Why you should accept Bitcoin as a merchant

Why should merchants accept Bitcoin?

What are the benefits of accepting Bitcoin for me as a merchant? This post explains the benefits Bitcoin can offer and how you can use Bitcoin for your own internet store.

The main reason why store owners offer Bitcoin in their own store is personal interest in the topic. Because the easiest way to get Bitcoin is to offer goods and services against Bitcoin.

Already Bitcoin expert Andreas Antonopoulos recommends that you should not buy Bitcoin, but earn it:

„Don’t buy Bitcoin – Earn it“

As a Bitcoin enthusiast, you might have included the Bitcoin payment method in your store just like that. In the meantime, however, there are numerous other arguments in favor of accepting Bitcoin as a merchant.

Accept Bitcoin vs. other payment methods

Those who operate an online store usually already offer payment methods such as PayPal, credit card or online bank transfers. In addition to these standard payment methods, there are a large number of other payment methods that are either very widespread in some countries and regions or have focused on specific business models.

However, what all these payment methods have in common is that merchants have to undergo a lengthy registration, legitimization and verification process for their company and business model beforehand.

Once this process has been successfully completed, the payment option is technically integrated into the online store.

Those who have then successfully processed their first payments are confronted with the problem that the end customer has paid, but as a merchant does not receive the purchase amount immediately.

As a merchant, you are subject to the specifications, rules, terms and conditions of credit card acquirers, banks or providers of payment methods such as PayPal and online money transfers.

These payment processors always stand between the merchant and the customer and set the rules.

The provider of the respective payment method acts as an intermediary between the payer (end customer) and the payee (merchant).

The payee is electronically notified that the end customer has successfully paid and can provide the goods or services, but the monetary amount is credited with a time delay.

The final credit to the merchant’s bank account can take from one week (PayPal) to one month (credit card), depending on the payment method.

Furthermore, the merchant bears a chargeback risk on the part of the buyer. If the end customer subsequently refuses to pay the payment method provider, the amount will be charged back to the merchant and credited back to the end customer.

The merchant can still claim payment from the end customer, but this involves further costs and risks. The merchant does not receive a payment guarantee for any of the common payment methods. While there is such a thing as PayPal Buyer Protection, there are numerous exceptions that one cannot speak of a 100% payment guarantee for the merchant.

Payment processing costs

For the payment processing service, the payment method providers charge a fee consisting of a fixed transaction fee and a percentage component (discount).

Merchants who accept PayPal pay 35 cents per transaction plus 2.49% on the purchase amount. For a credit card payment, the merchant must pay a discount rate of 2% to 4% plus a transaction fee of approximately 20 cents. These amounts vary, depending on sales and business model.

In summary, an online merchant has to calculate payment processing costs of about 2.5% of sales, plus about 20 cents per transaction.

In addition, the turnover of up to one month must be pre-financed, as the crediting on the part of the payment method is staggered. Likewise, there is no guarantee of payment for the purchase made and there is a risk of chargeback.

If you accept Bitcoin, you will have the following advantages:

Bitcoin payment processing costs range from 0.5% to 1% of sales for most payment providers. In fact, with Bitcoin payment processing via a BTCPay server, there are no payment processing fees at all.

The credit of the bitcoin transactions are immediately credited to the bitcoin wallet and are thus immediately and unrestrictedly available.

No other authority dictates which business models are allowed or where you and your company or business are located.

No chargeback risk

No chargeback risk

The world’s leading payment methods in Internet commerce are payments by credit card and PayPal. Both payment methods are so-called “pull transactions”. The merchant initiates the payment with the credit card company or PayPal, which then charges the end customer.

In contrast, there are “push transactions”, which are initiated by the payer. These are, for example, SEPA transfers, online transfers we Sofortüberweisung and Giropay, as well as the purchase on account.

With all of these payment methods, the end customer must provide their personal information to the merchant when placing the order so that the merchant can then process the payment with the credit card company or PayPal.

This transfer of data to the merchant entails a data protection risk, as this data can be stolen by hacker attacks, as has happened frequently in the past.

But why do retailers require such extensive data? Merchants collect this data to protect themselves from chargebacks from end customers.

An example for better illustration:

A merchant sells a picture in his store and payment is made by credit card.

The next day, the customer claims that the picture is not an original but a copy and initiates a chargeback with his credit card company without returning the picture.

The credit card company will not concern itself with the legality of the underlying transaction and will refund the amount to the customer without any objections.

The damage is borne by the dealer, who does not receive any money and can try to get the picture back.

The merchant can never be sure whether a supposedly honest customer will subsequently initiate a chargeback or perhaps pay him with stolen credit card data.

There are two main types of chargebacks for the merchant. Once a chargeback because a fraudster placed a fraudulent order using stolen credit card information and customer data.

In the second form of a chargeback, this is initiated by the customer himself because he no longer agrees with the purchase for whatever reason.

A purchase involves an exchange of goods for money. When buying in a retail store, the customer pays and gets the goods directly from the seller.

In online trading, the buyer and seller are separated from each other in terms of space and time.

To bridge the gap, banks, credit card institutions or PayPal act as middlemen or intermediaries.

These intermediaries require the merchant to present customer data for payment processing in order to provide proof of payment breakage.

If the end customer objects to the purchase and subsequently refuses to pay, he or she contacts the intermediary and requests that the payment be reversed.

This process is called a chargeback. In this case, the banks do not check whether the reversal of the payment is justified or whether the end customer has returned the goods.

In case of a pull transaction, banks, credit card institutions and also PayPal will refund the amount to the end customer without objection.

In turn, this amount will be returned to the dealer, regardless of whether the service has been provided.

The merchant must decide whether to write off the loss or take legal action to reclaim the money or merchandise.

The damage is in any case the merchant, because the intermediaries always credit the amount of money to the customer and debit the merchant.

To protect yourself as a merchant against chargebacks or fraudulent orders, it is necessary to minimize the risks in advance.

Accordingly, extensive data is collected on the end customer, on the basis of which a risk analysis is carried out.

In addition to risk analysis, the data may also be required to document any legal claims and successfully collect.

In essence, the merchant must protect itself from customers who fraudulently seek to order from it using illegally obtained data and stolen identities.

A payment by credit card or PayPal is a pull transaction where a merchant is always exposed to a very high chargeback risk.

Only through extensive analysis of customer data is it possible to minimize the risk of fraudulent orders.

Thus, the merchant must inevitably develop into a data octopus and is thus in turn exposed to the risk that fraudsters want to steal this data from him in order to use the stolen data elsewhere for fraudulent orders.

Thus, a cycle of data collection and hacking attacks is created to the detriment of merchants.

These risks can only be eliminated for the merchant through push payment procedures. In addition to bank transfer, this also includes payment by Bitcoin.

With a Bitcoin payment, there is no risk for the merchant that there will be a fraudulent order from the customer. The payment is 100% guaranteed for the merchant and cannot be contradicted.

Thus, when paying by Bitcoin, the merchant has a payment guarantee.

Thus, it is also not necessary on the part of the merchant to take any precautions for any fraudulent orders.

Merchants who accept Bitcoin do not have to collect any data about the customers or their order, which is not required exclusively for the pure ordering and delivery process.

Anyone can accept Bitcoin

Bitcoin differs from the other payment methods in that any merchant can accept Bitcoin.

The use of Bitcoin is available to any trader worldwide without any restrictions. No one needs to be asked for permission, no business documents or business models are checked, and it doesn’t matter if you’re a large corporation or a small online store trying to make a living.

If you are tech savvy and do it yourself, the cost of payment processing is zero. If the service of a payment provider is used, fees of up to 1% of the turnover may be incurred.

The cost of sending a payment is borne by the end customer in the form of a transaction fee based on the speed of transmission.

Another advantage is that a bitcoin payment made is final. A Bitcoin payment cannot be recovered by the buyer. Thus, there is no chargeback risk for the merchant.

Bitcoin is a global payment method. With Bitcoin, a store owner can offer his goods and services worldwide. The remaining restriction for the retailer when shipping physical goods is logistics. Otherwise, every potential customer in the world can be served.

A merchant can track the successfully executed payment in the blockchain after just a few seconds. The merchant’s wallet is usually credited within the next hour.

Depending on the product and business model, the merchant is free to provide the service immediately or wait until the credit is finalized.

Who owns Bitcoin and is it my target audience?

What good is the best payment method if no one owns Bitcoin? So it doesn’t make sense if you want to accept Bitcoin as a merchant, but your target audience is not interested in Bitcoin at all.

The integration of the Bitcoin payment method into your own store involves costs and effort.

This effort can only be justified if my store’s target audience overlaps with Bitcoin owners.

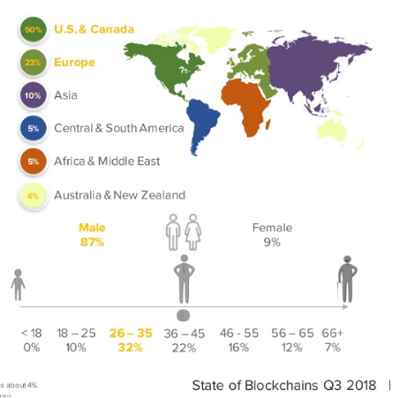

According to a survey conducted by Coindesk in Q3 2018, Bitcoin owners are distributed as follows:

It is thus predominantly a payment option for young, male, and tech-savvy customers.

However, it should not be concealed that the owner of Bitcoin is difficult to part with his Bitcoin. He tends to keep the bitcoin (hodl) and rather say goodbye to his euros and dollars.

Bitcoin as marketing to increase awareness

Offering Bitcoin in the store sends the message that you are technically innovative and with the times. If the target group of the store belongs to the same group of people who own Bitcoin or are interested in it, you can be sure that you will receive the appropriate attention.

Merchants who accept Bitcoin should prominently display this on the website. Be it on the home page or at least under the accept payment methods. Likewise, in other marketing activities (flyers, social media), you should point out that you accept Bitcoin.

Likewise, it is recommended that you list your store in Bitcoin directories. At Coinpages you can find all merchants that accept Bitcoin. There you can also find all other Bitcoin directories where a trader can register.

Advantages for the dealer

Bitcoin payment method offers the following advantages:

- Suitable for all business areas (digital and physical goods)

- Predestined for digital products and services such as memberships, software, services and content.

- Payment for micro and nano amounts as for newspaper articles and videos (pay per view)

- Products for anonymous payment, for which the customer does not have to share his personal data

- No chargeback risk for the merchant

- Low cost

- Faster availability of the purchase amount

Advantages for the customer

Bitcoin owners in particular appreciate the payment method via Bitcoin and prefer this payment method over other methods.

Especially when transmitting personal and sensitive data to an unknown merchant, many customers are deterred from buying by credit card.

For watching a video, reading a newspaper article or for a paid membership, people are reluctant to disclose personal address, bank or credit card data to the merchant.

The customer asks himself the question: What does the merchant do with my data or is the offer perhaps a subscription trap?

For the tech-savvy target group, the fast, uncomplicated and anonymous payment via Bitcoin is a very popular payment method.

So there are a lot of good reasons to accept Bitcoin or at least consider the topic. Learn how to accept Bitcoin, integrate it as a payment method in an online store or accept it in a retail store in the various posts and instructions at Coincharge.

Read also the article, Which business models are particularly suitable for Bitcoin and how the process of a Bitcoin payment works from a merchant’s point of view.

Leave a Reply

Your email is safe with us.