How can I buy Bitcoin?

How can I buy Bitcoin? What should you look out for when choosing a Bitcoin broker?

There are now many ways to buy Bitcoins. In this article, we want to help you get an overview and show you the options that are best suited to your needs.

You will learn about the different ways in which you can pay for the bitcoins you buy, what storage options are available for your bitcoins, what requirements the providers have for a legitimacy check and get a brief overview of the different providers.

YouTube video: How to buy Bitcoin?

On the German-language YouTube channel of Coincharge + Coinpages we have published a video with the title: How can you buy Bitcoin?”:

Buy Bitcoin online or offline?

You can buy Bitcoin online via the Internet or offline at Bitcoin ATMs.

This is also linked to the way in which the purchase can be paid for.

When buying Bitcoin at a Bitcoin ATM, only cash payment is possible.

When buying Bitcoin online, the most common payment method is bank transfer. However, some providers also support payment by credit card or PayPal.

Buy Bitcoin at a Bitcoin ATM.

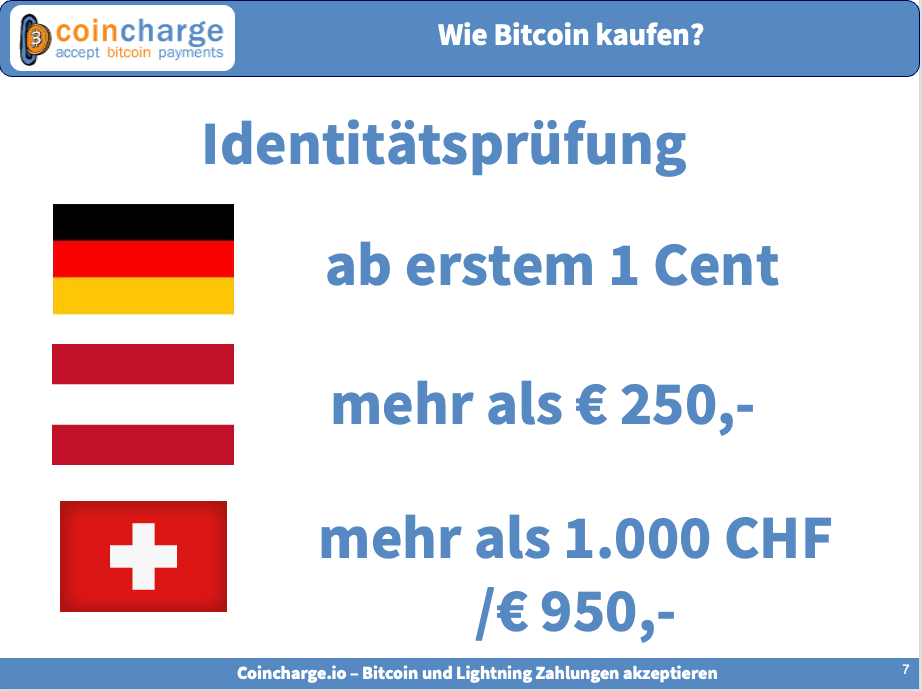

Anyone wishing to buy Bitcoin at a Bitcoin ATM in Germany must first register with the provider of the Bitcoin ATM and verify their identity.

This is a requirement of the German legislator and is already mandatory from 1 cent.

Bitcoin ATMs in Austria and Switzerland have limits up to which the purchase of Bitcoin is possible without registration and verification. In Austria this limit is €250 and in Switzerland around €1000. Anyone wishing to purchase higher amounts must also register.

On Coinpages you will find an article that describes exactly how to buy Bitcoin at a Bitcoin ATM.

As already mentioned, Bitcoin ATMs can only be paid for with cash. The sale of Bitcoin is supported at very few Bitcoin ATMs.

The fees for buying Bitcoin at a Bitcoin ATM are between 5% and approx. 10%, depending on the provider.

It is cheaper to buy Bitcoin on the Internet. The fees here are usually a maximum of 1.5%, depending on the provider and payment method used.

Buying and selling Bitcoin on the Internet

The providers on the Internet can be roughly categorized as follows:

- Bitcoin exchanges

- Bitcoin-Broker

- Bitcoin Per-to-Peer Marketplaces

- Banks as resellers

However, we will focus here on buying Bitcoin from Bitcoin exchanges and Bitcoin brokers.

When buying on peer-to-peer exchanges, you must already have Bitcoin and when buying via a bank, you cannot transfer the Bitcoin to your own Bitcoin wallet, which is why this is not recommended.

That’s why we look at Bitcoin exchanges and Bitcoin brokers here.

Bitcoin exchange

A Bitcoin exchange is a platform on which users can trade Bitcoin directly with each other. Buyers and sellers place bids and offers, and the exchange acts as an intermediary to facilitate the transactions.

Prices are determined by supply and demand on the platform.

The best-known Bitcoin exchanges are Coinbase, Binance, Kraken and, in Germany, Bitcoin.de.

Bitcoin Broker

A Bitcoin broker trades directly with its customers. The broker offers to buy or sell Bitcoin at a price set by the broker.

Users buy or sell Bitcoin directly from the broker and not from other users.

The activities of a Bitcoin broker can be compared to those of a bureau de change, which you may remember from airports.

Since most people probably want to buy a few Bitcoin now and then or perhaps save a fixed amount in Bitcoin on a regular basis, a Bitcoin broker is recommended for them.

Web or app?

The various Bitcoin brokers offer their services on different platforms.

Some providers can be reached via a website where you can register and then buy or sell.

Other Bitcoin brokers handle buying and selling via an app that you install on your smartphone.

Some Bitcoin brokers also offer both options.

Registration and verification

Anyone wishing to buy or sell Bitcoin must register with a provider of their choice and undergo an identity check.

The regulatory authorities stipulate that every company or person who exchanges or redeems Bitcoin for fiat must clearly identify themselves.

This process is known as Know Your Customer – or KYC for short.

This KYC process is handled differently depending on the country or financial supervisory authority.

In Germany, every customer must go through a video identification procedure.

In Austria, it is sufficient to present proof of identity and in Switzerland, no identity check is required for amounts under CHF 1,000 or approximately € 950. This is often referred to as KYC-Light.

For larger amounts, proof of the origin of the funds may be required.

Payment processing

In order to buy Bitcoin, an amount must be transferred to the respective Bitcoin broker in advance. The amount deposited is then available for the purchase of Bitcoin.

After registration, the Bitcoin broker will provide you with bank details and a reference to which you can transfer the purchase amount.

It should be noted that the bank account from which the transfer is made must be in the same name as the account holder at the Bitcoin broker.

The most common payment method is SEPA bank transfer, which can take 1-2 bank working days.

Some banks support the option of instant or real-time transfers. For a small additional fee, your own bank carries out the transfer immediately and the amount is credited to the Bitcoin broker after just a few seconds.

This is particularly advantageous if the Bitcoin price falls and you want to use the buying opportunity to buy the so-called dip.

In addition to bank transfer, some Bitcoin brokers also support payment options via PayPal, credit card or Apple or Google Pay.

The purchase amounts may be limited by the payment method used. Additional fees may also apply, which are charged by the respective payment methods and passed on to Bitcoin buyers by the Bitcoin brokers.

Buy Bitcoin

As soon as the deposit has been credited to the Bitcoin broker, the Bitcoin can be purchased. As the Bitcoin price fluctuates, the Bitcoin broker constantly changes the price at which it sells or buys Bitcoin.

You decide for yourself when and how much you buy or sell. You can invest a larger amount once or several smaller amounts over a certain period of time.

Bitcoin Savings Plan (DCA)

A popular variant is the so-called savings plan.

Here, for example, you buy Bitcoin every week for a constant amount.

This makes you independent of price fluctuations and the optimum time to buy.

Because you never meet him anyway.

For example, you buy Bitcoin for €50 every Monday, regardless of the current Bitcoin price.

If the exchange rate is low, you buy Bitcoin cheaply and get more Satoshis for your money.

If the Bitcoin exchange rate is high, you get less Satoshis for your money, but the value of the amount you have already saved is higher.

If you opt for a savings plan, you set up a standing order in your bank account. This is where you specify whether an automatic transfer should be made to the Bitcoin broker on a weekly or monthly basis and the amount.

Now you don’t need to do anything, because you are now saving Bitcoin regularly. You can also do this for your children, for example. My son saves part of his pocket money in Bitcoin.

Long-term saving in Bitcoin with a savings plan is offered by all Bitcoin brokers.

If you have an amount at your disposal, you can also make a one-off purchase in addition to the savings plan.

Custodial / Self-Custody

But once you’ve bought the Bitcoin, where are they? Who owns them or who has access to them? In Bitcoin circles they say: Not your keys – not your Bitcoin. So if you don’t have the keys to the Bitcoin, then it’s not your Bitcoin either.

That’s why it’s important that you get the keys and thus full control over your own Bitcoin.

There are the English terms custodial and non-custodial or self-custodial. The term custodial can be translated as custodian and means that someone holds the Bitcoin for you. With non-custodial, or rather self-custodial, you store the Bitcoin yourself.

What does this mean when we buy Bitcoin? If we buy Bitcoin from a Bitcoin broker and the Bitcoin broker holds this Bitcoin in custody for us, then it is custodial. This means a risk for you if the Bitcoin broker goes bankrupt or disappears with your Bitcoin.

You can protect yourself from this by transferring your Bitcoin from the Bitcoin broker to your own Bitcoin wallet immediately after the purchase. The best way to do this is with a secure hardware wallet from Ledger, Trezor or Bitbox02.

Anyone who buys Bitcoin must transfer this Bitcoin to their own Bitcoin wallet, for which they also have their own key. Such a key is also called a seed and consists of 12 different words. If you have the Bitcoin with a seed on your own Bitcoin wallet, then you have full control over your Bitcoin and this is referred to as self-custody.

The Swiss regulator attached particular importance to this own custody and has imposed the requirement on Swiss Bitcoin brokers that the Bitcoin must always be held in custody directly by the customer.

That a Swiss Bitcoin broker is not allowed to hold Bitcoin from its customers.

So if you buy Bitcoin from a Swiss Bitcoin broker, it will be credited directly to your own Bitcoin wallet.

This does not have to be done directly on a Bitcoin hardware wallet, but can also be done with your own Bitcoin wallet, which is provided by the Bitcoin broker and is part of the provider’s app. You will then receive your own seed with the 12 words.

If this provider goes bankrupt or disappears, you won’t care, as you have full control over your own Bitcoin.

Sell Bitcoin

There comes a time when you want to part with your Bitcoin.

This may be the case for merchants who accept Bitcoin and receive more Bitcoin from their customers than they want to keep themselves, or the Bitcoin price has developed so positively that you want to realize some of your profit.

You can of course do this by spending the Bitcoin and paying in a store that accepts Bitcoin.

If you want to know where you can pay with Bitcoin, then take a look at Coinpages, where you will find all stores and online stores in German-speaking countries where you can pay with Bitcoin.

You can also sell your Bitcoin to a Bitcoin broker, which every Bitcoin broker offers.

Selling Bitcoin is exactly the same as buying Bitcoin.

You send your Bitcoin to the Bitcoin broker and sell the Bitcoin. You can then have the equivalent value in euros paid out to your bank account.

Here too, the name of the bank account holder must be identical to the name of the account holder at the Bitcoin broker.

Ideally, you should use the same bank account that you used to buy the Bitcoin.

Buy and sell Lightning

At Coincharge we deal with Bitcoin Lightning.

Bitcoin Lightning is a variant of Bitcoin that is particularly suitable for payment processing. In addition to buying and selling on-chain Bitcoin, some Bitcoin brokers also offer the option of buying or selling Lightning.

For example, if you want to pay with Bitcoin, you can transfer a few Satoshi to your Lightning Wallet via Lightning. It’s lightning fast and very inexpensive.

The providers Relai, Pocket Bitcoin, DFX and Coinfinity offer this option at the time of recording. Other providers such as 21bitcoin are already working on the implementation and will follow shortly.

For example, if you accept Bitcoin or Lightning payments as a business or online store, the sales are credited to your Lightning Wallet via Lightning.

However, if a store would prefer to receive a credit to its bank account, this Lightning credit can also be resold directly.

Coinsnap has a direct connection to the Bitcoin broker DFX and Pocket Bitcoin will follow shortly, so that the sale of Lightning Bitcoin can be processed automatically.

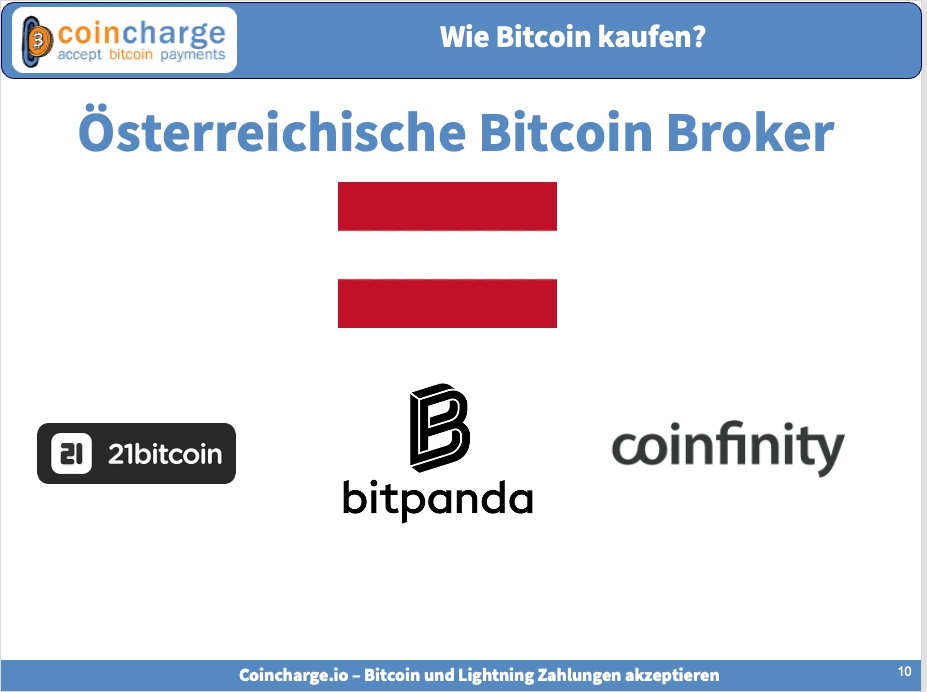

Seats of the provider

We have already talked several times about where the Bitcoin broker is based. We have concentrated on providers from German-speaking countries.

The providers must implement certain requirements of their national regulatory authorities.

This usually concerns the way in which the identity check is carried out and whether the Bitcoin may be held by the Bitcoin broker for its customers or must be credited directly to the buyer’s wallet.

As a Bitcoin buyer, you can buy your Bitcoin from any provider worldwide.

As a German customer, you can also buy your Bitcoin from a provider in Switzerland or Austria and a Swiss customer can also do this with a German or Austrian Bitcoin broker.

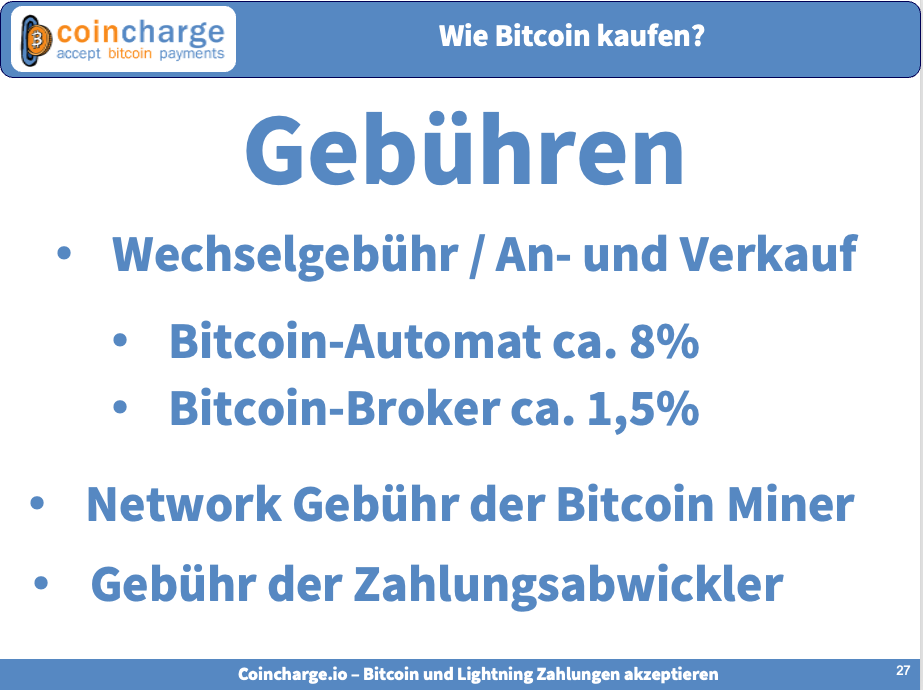

Fees

How high are the fees if you want to buy or sell Bitcoin?

We have already heard that the average purchase at a Bitcoin ATM with cash is 8%. Anyone who buys Bitcoin online from a Bitcoin broker by bank transfer pays an average of 1.5%.

You can find the exact fees of the individual providers in the article: “Bitcoin brokers: Where can I buy Bitcoin”

These fees are included by the Bitcoin broker in the Bitcoin price that is displayed as the buy or sell price.

If the purchased Bitcoin is then transferred from the Bitcoin broker to your own Bitcoin wallet, so-called network fees are incurred.

These are external fees that are not paid to the Bitcoin broker, but to the Bitcoin miners.

This fee is variable and depends on how many transactions are currently waiting for confirmation in the mempool and how quickly you want to receive your Bitcoin.

This fee is passed on by the Bitcoin broker to the buyer of the Bitcoin.

Payment processing fees may then be incurred. If you pay for your Bitcoin by bank transfer, there are no additional costs for the Bitcoin broker and no additional costs for you either.

However, if you pay for your Bitcoin by credit card, PayPal or with Apple or Google Pay, the Bitcoin broker must pay up to 3% to the payment provider.

These fees, which are charged by the payment methods, are also passed on by the Bitcoin broker.

If you want to buy a large amount of Bitcoin on a one-off basis or save regularly with a savings plan in Bitcoin, we recommend using a low-cost bank transfer.

If you want to react quickly to buy the so-called dip, we recommend paying by instant bank transfer, credit card, PayPal or Apple or Google Pay, as the Bitcoin broker is credited immediately after payment and the favorable exchange rate can thus be guaranteed.

With a normal bank transfer, this can take 1-2 bank working days and then the Bitcoin rate is taken, which is valid in 1-2 days and then the Bitcoin rate can be higher again.

Summary Buy Bitcoin

We have now received a lot of background information on what to look out for when buying or selling Bitcoin.

With this information, it should be easier for you to choose the right Bitcoin broker for you.

We have already got to know a few Bitcoin brokers where you can buy Bitcoin.

We present these Bitcoin brokers in detail in our article: “Bitcoin Broker – Where can you buy and sell Bitcoin?”.