You already run an internet store and accept payments like credit card and PayPal? Then you are familiar with the tasks of a payment provider. But what does a Bitcoin payment processor do and how do the tasks differ from a classic payment processor? What are the differences and what should you look for when choosing the right Bitcoin payment provider?

We describe what tasks a Bitcoin payment processor performs.

Then we will explain how you can process Bitcoin payments yourself and use the services of a Bitcoin payment processor or your own Bitcoin Payment Gateway.

We will start by describing how a Bitcoin payment works, what a Bitcoin payment processor contributes to it. Then we will go into what to look for when choosing a Bitcoin payment provider.

In addition, we recommend the articles:

Task of a Bitcoin payment provider

As we have learned, there are some cases where a regular Bitcoin wallet is sufficient to accept Bitcoin payments. When trading online or making a deferred payment, the service of a Bitcoin payment provider can be helpful. That’s why we’re going to take a look at what a Bitcoin payment processor does.

In the article “Process of a Bitcoin Payment from a Merchant’s Perspective” we describe a Bitcoin payment in a bit more detail.

Task of a Bitcoin payment provider

In an online store, the customer has placed his goods in the shopping cart and now wants to pay. The value of the shopping cart is shown in a fiat currency such as euros or dollars.

If the customer clicks on pay now, then he gets an overview of the payment methods offered by the merchant. This is where the activity of a Bitcoin payment provider begins.

If the customer has chosen the Bitcoin payment method, then this euro, dollar or other fiat amount is transmitted to the Bitcoin payment provider.

The Bitcoin payment provider, calculates the corresponding Bitcoin amount based on the Bitcoin rate valid at that time.

Likewise, the Bitcoin payment provider generates a unique one-time Bitcoin address. Since Bitcoin knows no reason for payment use, one uses a unique and one-of-a-kind Bitcoin address. An incoming payment on this Bitcoin address can thus be clearly assigned to a specific order.

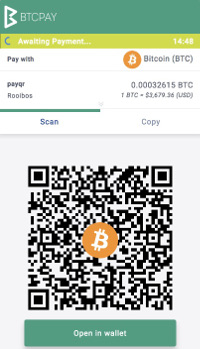

The Bitcoin payment provider generates a payment page (checkout page) and displays it to the customer.

The payment page is displayed in the form of a QR code, which contains the payment amount in Bitcoin and the Bitcoin address.

The customer now has about 15 minutes to make the Bitcoin payment. Within this period, the bitcoin exchange rate is guaranteed against the buyer.

If this period expires without any result, the buyer must update the payment page and a new payment page will be displayed based on the then valid exchange rate.

If the Bitcoin payment has been executed, this is confirmed to the customer.

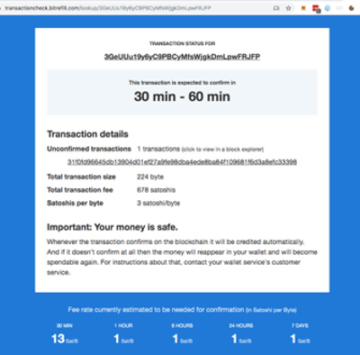

The Bitcoin payment provider recognizes whether the Bitcoin payment has been sent by monitoring the mempool.

All Bitcoin payments that have been executed but not yet confirmed by the blockchain are displayed in the mempool.

The Bitcoin payment provider determines after how many confirmations on the blockchain a Bitcoin payment is considered successfully completed.

This may vary by business model and amount. For low value products, a payment can be considered successful after one confirmation to the customer and for higher priced luxury items only after six confirmations.

For products with an equivalent value of a few cents and a high time pressure (customer wants to take his coffee), a payment can be considered successful if the payment is displayed in the mempool.

Monitoring the payment in the mempool and on the blockchain is part of the tasks performed by a Bitcoin payment processor.

Payment confirmation

The Bitcoin payment processor provides feedback to the merchant when the payment is successfully displayed on the blockchain (or mempool).

In parallel, the Bitcoin payment provider also monitors the Bitcoin amount to see if the amount was also paid in the expected amount.

Based on the calculated Bitcoin exchange rate, a certain Bitcoin amount was set. However, the payer can manually adjust this amount in his Bitcoin wallet and thus discrepancies may occur.

Bitcoin transaction fees

A variation may arise from the Bitcoin transaction fee. The Bitcoin transaction fee has to be paid by the payer and is based on the priority of how fast the Bitcoin payment should be executed.

Since the payer bears the cost of the payment, they may opt for a low transaction fee and a low priority, then it may take longer for the payment to be confirmed in the blockchain.

The Bitcoin payment provider makes a recommendation to the payer as to what fee they should pay to be confirmed in the next block, but the payer is not bound by this recommendation.

If a payment is not made directly from a Bitcoin wallet, but from the account at a Bitcoin exchange, then the Bitcoin transaction fee is deducted from the payment amount by the exchange. Accordingly, the Bitcoin amount is reduced and is less, compared to the amount expected by the Bitcoin payment provider.

For Bitcoin payment processing, this raises the questions, “How to deal with a reduced incoming payment?” and “How to respond to a delayed incoming payment”

Successful payment

After the payment is confirmed by the blockchain, the Bitcoin payment processor reports this status to the merchant.

Analogous to other payment methods such as credit card and PayPal, the merchant’s store system takes over the new status. Accordingly, the merchant can store and send an email confirmation and start shipping the goods or grant access on a protected area.

Bitcoin credit to the merchant

After the Bitcoin payment is successfully completed, the merchant will receive his credit.

The question here is whether to credit in bitcoin or fiat currency.

With most Bitcoin payment providers, it is common for a merchant to have a separate sub-account for each cryptocurrency. These sub-accounts are often referred to as a wallet. Depending on which cryptocurrency the customer paid with, the amount will be credited to that wallet accordingly.

If a merchant wants to change his balance on the respective wallet into another currency (e.g. Bitcoin, Euro, USD), this can be deposited accordingly.

So if you receive a Bitcoin payment, you can change it into Euros at the same time and have it credited to your Euro wallet.

The payout of his Euro balance to the own bank account can then be triggered manually.

Since Bitcoin cannot be booked back by the customer, the credit is also immediately available for withdrawal without any restrictions.

Those who prefer to receive their payout in Bitcoin can also deposit this accordingly. This option is usually the most favorable, as there are no exchange rate risks for the Bitcoin payment provider and there are no costs for the banking system.

We would like to point out once again that a particular advantage for accepting Bitcoin for the merchant is that there is NO chargeback. No end customer can reverse a payment made and therefore the revenue is also immediately available to the merchant.

Decision criteria for the selection of a Bitcoin payment provider

Technical integration and store modules

For the communication between the merchant’s store system and the Bitcoin payment provider, a technical integration is required.

Bitcoin payment providers provide corresponding API interfaces and store modules for the most common store software solutions.

For the selection of the appropriate Bitcoin payment provider, it should be checked whether corresponding modules can be provided on the part of the Bitcoin payment provider or whether good API documentation is available.

For those who have their own development, a connection via API will be an option. Accordingly, we link to the corresponding API interface descriptions in the Bitcoin payment provider comparison.

If you use your online store from an established eCommerce software provider, it will be of interest to you whether the Bitcoin payment provider provides a corresponding payment module for its store system.

Fees

Those who have already integrated a payment method such as credit card and PayPal into their store may pay a monthly fee. In any case, additionally a fee per transaction and a fee based on the amount of turnover.

PayPal and credit card fees are approximately 2.5% plus a 35 cent transaction fee. These fees may vary by business model, volume or region.

Bitcoin payment providers usually do not charge a basic monthly fee. Likewise, there is no transaction fee.

It is common for Bitcoin payment providers to charge a percentage fee on the volume. This fee is usually between 0.5% to 1% of the sales volume (clearing volume).

This fee is usually also the fee that is published on the websites of Bitcoin payment providers.

The fee just presented, may include pure Bitcoin transaction processing. However, this fee can also include the exchange of Bitcoin sales into a fiat currency.

In addition, other fees may be charged.

This may be the case if a conversion fee is additionally charged instead of the pure transaction processing.

Then there may be another fee for the withdrawal of his balance. This withdrawal fee depends on whether you want to have your Bitcoin funds in your own Bitcoin wallet, or you want a withdrawal to your bank account in a fiat currency such as Euro or USD.

Depending on the desired withdrawal method, different fees may then be charged. As a rule, Bitcoin and bank transfer are offered as withdrawal methods. However, some Bitcoin payment providers also offer withdrawals to a PayPal account or debit card.

The conversion fee and the withdrawal method fee are usually referred to collectively as the withdrawal fee.

Withdrawal in cryptocurrencies are usually free of charge.

Accounting and bitcoin rate

The high volatility of the bitcoin price and how to incorporate bitcoin into your accounting work as a deterrent for some traders at first.

But this problem is solved by numerous Bitcoin payment providers in the form that a settlement and payment guarantee is provided in euros.

If the product purchased in a store costs the end customer €50, the merchant receives this amount, after deduction of a service fee, paid out in his fiat currency (e.g. Euro).

You sell something in your store for 50,- Euro and you also get paid 50,-. The fact that the end customer paid this €50 in Bitcoin is therefore irrelevant for accounting purposes.

Due to the payment guarantee, any price changes are borne by the Bitcoin payment provider.

As with credit card and Paypal settlements, the merchant receives a statement from the Bitcoin payment provider about the Bitcoin sales including a payout to the bank account.

Thus, an accounting recording of the transacted sales is no problem and there is no risk in fluctuations of the bitcoin rate.

Accept cryptocurrencies

The most important cryptocurrency is indisputably Bitcoin. Bitcoin is the largest, best known and most widely used cryptocurrency. If you have decided to accept cryptocurrencies in your store, there is no getting around Bitcoin.

However, there are numerous other cryptocurrencies which also specialize in payment processing.

For a merchant, the question is,

- should we accept other cryptocurrencies besides Bitcoin?

- What cryptocurrencies should we offer in addition?

- How many more cryptocurrencies should we offer?

We have dedicated a separate article to this extensive topic, which we would like to refer to here.

In terms of choosing the right Bitcoin payment provider, the range of supported cryptocurrencies can be an important selection criterion.

It can be stated that all Bitcoin payment providers presented here support the most important cryptocurrency, namely Bitcoin.

Then there are Bitcoin payment providers that specialize in a selection of cryptocurrencies.

A few Bitcoin payment providers have chosen the business model of supporting as many cryptocurrencies as possible.

We do not advise offering all cryptocurrencies to its customers, which are also technically possible. The motto is that less is more.

Experience shows that most purchase cancellations are made by customers during the checkout process. Therefore, customers should not be “overwhelmed” with too many cryptocurrencies.

Many providers of “Shitcoins” like to suggest that this coin would revolutionize payment and list various, supposed advantages. But is this coin also used by merchants and customers for payment at all?

Customers use the cryptocurrency for payment, which is accepted by many merchants.

Conversely, many merchants will accept the cryptocurrency used by customers as a means of payment.

This is a classic network effect in which Bitcoin is currently far ahead.

Whether another cryptocurrency can eventually challenge Bitcoin’s dominant position remains to be seen.

Our recommendation: start with Bitcoin and watch the reaction of your customers. Ask your customers which cryptocurrencies they would like to pay with. Not just “wanting” to do it, but actually doing it.

Legitimation check

If you are a merchant who already uses payment methods such as credit card and PayPal, you are aware that a review of your business model, your company and the people acting on it will be carried out.

This verification is based on legal requirements, such as: Know your Customer (KYC) and to prevent money laundering (AML = Anti-Money Laundering).

Payment providers are additionally reviewing business models to exclude products and services with a negative image or add a high-risk price premium.

Another reason for reviewing the business models is to identify the products and services where there may be increased chargeback from the customer. This may result in a delayed payment to the merchant, as the risk of chargeback is always borne by the merchant.

Why is this being addressed at this point? The checks made on the other payment methods, are not required for Bitcoin and could be waived.

Business model verification would not be required with Bitcoin, as there is no risk to the merchant that a payment will be reversed. A Bitcoin payment is always final and a chargeback by the customer is not possible.

Similarly, KYC and AML verification is not required if the merchant wishes to withdraw in Bitcoin or any other cryptocurrency. A KYC & AML check only needs to be done if there is an exchange from cryptocurrency to fiat currency.

If this change is not made, but the payment is made in a cryptocurrency, it can be waived.

If you are a merchant who does not want to reveal any verification of your business model or your company and personal details, you should opt for a Bitcoin payment provider that offers cryptocurrency payout and waives this verification.

As part of the business model, KYC, and AML review, business records, copies of IDs, and utility bills are requested.

This information is analogous to the acceptance procedure for credit card or PayPal or when opening a bank account.

Do you want to accept Bitcoin in your online store?

In this post, we have explained what does a Bitcoin payment processor do and what tasks does a Bitcoin payment processor perform. Do you want to accept crypto and bitcoin payments in your internet store, then we recommend the following articles:

Do you want to accept Bitcoin in your online store and would like more information or individual advice? Then arrange a personal consultation with Coincharge.