Who pays with Bitcoin?

Who actually pays with Bitcoin? And who owns Bitcoin and therefore fulfils the requirements to pay with Bitcoin in my shop?

What motivates merchants to accept Bitcoin payments? How high is the proportion of Bitcoin payments at merchants that already accept Bitcoin payments?

We look at the five steps a Bitcoiner goes through before using Bitcoin and look at how many customers pay with Bitcoin and Lightning at Aprycot Media, Copiaro and Shopinbit.

YouTube: Who pays with Bitcoin?

On the Coincharge+Coinpages YouTube channel, we have published a German-language video entitled: “Wer bezahlt mit Bitcoin?” (Who pays with Bitcoin?).

Who owns Bitcoin?

Before we turn to the question of who pays with Bitcoin, let’s take a quick look at who actually owns Bitcoin and is able to pay with it.

With regard to the statistics mentioned here, it should also be noted that the survey always refers to cryptocurrencies in general and no distinction was made between crypto and Bitcoin.

However, we assume that everyone who holds cryptocurrencies will also have Bitcoin in their portfolio.

According to a survey conducted by the digital association Bitkom in 2021, 6% of Germans own bitcoins.

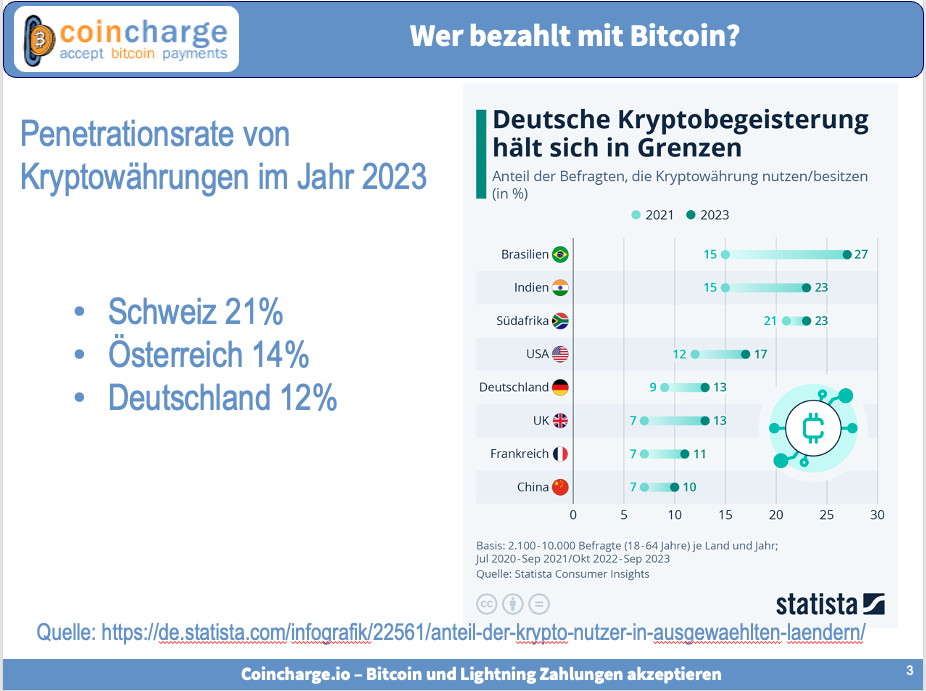

For the year 2023, Statista states that 21% of people in Switzerland, 14% in Austria and 12% in Germany will own cryptocurrencies.

Quelle: https://de.statista.com/infografik/22561/anteil-der-krypto-nutzer-in-ausgewaehlten-laendern/

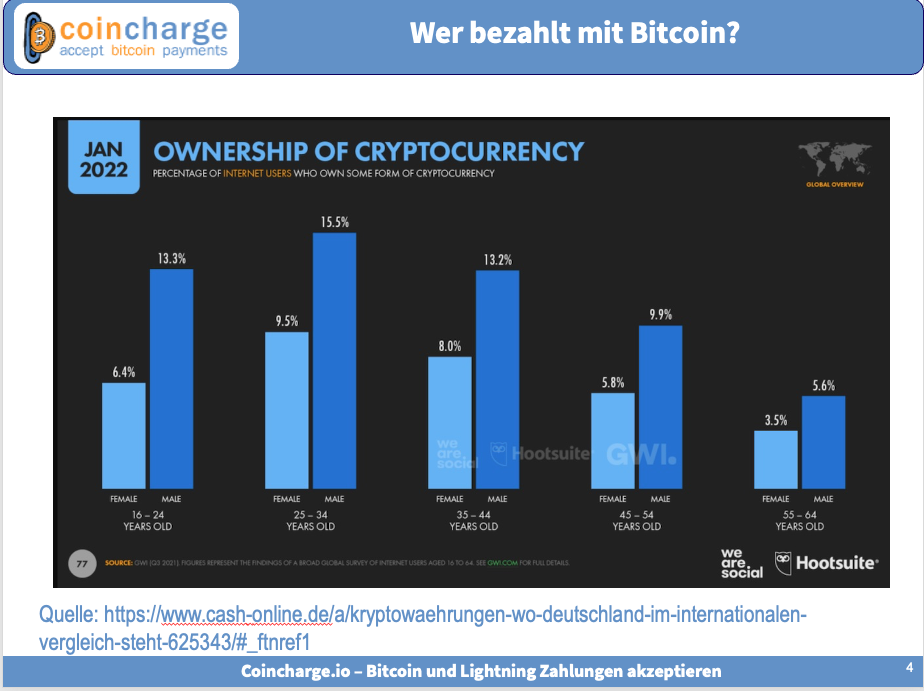

In this chart, we have grouped the distribution of global cryptocurrency holders by age.

We see that younger people in particular own cryptocurrencies.

If we once again differentiate between men and women within the age groups, men dominate with around 60%.

The figures shown here are global statistics and can also be roughly applied to the DACH region.

Source: https://wearesocial.com/de/blog/2022/01/digital-2022-ein-weiteres-jahr-mit-starkem-wachstum/

Now this statistic only says something about ownership, but nothing about whether you also want to use the Bitcoin or whether it is used for hodling, i.e. for long-term saving.

The Bitcoin payment dilemma

The Bitcoin payment dilemma describes the problem that nobody wants to pay with Bitcoin and therefore shops do not offer Bitcoin as a payment method.

Conversely, there are hardly any shops that accept Bitcoin, so there are hardly any options for paying with Bitcoin.

You then hear statements such as “There are hardly any shops where you can pay with Bitcoin” or

“I’m not spending my Bitcoin. I hodl”

The 5 stages of a Bitcoiner

But why are so few or no payments made with Bitcoin? When is a Bitcoiner ready to spend their Bitcoin?

We have observed that a Bitcoiner goes through several stages before he is ready to spend his Bitcoin. We would like to briefly introduce these 5 levels and are very interested in your opinion, which you are welcome to leave in the comments.

Stage 0: No-Coiner Phase

In Germany, around 90% of the population are said to have heard of Bitcoin, but do not yet own any and have not yet taken a closer look at it.

This is the no-coiner phase.

These are the people who don’t have Bitcoin. Who have consciously decided against Bitcoin for various reasons, because the power consumption is too high, because it is too late to get in, because it is just a Ponzi scheme or whatever other reasons you want to cite for rejecting it.

However, there are also no-coiners who have heard of Bitcoin but have not yet looked into it, do not know how to buy Bitcoin and have not yet taken the decisive step.

Stage 1: Pre-Coin Phase

Then the pre-coin phase begins, in which you start to familiarise yourself with Bitcoin and perhaps crypto.

You start to take an interest, read the first articles and start researching on the Internet.

Stage 2: Bitcoiner phase

Then the entry begins and you buy your first Bitcoin and perhaps also cryptos.

For most, the motive for buying is the hope of rising prices and quick money.

Stage 3: Hodler phase

Most newcomers buy Bitcoin when the price rises and then soon realise that the price also goes in the other direction.

One would like to wait for this weak phase so as not to sell below the entry price.

If you buy cheaply and the price rises, you want to hold the bitcoins for a year, at least in Germany, so that you don’t have to pay tax on them.

In any case, you become a hodler and (hopefully) start to take a closer and more intensive look at Bitcoin.

You get to know the many facets of Bitcoin and its potential and run the risk of falling into the rabbit hole.

The Hodl phase does not really end, but the next phase begins in parallel.

Stage 4: User phase

As you get more and more involved with Bitcoin, listen to podcasts, read books and go to Bitcoin meetups and conferences, you start to realise that you can also use Bitcoin.

You learn that you can support the work of YouTubers with Bitcoin, that you can buy Bitcoin books and Bitcoin accessories on the Internet with Bitcoin, that you can pay the bill in the restaurant where the Bitcoin Meetup is taking place with Bitcoin, that the ticket for the Bitcoin conference can be paid for with Bitcoin and that at the conference itself only Bitcoin is accepted at the bar, at the beer tap or at the merchandising stand.

The experience is that you can use Bitcoin, i.e. you can also pay with it.

As you gain experience, you are also prepared to pay with Bitcoin outside the Bitcoin Space and look at Bitcoin directories such as Coinpages to see where else you can pay with Bitcoin.

Stage 5: Earn Bitcoin phase

At some point, bitcoiners will ask themselves how they can convert their salary into bitcoin.

or how to accept Bitcoin payments in your shop or online shop.

Development phases of a Bitcoiner

In any case, it is unfortunate to realise that if you as a merchant want to persuade a Bitcoiner to pay with Bitcoin in a shop, this Bitcoiner must already have gone through several phases of being a Bitcoiner.

If you look at the phases side by side, you can ask yourself which phase you are in.

Which phase are you in? Do you already own Bitcoin and are you using or have you already paid with Bitcoin?

How do you pay in Bitcoin shops?

Now we have looked at the theory of when Bitcoiners start paying with Bitcoin or Lightning.

But what does it look like in reality?

We take a look at three online shops from German-speaking countries that specifically target Bitcoiners.

Aprycot Media

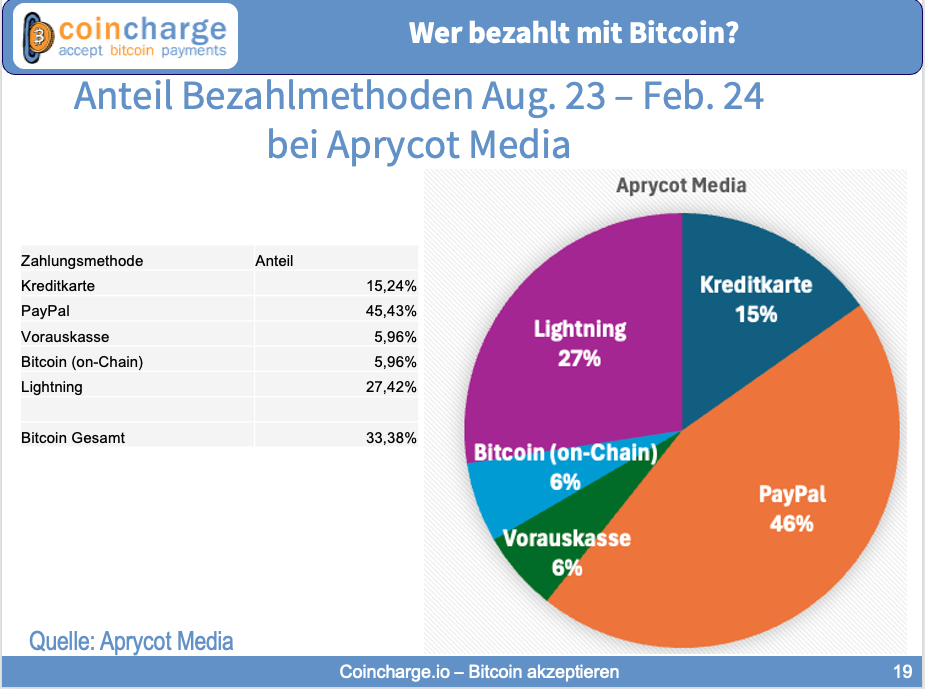

Let’s start with Aprycot Media. This is a Bitcoin publishing house that publishes German-language Bitcoin books, such as the German version of the Bitcoin Standard.

Accordingly, the online shop is aimed at the German-speaking Bitcoin community and provides a very good insight into how Bitcoiners pay.

In the period from August 2023 to February 2024, 46% of all customers paid with PayPal

In total, 33.38% of all customers paid with Bitcoin.

Divided into 5.96% in Bitcoin via the blockchain, i.e. via onchain, and 27.42% of customers have already paid with Lightning.

This is followed by credit card with 15.24% and prepayment with 5.96%.

The average value of goods per order is between 30 and 35 euros.

Already 1/3 of all customers pay with Bitcoin and over 80% of them with Lightning.

Copiaro

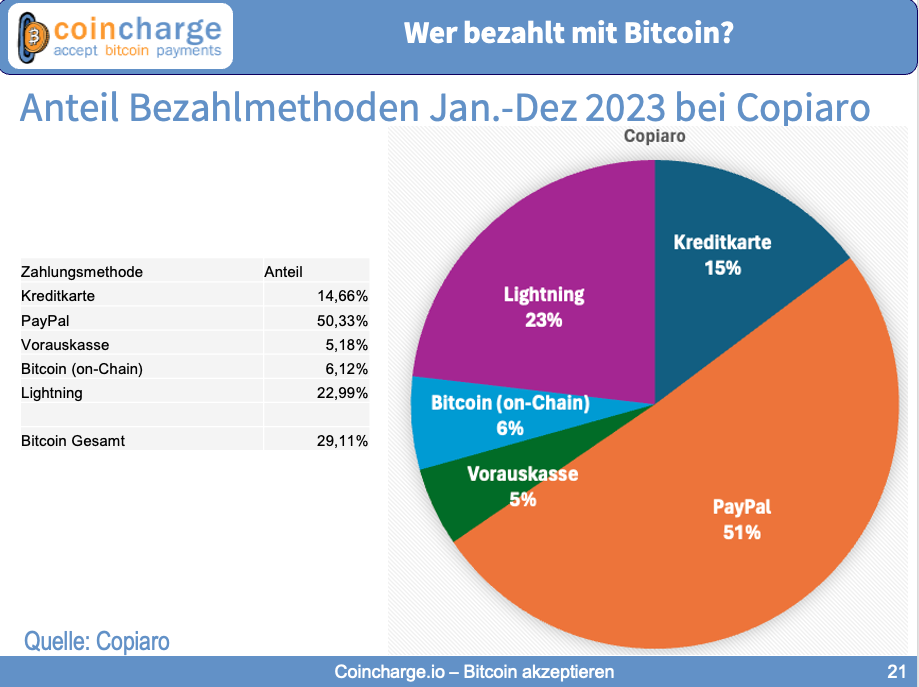

Then let’s take a look at Copiaro’s figures for 2023.

Copiaro is an online shop for Bitcoin items such as T-shirts and merchandise, as well as accessories such as hardware wallets.

All products for Bitcoiners.

The average value of goods per order is between 100 and 120 euros.

Here we see a similar relationship to that of Aprycot Media.

PayPal continues to dominate with 50.33%.

But here too, almost 1/3 of all customers paid with Bitcoin, totalling 29.13%.

Of this, 6.12% with Bitcoin, i.e. on-chain, and 22.99% with Lightning.

Shopinbit

The third online shop we want to look at is Shopinbit.

This is the largest Bitcoin shop in Europe.

There is a huge selection of products here that are sold with Bitcoin and Lightning, but also against another cryptocurrency such as Monero.

The most popular products on Shopinbit are high-quality electrical and computer parts, a travel service and a concierge service that can also be used to buy cars.

In total, over 76 per cent are paid with Bitcoin, while Lightning’s share is less than one per cent. The share of PayPal and credit cards is also marginal at just over 1%. Monero’s share of 22.76, on the other hand, is considerable.

Shopinbit also offered other cryptocurrencies in the past, but has since discontinued these as they are no longer relevant.

Monero is popular with people who attach great importance to privacy.

The fact that Bitcoin Onchain is so strong compared to Lightning is surprising, especially after we got to know the values of Aprycot Media and Copiaro.

However, this can be explained by the fact that the average order size at Shopinbit is around €1,000.

Summary

The customers of the three online shops presented are prepared to pay with Bitcoin.

This willingness also exists among other online shops that cater to the target group of Bitcoiners.

We were given similar figures by other shops that sell Bitcoin merchandise, Bitcoin accessories or hardware wallets, for example.

If you specifically target the Bitcoin community with your offer, you cannot avoid also offering Bitcoin payments.

Now, these figures cannot be transferred 1:1 to other online shops, but those who target Bitcoiners with their offers and advertising measures can benefit from Bitcoin as a means of payment.

But is it enough to accept Bitcoin as on-chain payments or also via the Lightning network?

For high-value products, Bitcoin still dominates in the on-chain variant, as we have seen at Shopinbit, where the average value of goods per order is €1000.

With an average value of goods per order of €30, as with Aprycot Media, or around €100, as with Copiaro, Lightning dominates.

It can be stated that between 15 and 20% of people in the DACH region already own cryptocurrencies and therefore also bitcoins.

Not all Bitcoiners are ready to spend Bitcoin yet. The desire to hold Bitcoin in order to participate in possible price gains still predominates.

Then you pay with Bitcoin and buy back the Bitcoin you spent. So you have used Bitcoin and no Satoshi less.

Regardless of how long you have been holding Bitcoin. At some point, the time comes when you want or have to part with your Bitcoin.

When this time comes, you can either exchange your Bitcoins back into euros or pay with Bitcoin and spend your Bitcoin.

The spread of Bitcoin is steadily increasing. More and more people are finding their way to Bitcoin in various ways. You invest and save in Bitcoin and at some point you use Bitcoin and spend it again.

The more people who own Bitcoin, the more potential customers can pay with Bitcoin in your shop.

Every business that accepts Bitcoin payments and publicises this fact is also promoting Bitcoin. As a shop, you show that you can also pay with Bitcoin and offer the opportunity to talk to people interested in Bitcoin.

As a business owner, you can explain Bitcoin and help attract a new Bitcoiner.

And as a business owner, you also receive Bitcoin, which you can save yourself. The most convenient way to receive bitcoins yourself and KYC-free.

When do you accept Bitcoin payments? Take the opportunity and offer Bitcoiners the chance to pay with Bitcoin and Lightning.