at no additional cost. Other Bitcoin Lightning wallets charge an average fee of 0.5% for forwarding to an on-chain Bitcoin wallet, which Strike does not charge. To be fair, however, it must be pointed out that network fees are incurred when paying via Lightning and Onchain. However, these fees are not charged by Strike, but the actual network costs are passed on. Lightning payments only incur routing fees in the millicent range.

Onchain

Fees are charged for on-chain payments depending on how quickly the credit is to be issued. However, these fees are displayed before the payment is executed. Strike breaks this down into three stages:

- Priority – about 10 minutes – network fee plus strike fee

- Standard – about one hour – network fee plus strike fee

- Free – about one day – no fees

Strike here means that a strike fee is incurred, but not how high it is. So please pay attention to this when transferring Bitcoin yourself. But if you transfer the Bitcoin to your own Bitcoin wallet, then you certainly have enough time and then there should be no fees and no network fees. I almost can’t believe it. So take a close look at the fees that are displayed.

Exchange fee

But how does Strike Business earn its money? Strike’s business model is based on the exchange between euros and Bitcoin. Every time you buy or sell Bitcoin, i.e. exchange euros for Bitcoin and vice versa, Strike charges a fee.

This fee is staggered and depends on the monthly exchange volume. If you exchange less than €250 per month, you pay 1.29%. If you exchange €1,000 per month, the fee is only 1% and is reduced accordingly. Every month it starts all over again. So check for yourself what fees you would incur. The standard market rate is around 1.5%, making Strike one of the most favourable providers.

Strike Business Summary

Strike Business is the ideal Bitcoin wallet for businesses. Strike is a custody wallet where your Euro balance and your Bitcoin are held by Strike. To open a Strike account, KYC is required for your company and the acting persons. You will receive a wallet with a euro account and a Bitcoin account, which you can use to manage both separately. You will receive your own Lightning address for your company and, if you want to accept Bitcoin Lightning payments in your shop or on your website, you can have the sales credited directly to your Bitcoin or euro account. You can receive Bitcoin and Lightning payments from your customers and decide whether you want to keep the Bitcoin or convert it into euros immediately. With Strike Business, you have a clean separation between your private Bitcoin and your company’s Bitcoin. Strike Business also scores highly in terms of fees. Deposits and withdrawals by bank transfer are free of charge. There are also no fees for deposits and withdrawals via Bitcoin Onchain and Lightning, only the routing and network fees are passed on. Fees are only charged when exchanging Bitcoin for euros or vice versa. However, these fees are more favourable than what is usually charged on the market. I can recommend Strike Business to anyone who wants to use Bitcoin and Lightning for their business. Especially for businesses that want to accept Bitcoin and Lightning payments in-store with Opago or on the internet or online shop with Coinsnap.